Q1 Financial Report - 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Ag Growth International Inc.<br />

NOTES TO UNAUDITED INTERIM CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

[in thousands of Canadian dollars, except where otherwise noted and per share data]<br />

March 31, <strong>2011</strong><br />

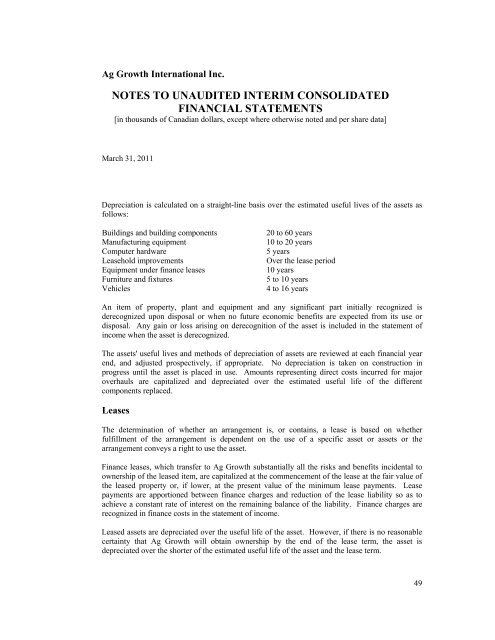

Depreciation is calculated on a straight-line basis over the estimated useful lives of the assets as<br />

follows:<br />

Buildings and building components<br />

Manufacturing equipment<br />

Computer hardware<br />

Leasehold improvements<br />

Equipment under finance leases<br />

Furniture and fixtures<br />

Vehicles<br />

20 to 60 years<br />

10 to 20 years<br />

5 years<br />

Over the lease period<br />

10 years<br />

5 to 10 years<br />

4 to 16 years<br />

An item of property, plant and equipment and any significant part initially recognized is<br />

derecognized upon disposal or when no future economic benefits are expected from its use or<br />

disposal. Any gain or loss arising on derecognition of the asset is included in the statement of<br />

income when the asset is derecognized.<br />

The assets' useful lives and methods of depreciation of assets are reviewed at each financial year<br />

end, and adjusted prospectively, if appropriate. No depreciation is taken on construction in<br />

progress until the asset is placed in use. Amounts representing direct costs incurred for major<br />

overhauls are capitalized and depreciated over the estimated useful life of the different<br />

components replaced.<br />

Leases<br />

The determination of whether an arrangement is, or contains, a lease is based on whether<br />

fulfillment of the arrangement is dependent on the use of a specific asset or assets or the<br />

arrangement conveys a right to use the asset.<br />

Finance leases, which transfer to Ag Growth substantially all the risks and benefits incidental to<br />

ownership of the leased item, are capitalized at the commencement of the lease at the fair value of<br />

the leased property or, if lower, at the present value of the minimum lease payments. Lease<br />

payments are apportioned between finance charges and reduction of the lease liability so as to<br />

achieve a constant rate of interest on the remaining balance of the liability. Finance charges are<br />

recognized in finance costs in the statement of income.<br />

Leased assets are depreciated over the useful life of the asset. However, if there is no reasonable<br />

certainty that Ag Growth will obtain ownership by the end of the lease term, the asset is<br />

depreciated over the shorter of the estimated useful life of the asset and the lease term.<br />

49