Q1 Financial Report - 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

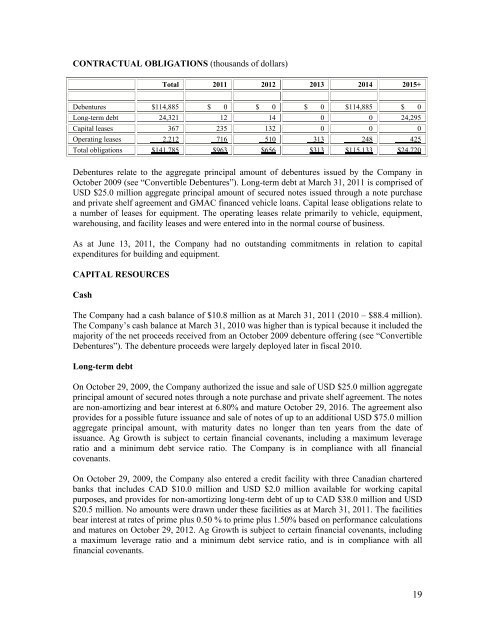

CONTRACTUAL OBLIGATIONS (thousands of dollars)<br />

Total <strong>2011</strong> 2012 2013 2014 2015+<br />

Debentures $114,885 $ 0 $ 0 $ 0 $114,885 $ 0<br />

Long-term debt 24,321 12 14 0 0 24,295<br />

Capital leases 367 235 132 0 0 0<br />

Operating leases 2,212 716 510 313 248 425<br />

Total obligations $141,785 $963 $656 $313 $115,133 $24,720<br />

Debentures relate to the aggregate principal amount of debentures issued by the Company in<br />

October 2009 (see “Convertible Debentures”). Long-term debt at March 31, <strong>2011</strong> is comprised of<br />

USD $25.0 million aggregate principal amount of secured notes issued through a note purchase<br />

and private shelf agreement and GMAC financed vehicle loans. Capital lease obligations relate to<br />

a number of leases for equipment. The operating leases relate primarily to vehicle, equipment,<br />

warehousing, and facility leases and were entered into in the normal course of business.<br />

As at June 13, <strong>2011</strong>, the Company had no outstanding commitments in relation to capital<br />

expenditures for building and equipment.<br />

CAPITAL RESOURCES<br />

Cash<br />

The Company had a cash balance of $10.8 million as at March 31, <strong>2011</strong> (2010 – $88.4 million).<br />

The Company’s cash balance at March 31, 2010 was higher than is typical because it included the<br />

majority of the net proceeds received from an October 2009 debenture offering (see “Convertible<br />

Debentures”). The debenture proceeds were largely deployed later in fiscal 2010.<br />

Long-term debt<br />

On October 29, 2009, the Company authorized the issue and sale of USD $25.0 million aggregate<br />

principal amount of secured notes through a note purchase and private shelf agreement. The notes<br />

are non-amortizing and bear interest at 6.80% and mature October 29, 2016. The agreement also<br />

provides for a possible future issuance and sale of notes of up to an additional USD $75.0 million<br />

aggregate principal amount, with maturity dates no longer than ten years from the date of<br />

issuance. Ag Growth is subject to certain financial covenants, including a maximum leverage<br />

ratio and a minimum debt service ratio. The Company is in compliance with all financial<br />

covenants.<br />

On October 29, 2009, the Company also entered a credit facility with three Canadian chartered<br />

banks that includes CAD $10.0 million and USD $2.0 million available for working capital<br />

purposes, and provides for non-amortizing long-term debt of up to CAD $38.0 million and USD<br />

$20.5 million. No amounts were drawn under these facilities as at March 31, <strong>2011</strong>. The facilities<br />

bear interest at rates of prime plus 0.50 % to prime plus 1.50% based on performance calculations<br />

and matures on October 29, 2012. Ag Growth is subject to certain financial covenants, including<br />

a maximum leverage ratio and a minimum debt service ratio, and is in compliance with all<br />

financial covenants.<br />

19