The Developer's Digest, May - June 2015 Issue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

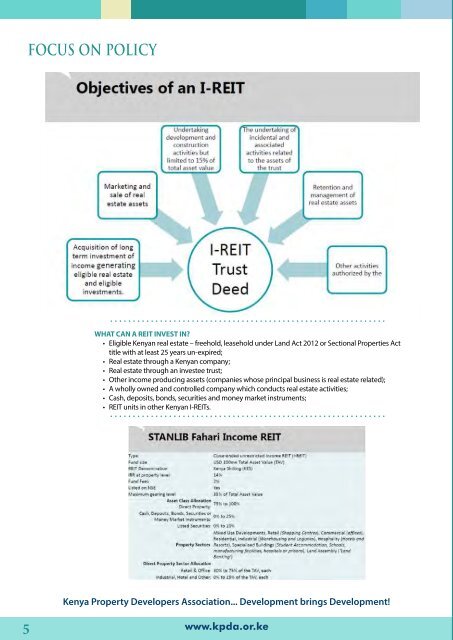

FOCUS ON POLICY<br />

FOCUS ON POLICY<br />

REITS REGIONAL INVESTMENTS AND TAX TREATMENT<br />

• Kenya, Tanzania and Uganda (July <strong>2015</strong>) have REIT regulations which are significantly similar;<br />

• Kenya and Uganda are expressly tax exempt. Tanzania REIT structure follows a unit trust structure<br />

and are not tax exempt;<br />

• In Tanzania REIT, Rule 102 of the Collective Investment Schemes Real Estate Investments Trusts,<br />

Rules 2011 states that – Distribution of Income states that:<br />

‘ <strong>The</strong> fund shall distribute dividends which have arose from gains or realized income each year<br />

an amount not less than 90% of its annual net income after tax.’<br />

• Kenya cannot invest across geographical jurisdictions. Tanzania and Uganda REITs can invest in<br />

foreign real estate/funds however, the investment objective of the fund must be clear, specific<br />

and sufficiently stipulated in the deed;<br />

• Uganda has not amended its Income Tax Act, hence the cross border investment may pose<br />

administrative challenges for now.<br />

FUTURE IMPLICATIONS OF REITS<br />

• Spur further property developments through forward purchases with developers;<br />

• Provide liquidity in the market place;<br />

• Provide price discovery;<br />

• Enhance the structure and due diligence of property transactions, especially record keeping;<br />

• Lead to the formation of a property transaction registry;<br />

• In keeping with the theme of EAC, it will lead to more EA transactions. This is also in line with<br />

EASEA which envisages one common EA stock exchange;<br />

• Enhance quality of investment returns for insurance companies, pension funds and individuals;<br />

• Enhance transparency and comparison of risk and investment returns with other asset classes.<br />

WHAT CAN A REIT INVEST IN?<br />

• Eligible Kenyan real estate – freehold, leasehold under Land Act 2012 or Sectional Properties Act<br />

title with at least 25 years un-expired;<br />

• Real estate through a Kenyan company;<br />

• Real estate through an investee trust;<br />

• Other income producing assets (companies whose principal business is real estate related);<br />

• A wholly owned and controlled company which conducts real estate activities;<br />

• Cash, deposits, bonds, securities and money market instruments;<br />

• REIT units in other Kenyan I-REITs.<br />

CONCLUSION<br />

REITs sector in the region has significant potential supported by:<br />

• Regional integration;<br />

• Supportive monetary policies;<br />

• Stable macro-economic environment;<br />

• Improving infrastructure;<br />

• Increasing foreign investment and diaspora remittance;<br />

• Need for internationally recognized structured vehicles in real estate sector<br />

Kenya Property Developers Association... Development brings Development!<br />

Kenya Property Developers Association... Development brings Development!<br />

5<br />

6