You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

correlati<strong>on</strong> between EUR and USD government inflati<strong>on</strong>-linked<br />

b<strong>on</strong>ds and o<strong>the</strong>r asset classes. The lower <strong>the</strong> correlati<strong>on</strong> coefficient<br />

(R 2 ), <strong>the</strong> higher <strong>the</strong> diversificati<strong>on</strong> value, and a value of 1.00<br />

indicates perfect correlati<strong>on</strong>, while a value of 0.00 indicates that<br />

two asset classes exhibit no correlati<strong>on</strong>. For example, <strong>the</strong> correlati<strong>on</strong><br />

between EUR linkers and EUR (nominal) government b<strong>on</strong>ds<br />

is 0.58. The correlati<strong>on</strong> between USD linkers and USD equities<br />

is 0.02, etc.<br />

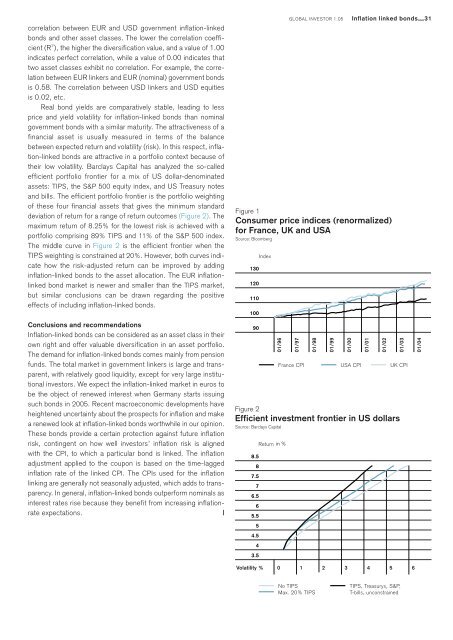

Real b<strong>on</strong>d yields are comparatively stable, leading to less<br />

price and yield volatility for inflati<strong>on</strong>-linked b<strong>on</strong>ds than nominal<br />

government b<strong>on</strong>ds with a similar maturity. The attractiveness of a<br />

financial asset is usually measured in terms of <strong>the</strong> balance<br />

between expected return and volatility (risk). In this respect, inflati<strong>on</strong>-linked<br />

b<strong>on</strong>ds are attractive in a portfolio c<strong>on</strong>text because of<br />

<strong>the</strong>ir low volatility. Barclays Capital has analyzed <strong>the</strong> so-called<br />

efficient portfolio fr<strong>on</strong>tier for a mix of US dollar-denominated<br />

assets: TIPS, <strong>the</strong> S&P 500 equity index, and US Treasury notes<br />

and bills. The efficient portfolio fr<strong>on</strong>tier is <strong>the</strong> portfolio weighting<br />

of <strong>the</strong>se four financial assets that gives <strong>the</strong> minimum standard<br />

deviati<strong>on</strong> of return for a range of return outcomes (Figure 2) . The<br />

maximum return of 8.25% for <strong>the</strong> lowest risk is achieved with a<br />

portfolio comprising 89% TIPS and 11% of <strong>the</strong> S&P 500 index.<br />

The middle curve in Figure 2 is <strong>the</strong> efficient fr<strong>on</strong>tier when <strong>the</strong><br />

TIPS weighting is c<strong>on</strong>strained at 20% . However, both curves indicate<br />

how <strong>the</strong> risk-adjusted return can be improved by adding<br />

inflati<strong>on</strong>-linked b<strong>on</strong>ds to <strong>the</strong> asset allocati<strong>on</strong>. The EUR inflati<strong>on</strong>linked<br />

b<strong>on</strong>d market is newer and smaller than <strong>the</strong> TIPS market,<br />

but similar c<strong>on</strong>clusi<strong>on</strong>s can be drawn regarding <strong>the</strong> positive<br />

effects of including inflati<strong>on</strong>-linked b<strong>on</strong>ds.<br />

C<strong>on</strong>clusi<strong>on</strong>s and recommendati<strong>on</strong>s<br />

Inflati<strong>on</strong>-linked b<strong>on</strong>ds can be c<strong>on</strong>sidered as an asset class in <strong>the</strong>ir<br />

own right and offer valuable diversificati<strong>on</strong> in an asset portfolio.<br />

The demand for inflati<strong>on</strong>-linked b<strong>on</strong>ds comes mainly from pensi<strong>on</strong><br />

funds. The total market in government linkers is large and transparent,<br />

with relatively good liquidity, except for very large instituti<strong>on</strong>al<br />

investors. We expect <strong>the</strong> inflati<strong>on</strong>-linked market in euros to<br />

be <strong>the</strong> object of renewed interest when Germany starts issuing<br />

such b<strong>on</strong>ds in 2005 . Recent macroec<strong>on</strong>omic developments have<br />

heightened uncertainty about <strong>the</strong> prospects for inflati<strong>on</strong> and make<br />

a renewed look at inflati<strong>on</strong>-linked b<strong>on</strong>ds worthwhile in our opini<strong>on</strong>.<br />

These b<strong>on</strong>ds provide a certain protecti<strong>on</strong> against future inflati<strong>on</strong><br />

risk, c<strong>on</strong>tingent <strong>on</strong> how well investors’ inflati<strong>on</strong> risk is aligned<br />

with <strong>the</strong> CPI, to which a particular b<strong>on</strong>d is linked. The inflati<strong>on</strong><br />

adjustment applied to <strong>the</strong> coup<strong>on</strong> is based <strong>on</strong> <strong>the</strong> time-lagged<br />

inflati<strong>on</strong> rate of <strong>the</strong> linked CPI. The CPIs used for <strong>the</strong> inflati<strong>on</strong><br />

linking are generally not seas<strong>on</strong>ally adjusted, which adds to transparency.<br />

In general, inflati<strong>on</strong>-linked b<strong>on</strong>ds outperform nominals as<br />

interest rates rise because <strong>the</strong>y benefit from increasing inflati<strong>on</strong>rate<br />

expectati<strong>on</strong>s. |<br />

Index<br />

01/96<br />

GLOBAL INVESTOR 1.05 Inflati<strong>on</strong> linked b<strong>on</strong>ds — 31<br />

Figure 1<br />

C<strong>on</strong>sumer price indices (renormalized)<br />

for France, UK and USA<br />

Source: Bloomberg<br />

130<br />

120<br />

110<br />

100<br />

90<br />

Return in %<br />

01/97<br />

01/98<br />

01/99<br />

01/00<br />

01/01<br />

01/02<br />

01/03<br />

France CPI USA CPI UK CPI<br />

Figure 2<br />

Efficient investment fr<strong>on</strong>tier in US dollars<br />

Source: Barclays Capital<br />

8.5<br />

8<br />

7.5<br />

7<br />

6.5<br />

6<br />

5.5<br />

5<br />

4.5<br />

4<br />

3.5<br />

01/04<br />

Volatility % 0 1 2 3 4 5 6<br />

No TIPS<br />

Max. 20% TIPS<br />

TIPS, Treasurys, S&P,<br />

T-bills, unc<strong>on</strong>strained