20495_Debenhams_AR_151104

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Group routinely monitors its capital and liquidity requirements through leverage ratios consistent with industry-wide<br />

borrowing standards, maintaining suitable headroom to the bank facility fixed charge, senior notes and leverage<br />

covenants together with credit market requirements to ensure that financing requirements continue to be serviceable.<br />

c) Fair value estimates<br />

The fair value of interest rate swaps is calculated as the present value of the estimated future cash flows. The fair value<br />

of forward currency contracts has been determined based on discounted market forward currency exchange rates at<br />

the balance sheet date.<br />

The fair values of short-term deposits, loans and overdrafts with a maturity of less than one year are assumed to<br />

approximate to their book values. In the case of the Group’s loans due in more than one year, the fair value of financial<br />

liabilities for disclosure purposes is estimated by discounting the future contractual cash flows at the current market<br />

interest rates available to the Group.<br />

Note 22 shows the carrying value and fair value of financial assets and liabilities.<br />

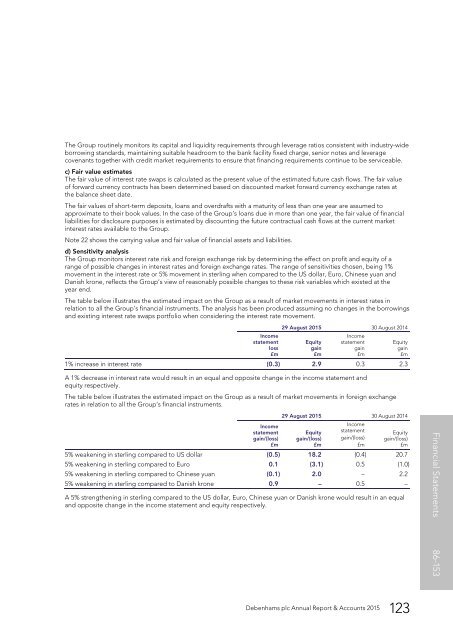

d) Sensitivity analysis<br />

The Group monitors interest rate risk and foreign exchange risk by determining the effect on profit and equity of a<br />

range of possible changes in interest rates and foreign exchange rates. The range of sensitivities chosen, being 1%<br />

movement in the interest rate or 5% movement in sterling when compared to the US dollar, Euro, Chinese yuan and<br />

Danish krone, reflects the Group’s view of reasonably possible changes to these risk variables which existed at the<br />

year end.<br />

The table below illustrates the estimated impact on the Group as a result of market movements in interest rates in<br />

relation to all the Group’s financial instruments. The analysis has been produced assuming no changes in the borrowings<br />

and existing interest rate swaps portfolio when considering the interest rate movement.<br />

Income<br />

statement<br />

loss<br />

£m<br />

29 August 2015 30 August 2014<br />

Equity<br />

gain<br />

£m<br />

Income<br />

statement<br />

gain<br />

£m<br />

1% increase in interest rate (0.3) 2.9 0.3 2.3<br />

A 1% decrease in interest rate would result in an equal and opposite change in the income statement and<br />

equity respectively.<br />

The table below illustrates the estimated impact on the Group as a result of market movements in foreign exchange<br />

rates in relation to all the Group’s financial instruments.<br />

Income<br />

statement<br />

gain/(loss)<br />

£m<br />

A 5% strengthening in sterling compared to the US dollar, Euro, Chinese yuan or Danish krone would result in an equal<br />

and opposite change in the income statement and equity respectively.<br />

Equity<br />

gain<br />

£m<br />

29 August 2015 30 August 2014<br />

Equity<br />

gain/(loss)<br />

£m<br />

Income<br />

statement<br />

gain/(loss)<br />

£m<br />

Equity<br />

gain/(loss)<br />

£m<br />

5% weakening in sterling compared to US dollar (0.5) 18.2 (0.4) 20.7<br />

5% weakening in sterling compared to Euro 0.1 (3.1) 0.5 (1.0)<br />

5% weakening in sterling compared to Chinese yuan (0.1) 2.0 – 2.2<br />

5% weakening in sterling compared to Danish krone 0.9 – 0.5 –<br />

Strategic Report 1-37 Governance 38-58 Financial Statements XX-XX 86-153<br />

123<br />

<strong>Debenhams</strong> <strong>Debenhams</strong> plc Annual plc Annual Report Report & Accounts & 2015<br />

123