MBR_Issue_27 -January 2017 low res

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Malta Business Review<br />

MALTA GOVERNMENT SECURITIES<br />

EU TOP STORY<br />

Malta Business Review<br />

Malta Government Securities<br />

<strong>2017</strong> Indicative Calendar<br />

Securities with maturity of more than one year<br />

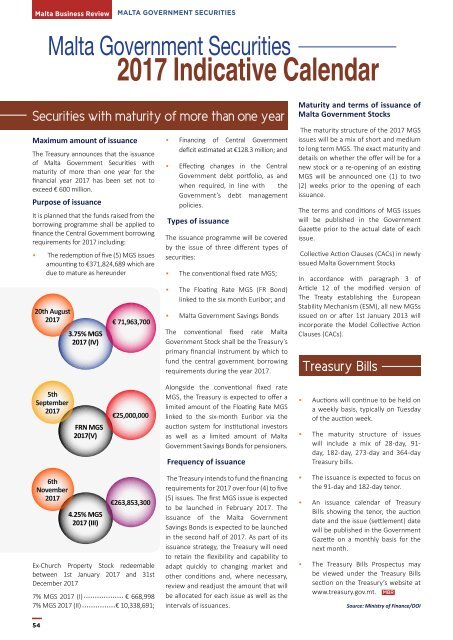

Maximum amount of issuance<br />

The Treasury announces that the issuance<br />

of Malta Government Securities with<br />

maturity of more than one year for the<br />

financial year <strong>2017</strong> has been set not to<br />

exceed € 600 million.<br />

Purpose of issuance<br />

It is planned that the funds raised from the<br />

borrowing programme shall be applied to<br />

finance the Central Government borrowing<br />

requirements for <strong>2017</strong> including:<br />

• The redemption of five (5) MGS issues<br />

amounting to €371,824,689 which are<br />

due to mature as hereunder<br />

20th August<br />

<strong>2017</strong> € 71,963,700<br />

3.75% MGS<br />

<strong>2017</strong> (IV)<br />

• Financing of Central Government<br />

deficit estimated at €128.3 million; and<br />

• Effecting changes in the Central<br />

Government debt portfolio, as and<br />

when required, in line with the<br />

Government’s debt management<br />

policies.<br />

Types of issuance<br />

The issuance programme will be covered<br />

by the issue of three different types of<br />

securities:<br />

• The conventional fixed rate MGS;<br />

• The Floating Rate MGS (FR Bond)<br />

linked to the six month Euribor; and<br />

• Malta Government Savings Bonds<br />

The conventional fixed rate Malta<br />

Government Stock shall be the Treasury’s<br />

primary financial instrument by which to<br />

fund the central government borrowing<br />

requirements during the year <strong>2017</strong>.<br />

Maturity and terms of issuance of<br />

Malta Government Stocks<br />

The maturity structure of the <strong>2017</strong> MGS<br />

issues will be a mix of short and medium<br />

to long term MGS. The exact maturity and<br />

details on whether the offer will be for a<br />

new stock or a re-opening of an existing<br />

MGS will be announced one (1) to two<br />

(2) weeks prior to the opening of each<br />

issuance.<br />

The terms and conditions of MGS issues<br />

will be published in the Government<br />

Gazette prior to the actual date of each<br />

issue.<br />

Collective Action Clauses (CACs) in newly<br />

issued Malta Government Stocks<br />

In accordance with paragraph 3 of<br />

Article 12 of the modified version of<br />

The Treaty establishing the European<br />

Stability Mechanism (ESM), all new MGSs<br />

issued on or after 1st <strong>January</strong> 2013 will<br />

incorporate the Model Collective Action<br />

Clauses (CACs).<br />

Treasury Bills<br />

Antonio Tajani<br />

elected p<strong>res</strong>ident:<br />

“I will be a<br />

spokesman for the<br />

whole Parliament”<br />

Antonio Tajani was elected p<strong>res</strong>ident<br />

of the European Parliament on 17<br />

<strong>January</strong>, succeeding Martin Schulz.<br />

Tajani, an Italian member of the<br />

centre-right European People’s Party<br />

(EPP) group and vice-p<strong>res</strong>ident of<br />

the Parliament, received 351 votes in<br />

the fourth and final round of voting,<br />

compared to 282 votes for Gianni<br />

Pittella, the Italian leader of the S&D<br />

group. His term in office will end in<br />

2019, when the next elections for the<br />

European Parliament will be held.<br />

The election took four rounds of voting<br />

over 12 hours. At the p<strong>res</strong>s conference<br />

fol<strong>low</strong>ing the election, Tajani said: “This<br />

was a long day of democracy."<br />

The new p<strong>res</strong>ident also thanked his<br />

predecessor Martin Schulz for the work<br />

he did as well as the MEPs who voted<br />

for the other candidates, telling them he<br />

would be a "p<strong>res</strong>ident for everybody".<br />

Tajani said he would seek to ensure that<br />

Parliament would be strong and have its<br />

views heard by the Council, rep<strong>res</strong>enting<br />

national governments in the EU. He also<br />

said he dedicated his election to the<br />

victims of last year's earthquakes in Italy.<br />

The election on 17 <strong>January</strong> started at<br />

9.00 CET with speeches given by the<br />

candidates and concluded 12 hours<br />

later with the announcement of Tajani<br />

becoming p<strong>res</strong>ident. In addition to Pitella,<br />

the other candidates were Helga Stevens<br />

(ECR, Belgium), Jean Lamberts (Greens,<br />

UK), Eleonora Forenza (GUE/NGL, Italy)<br />

and Laurentiu Rebega (ENF, Romania).<br />

Guy Verhofstadt, the Belgian leader of<br />

ALDE, was also a candidate, but withdrew<br />

before the first in favour of Tajani. Tajani<br />

received the most votes in every round<br />

and the final round was only between<br />

him and Pittella. <strong>MBR</strong><br />

Tajani served in the Italian army and worked as a journalist before entering politics<br />

with Forza Italia. He was first elected to the European Parliament in 1994 and served<br />

as a spokesperson for Italian prime minister Silvio Berlusconi, the leader of Forza<br />

Italia, in 1994-95. He became the commissioner in charge of transport in 2008 and<br />

take over <strong>res</strong>ponsibility for the industry and entrepreneurship portfolio in 2010.<br />

Tajani, who holds a law degree and is married with two children, was re-elected as<br />

MEP in 1999, 2004 and 2014. Fol<strong>low</strong>ing his latest re-election he was elected vicep<strong>res</strong>ident<br />

of the European Parliament. He is the Parliament’s 30th p<strong>res</strong>ident and the<br />

15th since the first Parliament elections in 1979.<br />

Avoid unnecessary legal costs when chasing your debts<br />

5th<br />

September<br />

<strong>2017</strong><br />

FRN MGS<br />

<strong>2017</strong>(V)<br />

€25,000,000<br />

Alongside the conventional fixed rate<br />

MGS, the Treasury is expected to offer a<br />

limited amount of the Floating Rate MGS<br />

linked to the six-month Euribor via the<br />

auction system for institutional investors<br />

as well as a limited amount of Malta<br />

Government Savings Bonds for pensioners.<br />

Frequency of issuance<br />

• Auctions will continue to be held on<br />

a weekly basis, typically on Tuesday<br />

of the auction week.<br />

• The maturity structure of issues<br />

will include a mix of 28-day, 91-<br />

day, 182-day, <strong>27</strong>3-day and 364-day<br />

Treasury bills.<br />

Creditinfo P<strong>res</strong>sure Letters<br />

An alternative method of collecting money owed to you<br />

that is both Inexpensive and Effective<br />

6th<br />

November<br />

<strong>2017</strong><br />

4.25% MGS<br />

<strong>2017</strong> (III)<br />

€263,853,300<br />

Ex-Church Property Stock redeemable<br />

between 1st <strong>January</strong> <strong>2017</strong> and 31st<br />

December <strong>2017</strong><br />

7% MGS <strong>2017</strong> (I) € 668,998<br />

7% MGS <strong>2017</strong> (II) € 10,338,691;<br />

The Treasury intends to fund the financing<br />

requirements for <strong>2017</strong> over four (4) to five<br />

(5) issues. The first MGS issue is expected<br />

to be launched in February <strong>2017</strong>. The<br />

issuance of the Malta Government<br />

Savings Bonds is expected to be launched<br />

in the second half of <strong>2017</strong>. As part of its<br />

issuance strategy, the Treasury will need<br />

to retain the flexibility and capability to<br />

adapt quickly to changing market and<br />

other conditions and, where necessary,<br />

review and readjust the amount that will<br />

be allocated for each issue as well as the<br />

intervals of issuances.<br />

• The issuance is expected to focus on<br />

the 91-day and 182-day tenor.<br />

• An issuance calendar of Treasury<br />

Bills showing the tenor, the auction<br />

date and the issue (settlement) date<br />

will be published in the Government<br />

Gazette on a monthly basis for the<br />

next month.<br />

• The Treasury Bills Prospectus may<br />

be viewed under the Treasury Bills<br />

section on the Treasury’s website at<br />

www.treasury.gov.mt. <strong>MBR</strong><br />

Source: Ministry of Finance/DOI<br />

Close to €500,000 of<br />

debt paid back in 2016 alone<br />

2131 2344 - info@creditinfo.com.mt - www.creditinfo.com.mt<br />

Over 45,000 letters sent on behalf of<br />

companies and individuals.<br />

54 www.maltabusinessreview.net 55