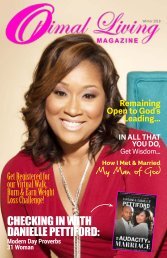

Optimal Living Magazine Fit, Fabulous & Full of Faith Issue

Our Fit, Fabulous & Full of Faith Issue features an exclusive interview with Tangie Henry - the "Healthy Inspired Sistah" from Atlanta, Georgia. Start your New Year off right with the "Intentionally Loving Myself Weight Loss Challenge!"

Our Fit, Fabulous & Full of Faith Issue features an exclusive interview with Tangie Henry - the "Healthy Inspired Sistah" from Atlanta, Georgia. Start your New Year off right with the "Intentionally Loving Myself Weight Loss Challenge!"

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

By Kelly Long<br />

5<br />

Harvest Matters<br />

Simple Ways to<br />

Increase Your<br />

Credit Score<br />

Happy New Year! One great<br />

way to get started is by understanding<br />

what your credit score<br />

is and what it means for<br />

you. For many people, without<br />

an attractive score, usually ranging<br />

from 650 or greater, you are<br />

forbidden in most cases to make<br />

certain purchases (unless you<br />

have all the cash necessary, <strong>of</strong><br />

course). In some cases, people<br />

have even been denied job opportunities<br />

and lost jobs because<br />

<strong>of</strong> their low credit scores.<br />

The beginning<br />

<strong>of</strong> the year is<br />

the perfect<br />

time to get<br />

your financial<br />

house in order.<br />

Nevertheless, being “credible” is simply a matter <strong>of</strong> positioning<br />

yourself for wealth building opportunities. In 5 simple steps, I<br />

am going to help you master and take charge <strong>of</strong> your credit<br />

score. Whether you are trying to establish or reestablish your<br />

credit score to purchase a home, a new vehicle, or to acquire<br />

a loan for a new business venture, I’m going to share with you<br />

some simple and powerful tips that can increase your FICO<br />

score to obtain your financial goals.<br />

Before you endeavor to take advantage <strong>of</strong> the tips listed<br />

below, be sure to obtain your credit report and scores. A few<br />

websites to consider are: www.creditkarma.com,<br />

www.annualcreditreport.com, and myfico.com.<br />

5 Simple Ways to Increase Your Credit Score<br />

Correct All Errors. Errors<br />

1<br />

can be found in 80% <strong>of</strong> all credit<br />

reports. It is your duty to review your report and check for<br />

errors. By law, you have the right to challenge any error that is<br />

on your report. If your dispute proves to be true, then the law<br />

requires the bureaus remove the error, which in turn will<br />

increase your score.<br />

For a free credit consultation and more<br />

information about how to<br />

restore your credit<br />

A PLUS CREDIT REPAIR SOLUTIONS<br />

800-839-0848<br />

Pay Your Bills On Time. Most people know this, but have no<br />

clue how serious this first point<br />

2<br />

is, so let me give you an example.<br />

Let’s say your credit score was a 700 and you had a mortgage<br />

or credit card that you were paying on successfully for 10<br />

years without ever being late. But one month you just so happen<br />

to miss a payment because <strong>of</strong> some hardship. I can guarantee<br />

that your score <strong>of</strong> 700 would have dropped by 50-70<br />

points because <strong>of</strong> that one missed 30-day payment. Now imagine<br />

what would happen if you missed two or more payments?<br />

Enough said. Make the intended effort to pay your bills<br />

on time in 2014!<br />

Keep all balances low. Whether you have remaining balances<br />

on your store cards, credit cards, and/or installment loans,<br />

your goal should always be to<br />

3<br />

pay them <strong>of</strong>f to zero. You may<br />

have heard that keeping a low balance on your credit cards<br />

have a positive effect, but I would challenge that and say no,<br />

not at all. The less debt you are carrying, the higher your credit<br />

score will prove to be. So if you have a card with a zero<br />

balance, surely that’s better than having a card with a 10%<br />

balance remaining. NOTE: 30% percent <strong>of</strong> your score is the<br />

amount owed on all cards and accounts.<br />

Types <strong>of</strong> credit in use. The types <strong>of</strong> accounts you have<br />

established determines 15% <strong>of</strong> your credit score on your report.<br />

What I mean by types<br />

4<br />

<strong>of</strong> credit in use is simply a diversity<br />

<strong>of</strong> accounts. You will have to establish an installment account,<br />

such as a car loan, or a borrowed loan from a banking institution<br />

while managing several credit cards (two or three credit<br />

cards, at least two). As you pay on these accounts over time,<br />

without being late, your scores will gradually increase.<br />

Don’t ever close existing accounts. You should never look<br />

to close out existing accounts, especially if you had a very positive<br />

history with the creditor.<br />

5<br />

Closing out your existing accounts<br />

because you are no longer using them could impact<br />

your score negatively. I highly recommend keeping those<br />

cards open. Another reason for keeping the cards open and<br />

active is simply due to the history behind the cards. The longer<br />

the history behind the card, the more positive effect the<br />

account will have on your score.<br />

In conclusion, if you follow these 5 simple and powerful steps,<br />

you will almost immediately see an increase in your overall<br />

FICO score. Some would have you think that fixing your credit<br />

score is next to impossible, but I would say it’s simply a matter<br />

<strong>of</strong> taking the initiative to follow the guidelines above and maintain<br />

a consistent and good history for all established accounts.<br />

After all, you were created to “be the lender, not the borrower”.<br />

Winter 2017 <strong>Optimal</strong> <strong>Living</strong> 5