You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

minor improvements in <strong>the</strong> accounting treatment of provisi<strong>on</strong>s,<br />

leases and revenue recogniti<strong>on</strong> enhance <strong>the</strong> uniformity of financial<br />

reporting.<br />

GLOBAL INVESTOR 1.05 IFRS— 15<br />

The impact <strong>on</strong> valuati<strong>on</strong>s and credit profiles<br />

Oftentimes, <strong>the</strong> first reacti<strong>on</strong> to accounting alterati<strong>on</strong>s is to argue<br />

that <strong>the</strong>y are of limited relevance to company valuati<strong>on</strong>s since<br />

cash flows for <strong>the</strong> DCF models do not change. We do not fully<br />

agree with this view for four reas<strong>on</strong>s. First, valuati<strong>on</strong> metrics such<br />

as P/E , P/B and EV/EBITDA multiples, which will look more<br />

attractive thanks to <strong>the</strong> switch to IFRS, are still comm<strong>on</strong>ly used.<br />

Sec<strong>on</strong>d, <strong>the</strong> underlying assumpti<strong>on</strong>s for DCF models could be<br />

affected as new and more reliable segmental informati<strong>on</strong><br />

becomes available. Third, credit ratios such as EBITDA interest<br />

coverage, interest-bearing debt to EBITDA, and leverage will<br />

change and thus shift company credit profiles. It is still uncertain<br />

how <strong>the</strong> rating agencies will handle this issue, but some companies<br />

presenting higher operating performance in additi<strong>on</strong> to beneficial<br />

alterati<strong>on</strong>s <strong>on</strong> <strong>the</strong>ir balance sheets are likely to receive rating<br />

and outlook upgrades in due course. And fourth, moving<br />

off-balance-sheet informati<strong>on</strong> to <strong>the</strong> balance sheet will change<br />

investors’ percepti<strong>on</strong>s of companies’ leverage and risk.<br />

The introducti<strong>on</strong> of IFRS is a welcome development<br />

The volatility of net earnings and shareholders’ equity is likely to<br />

increase, particularly due to <strong>the</strong> switch from goodwill amortizati<strong>on</strong><br />

to impairment testing (IFRS 3) and <strong>the</strong> valuati<strong>on</strong> of financial instruments<br />

at fair value (IAS 39/32) . Some market participants may<br />

initially have difficulty absorbing <strong>the</strong> new, complex financial informati<strong>on</strong><br />

and appropriately assessing <strong>the</strong> aforementi<strong>on</strong>ed heightened<br />

volatility. Hence, <strong>the</strong> informati<strong>on</strong> policy (guidance) of individual<br />

companies is likely to be of essential importance here.<br />

We welcome <strong>the</strong> implementati<strong>on</strong> of IFRS because, in <strong>the</strong><br />

l<strong>on</strong>ger term, it will substantially enhance <strong>the</strong> transparency and<br />

comparability of corporate financial statements and will move<br />

European accounting practices closer to US GAAP norms. As for<br />

company valuati<strong>on</strong>s, we believe that <strong>the</strong> transiti<strong>on</strong> to IFRS will lead<br />

to improved earnings quality in <strong>the</strong> l<strong>on</strong>ger term and will thus give<br />

rise to more accurate, more reliable and more c<strong>on</strong>sistent valuati<strong>on</strong>s<br />

for European companies.<br />

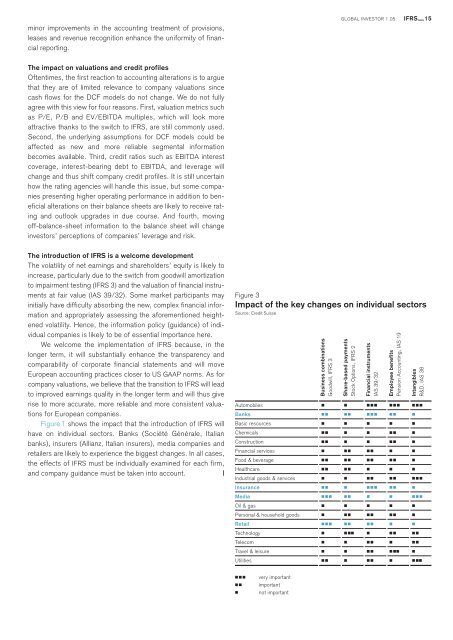

Figure1 shows <strong>the</strong> impact that <strong>the</strong> introducti<strong>on</strong> of IFRS will<br />

have <strong>on</strong> individual sectors. Banks (Société Générale, Italian<br />

banks), insurers (Allianz, Italian insurers), media companies and<br />

retailers are likely to experience <strong>the</strong> biggest changes. In all cases,<br />

<strong>the</strong> effects of IFRS must be individually examined for each firm,<br />

and company guidance must be taken into account. |<br />

Figure 3<br />

Impact of <strong>the</strong> key changes <strong>on</strong> individual sectors<br />

Source: Credit Suisse<br />

Business combinati<strong>on</strong>s<br />

Goodwill, IFRS 3<br />

Share-based payments<br />

Stock Opti<strong>on</strong>s, IFRS 2<br />

Financial instruments<br />

IAS 39/32<br />

Employee benefits<br />

Pensi<strong>on</strong> Accounting, IAS 19<br />

Automobiles <br />

Banks <br />

Basic resources <br />

Chemicals <br />

C<strong>on</strong>structi<strong>on</strong> <br />

Financial services <br />

Food & beverage <br />

Healthcare <br />

Industrial goods & services <br />

Insurance <br />

Media <br />

Oil & gas <br />

Pers<strong>on</strong>al & household goods <br />

Retail <br />

Technology <br />

Telecom <br />

Travel & leisure <br />

Intangibles<br />

R&D, IAS 38<br />

Utilities <br />

<br />

<br />

<br />

very important<br />

important<br />

not important