compressed_Annual Report 2016-ilovepdf-compressed

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

REPORT OF THE<br />

ACTUARIES TO THE<br />

BOARD OF DIRECTORS OF<br />

SINCEPHETELO MOTOR<br />

VEHICLE ACCIDENTS FUND<br />

for the year ended 31 March <strong>2016</strong><br />

We hereby certify that:<br />

we have undertaken an actuarial valuation of the<br />

outstanding claims provision of the Sincephetelo<br />

Motor Vehicle Accidents Fund as at 31 March<br />

<strong>2016</strong>.<br />

the valuation, on accepted actuarial principles,<br />

reveals the total outstanding claims amount, which<br />

allows for outstanding reported as well as incurred<br />

but not reported claims.<br />

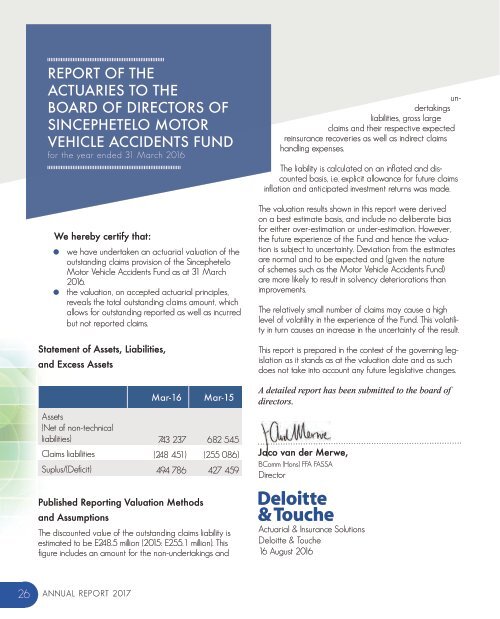

Statement of Assets, Liabilities,<br />

and Excess Assets<br />

Mar-16<br />

Mar-15<br />

Assets<br />

(Net of non-technical<br />

liabilities) 743237 682 545<br />

Claims liabilities (248 451) (255 086)<br />

Suplus/(Deficit) 494 786 427 459<br />

undertakings<br />

liabilities, gross large<br />

claims and their respective expected<br />

reinsurance recoveries as well as indirect claims<br />

handling expenses.<br />

The liability is calculated on an inflated and discounted<br />

basis, i.e. explicit allowance for future claims<br />

inflation and anticipated investment returns was made.<br />

The valuation results shown in this report were derived<br />

on a best estimate basis, and include no deliberate bias<br />

for either over-estimation or under-estimation. However,<br />

the future experience of the Fund and hence the valuation<br />

is subject to uncertainty. Deviation from the estimates<br />

are normal and to be expected and (given the nature<br />

of schemes such as the Motor Vehicle Accidents Fund)<br />

are more likely to result in solvency deteriorations than<br />

improvements.<br />

The relatively small number of claims may cause a high<br />

level of volatility in the experience of the Fund. This volatility<br />

in turn causes an increase in the uncertainty of the result.<br />

This report is prepared in the context of the governing legislation<br />

as it stands as at the valuation date and as such<br />

does not take into account any future legislative changes.<br />

A detailed report has been submitted to the board of<br />

directors.<br />

Jaco van der Merwe,<br />

BComm (Hons) FFA FASSA<br />

Director<br />

Published <strong>Report</strong>ing Valuation Methods<br />

and Assumptions<br />

The discounted value of the outstanding claims liability is<br />

estimated to be E248.5 million (2015: E255.1 million). This<br />

figure includes an amount for the non-undertakings and<br />

Actuarial & Insurance Solutions<br />

Deloitte & Touche<br />

16 August <strong>2016</strong><br />

26<br />

ANNUAL REPORT 2017