Q1 Financial Report - 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

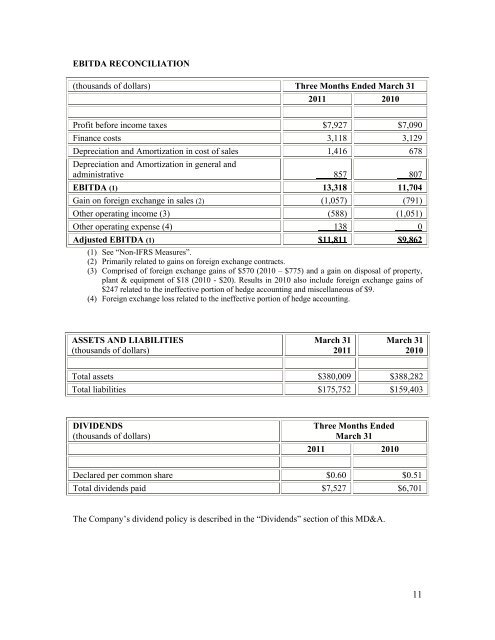

EBITDA RECONCILIATION<br />

(thousands of dollars) Three Months Ended March 31<br />

<strong>2011</strong> 2010<br />

Profit before income taxes $7,927 $7,090<br />

Finance costs 3,118 3,129<br />

Depreciation and Amortization in cost of sales 1,416 678<br />

Depreciation and Amortization in general and<br />

administrative 857 807<br />

EBITDA (1) 13,318 11,704<br />

Gain on foreign exchange in sales (2) (1,057) (791)<br />

Other operating income (3) (588) (1,051)<br />

Other operating expense (4) 138 0<br />

Adjusted EBITDA (1) $11,811 $9,862<br />

(1) See “Non-IFRS Measures”.<br />

(2) Primarily related to gains on foreign exchange contracts.<br />

(3) Comprised of foreign exchange gains of $570 (2010 – $775) and a gain on disposal of property,<br />

plant & equipment of $18 (2010 - $20). Results in 2010 also include foreign exchange gains of<br />

$247 related to the ineffective portion of hedge accounting and miscellaneous of $9.<br />

(4) Foreign exchange loss related to the ineffective portion of hedge accounting.<br />

ASSETS AND LIABILITIES<br />

(thousands of dollars)<br />

March 31<br />

<strong>2011</strong><br />

March 31<br />

2010<br />

Total assets $380,009 $388,282<br />

Total liabilities $175,752 $159,403<br />

DIVIDENDS<br />

(thousands of dollars)<br />

Three Months Ended<br />

March 31<br />

<strong>2011</strong> 2010<br />

Declared per common share $0.60 $0.51<br />

Total dividends paid $7,527 $6,701<br />

The Company’s dividend policy is described in the “Dividends” section of this MD&A.<br />

11