Abacus Property Group – Annual Financial Report 2017

Abacus Property Group – Annual Financial Report 2017

Abacus Property Group – Annual Financial Report 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

30 JUNE <strong>2017</strong><br />

ABACUS PROPERTY GROUP<br />

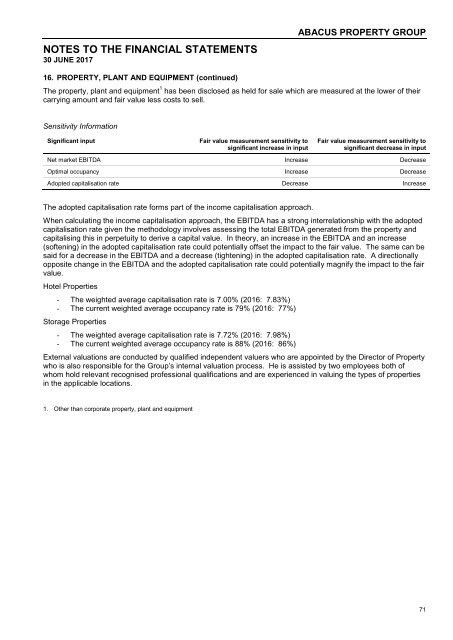

16. PROPERTY, PLANT AND EQUIPMENT (continued)<br />

The property, plant and equipment 1 has been disclosed as held for sale which are measured at the lower of their<br />

carrying amount and fair value less costs to sell.<br />

Sensitivity Information<br />

Significant input<br />

Fair value measurement sensitivity to<br />

significant increase in input<br />

Fair value measurement sensitivity to<br />

significant decrease in input<br />

Net market EBITDA Increase Decrease<br />

Optimal occupancy Increase Decrease<br />

Adopted capitalisation rate Decrease Increase<br />

The adopted capitalisation rate forms part of the income capitalisation approach.<br />

When calculating the income capitalisation approach, the EBITDA has a strong interrelationship with the adopted<br />

capitalisation rate given the methodology involves assessing the total EBITDA generated from the property and<br />

capitalising this in perpetuity to derive a capital value. In theory, an increase in the EBITDA and an increase<br />

(softening) in the adopted capitalisation rate could potentially offset the impact to the fair value. The same can be<br />

said for a decrease in the EBITDA and a decrease (tightening) in the adopted capitalisation rate. A directionally<br />

opposite change in the EBITDA and the adopted capitalisation rate could potentially magnify the impact to the fair<br />

value.<br />

Hotel Properties<br />

- The weighted average capitalisation rate is 7.00% (2016: 7.83%)<br />

- The current weighted average occupancy rate is 79% (2016: 77%)<br />

Storage Properties<br />

- The weighted average capitalisation rate is 7.72% (2016: 7.98%)<br />

- The current weighted average occupancy rate is 88% (2016: 86%)<br />

External valuations are conducted by qualified independent valuers who are appointed by the Director of <strong>Property</strong><br />

who is also responsible for the <strong>Group</strong>’s internal valuation process. He is assisted by two employees both of<br />

whom hold relevant recognised professional qualifications and are experienced in valuing the types of properties<br />

in the applicable locations.<br />

1. Other than corporate property, plant and equipment<br />

71