Q1 Financial Report - 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Ag Growth International Inc.<br />

NOTES TO UNAUDITED INTERIM CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

[in thousands of Canadian dollars, except where otherwise noted and per share data]<br />

March 31, <strong>2011</strong><br />

The Company enters into foreign exchange forward contracts to mitigate foreign currency risk<br />

relating to certain cash flow exposures. The hedged transactions are expected to occur within<br />

a maximum 12-month period. The Company's foreign exchange forward contracts reduce the<br />

Company's risk from exchange movements because gains and losses on such contracts offset<br />

losses and gains on transactions being hedged. The Company's exposure to foreign currency<br />

changes for all other currencies is not material.<br />

Ag Growth's sales denominated in U.S. dollars for the three-month period ended March 31,<br />

<strong>2011</strong> were U.S. $49.2 million, and the total of its cost of goods sold and its selling, general<br />

and administrative expenses denominated in that currency were U.S. $28.8 million.<br />

Accordingly, a 10% increase or decrease in the value of the U.S. dollar relative to its<br />

Canadian counterpart would result in a $4.9 million increase or decrease in sales and a total<br />

increase or decrease of $2.9 million in its cost of goods sold and its selling, general and<br />

administrative expenses. In relation to Ag Growth's foreign exchange hedging contracts, a<br />

10% increase or decrease in the value of the U.S. dollar relative to its Canadian counterpart<br />

would result in an increase or decrease in the foreign exchange loss of $0.8 million and an<br />

increase or decrease to other comprehensive income of $3.6 million.<br />

The counterparty to the contracts is a multinational commercial bank and therefore credit risk<br />

of counterparty non-performance is remote. Realized gains or losses are included in net<br />

earnings and for the three-month period ended March 31, <strong>2011</strong> the Company realized a gain<br />

on its foreign exchange contracts of $798 [2010 - $965 gain].<br />

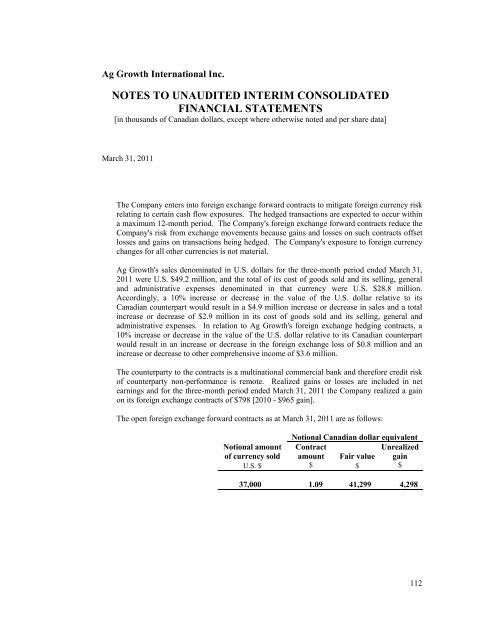

The open foreign exchange forward contracts as at March 31, <strong>2011</strong> are as follows:<br />

Notional Canadian dollar equivalent<br />

Notional amount<br />

of currency sold<br />

Contract<br />

amount Fair value<br />

Unrealized<br />

gain<br />

U.S. $ $ $ $<br />

37,000 1.09 41,299 4,298<br />

112