ANNUAL

ENKAI_ANNUAL_REPORT_31122016

ENKAI_ANNUAL_REPORT_31122016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ENKA İNŞAAT VE SANAYİ A.Ş. AND ITS SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2016<br />

(Amounts are expressed as thousands of U.S. Dollars (“USD”) unless otherwise stated. Currencies other than USD are<br />

expressed in thousands unless otherwise indicated.)<br />

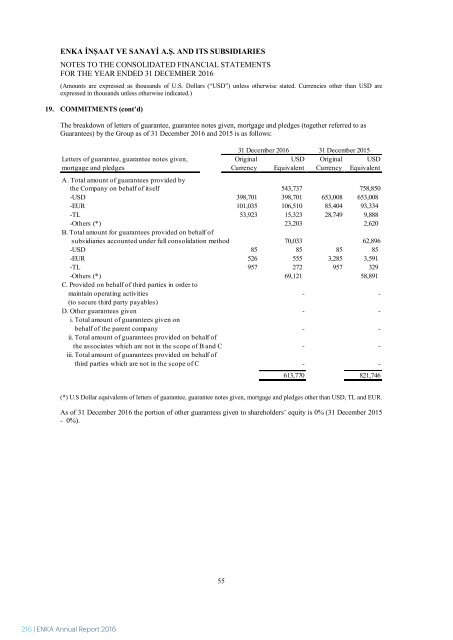

19. COMMITMENTS (cont’d)<br />

The breakdown of letters of guarantee, guarantee notes given, mortgage and pledges (together referred to as<br />

Guarantees) by the Group as of 31 December 2016 and 2015 is as follows:<br />

Letters of guarantee, guarantee notes given,<br />

mortgage and pledges<br />

31 December 2016 31 December 2015<br />

USD<br />

Equivalent<br />

Original<br />

Currency<br />

Original<br />

Currency<br />

USD<br />

Equivalent<br />

A. Total amount of guarantees provided by<br />

the Company on behalf of itself 543,737 758,850<br />

-USD 398,701 398,701 653,008 653,008<br />

-EUR 101,035 106,510 85,404 93,334<br />

-TL 53,923 15,323 28,749 9,888<br />

-Others (*) 23,203 2,620<br />

B. Total amount for guarantees provided on behalf of<br />

subsidiaries accounted under full consolidation method 70,033 62,896<br />

-USD 85 85 85 85<br />

-EUR 526 555 3,285 3,591<br />

-TL 957 272 957 329<br />

-Others (*) 69,121 58,891<br />

C. Provided on behalf of third parties in order to<br />

maintain operating activities - -<br />

(to secure third party payables)<br />

D. Other guarantees given - -<br />

i. Total amount of guarantees given on<br />

behalf of the parent company - -<br />

ii. Total amount of guarantees provided on behalf of<br />

the associates which are not in the scope of B and C - -<br />

iii. Total amount of guarantees provided on behalf of<br />

third parties which are not in the scope of C - -<br />

613,770 821,746<br />

(*) U.S Dollar equivalents of letters of guarantee, guarantee notes given, mortgage and pledges other than USD, TL and EUR.<br />

As of 31 December 2016 the portion of other guarantess given to shareholders’ equity is 0% (31 December 2015<br />

- 0%).<br />

ENKA İNŞAAT VE SANAYİ A.Ş. AND ITS SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2016<br />

(Amounts are expressed as thousands of U.S. Dollars (“USD”) unless otherwise stated. Currencies other than USD are<br />

expressed in thousands unless otherwise indicated.)<br />

20. PROVISIONS FOR EMPLOYEE BENEFITS<br />

a) Short-term employee benefits<br />

Liabilities with the scope of employee benefits<br />

31 December 31 December<br />

2016 2015<br />

Payroll payable 21,873 13,551<br />

Short-term provisions related to employee benefits<br />

21,873 13,551<br />

31 December 31 December<br />

2016 2015<br />

Bonus accrual 9,402 5,057<br />

Vacation pay liability 8,940 9,626<br />

18,342 14,683<br />

b) Long-term employee benefits<br />

In accordance with existing social legislation, the Company and its subsidiaries incorporated in Turkey are required<br />

to make lump-sum payments to employees whose employment is terminated due to retirement or for reasons other<br />

than resignation or misconduct. Such payments are calculated on the basis of 30 days’ pay limited to a maximum<br />

of full TL 4,297 equivalent to full USD 1,221 (31 December 2015 - full TL 3,828 equivalent to full USD 1,317)<br />

per year of employment at the rate of pay applicable at the date of retirement or termination.<br />

The liability is not funded as there is no funding requirement.<br />

The provision has been calculated by estimating the present value of the future probable obligation of the Company<br />

arising from the retirement of employees. IAS 19 requires actuarial valuation methods to be developed to estimate the<br />

enterprise’s obligation under defined benefit plans. Accordingly, the following actuarial assumptions were used in the<br />

calculation of the total liability:<br />

The principal assumption is that the maximum liability for each year of service will increase parallel with inflation.<br />

Thus, the discount rate applied represents the expected real rate after adjusting for the anticipated effects of future<br />

inflation. Consequently, in the accompanying financial statements as at 31 December 2016, the provision has been<br />

calculated by estimating the present value of the future probable obligation of the Company arising from the retirement<br />

of the employees. The provisions at the respective balance sheet dates have been calculated with 3.99% real discount<br />

rate, assuming an annual inflation rate of 6.5% and a discount rate of 10.75% (31 December 2015 – 3.99 %).<br />

Estimated amount of retirement pay not paid due to voluntary leaves is also taken into consideration. Retirement<br />

ceiling pay revised each six month period basis and ceiling amount of full TL 4,426 which is in effect since 1<br />

January 2017 is used in the calculation of Groups’ provision for retirement pay liability (1 January 2016 – full TL<br />

4,093).<br />

Movements of the provision for employee termination benefits during years ended 31 December 2016 and 2015 are<br />

as follows:<br />

1 January - 1 January -<br />

31 December 2016 31 December 2015<br />

Opening balance 16,952 16,294<br />

Service cost 2,606 2,589<br />

Actuarial loss 483 2,005<br />

Retirement benefits paid (1,830) (1,869)<br />

Translation gain (1,921) (2,067)<br />

Closing balance 16,290 16,952<br />

55<br />

56<br />

216 | ENKA Annual Report 2016<br />

ENKA Annual Report 2016 | 217