Q1 Financial Report - 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Ag Growth International Inc.<br />

NOTES TO UNAUDITED INTERIM CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

[in thousands of Canadian dollars, except where otherwise noted and per share data]<br />

March 31, <strong>2011</strong><br />

Construction in progress is comprised primarily of building and equipment, the cost of which has<br />

not been depreciated as the assets were not placed in use in the reporting period.<br />

Ag Growth regularly assesses its long-lived assets for impairment. As at March 31, <strong>2011</strong>, the<br />

recoverable amount of each CGU exceeded the carrying amounts of the assets allocated to the<br />

respective units.<br />

Capitalized borrowing costs<br />

No borrowing costs were capitalized in 2010 or the first quarter of <strong>2011</strong>. Ag Growth availed itself<br />

of the borrowing cost exemption available in IFRS 1.<br />

Finance leases<br />

Included in manufacturing equipment is equipment held under finance leases, the carrying value of<br />

which at March 31, <strong>2011</strong> was $740 [December 31, 2010 - $839, January 1, 2010 - nil]. Leased<br />

assets are pledged as security for the related finance lease liabilities.<br />

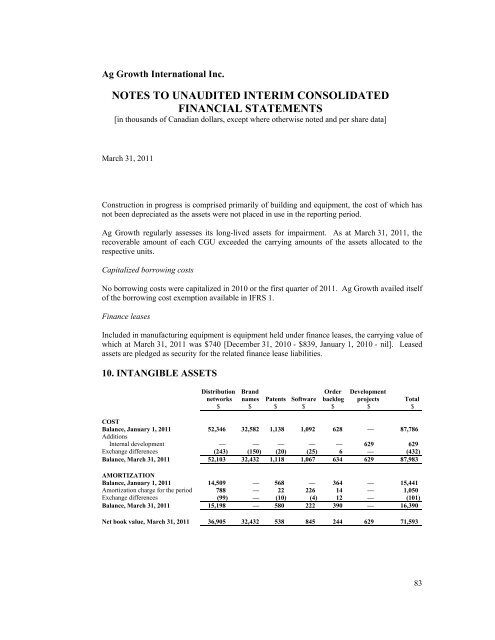

10. INTANGIBLE ASSETS<br />

Distribution<br />

networks<br />

Brand<br />

names Patents Software<br />

Order<br />

backlog<br />

Development<br />

projects Total<br />

$ $ $ $ $ $ $<br />

COST<br />

Balance, January 1, <strong>2011</strong> 52,346 32,582 1,138 1,092 628 — 87,786<br />

Additions<br />

Internal development — — — — — 629 629<br />

Exchange differences (243) (150) (20) (25) 6 — (432)<br />

Balance, March 31, <strong>2011</strong> 52,103 32,432 1,118 1,067 634 629 87,983<br />

AMORTIZATION<br />

Balance, January 1, <strong>2011</strong> 14,509 — 568 — 364 — 15,441<br />

Amortization charge for the period 788 — 22 226 14 — 1,050<br />

Exchange differences (99) — (10) (4) 12 — (101)<br />

Balance, March 31, <strong>2011</strong> 15,198 — 580 222 390 — 16,390<br />

Net book value, March 31, <strong>2011</strong> 36,905 32,432 538 845 244 629 71,593<br />

83