Property Drop Issue 16

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

34 ADVICE<br />

How to prepare for an<br />

interest rate rise<br />

Interest rate changes can have an impact on mortgages, The Bank of England sets the bank rate (or ‘base rate’)<br />

for the UK, which is currently 0.5%. This, in turn, can influence the cost of borrowing or the rate<br />

of interest charged by financial institutions, such as banks and building societies.<br />

Interest rates in the UK are set by the Monitory Policy Committee (MPC) of the<br />

Bank of England (BoE). This is the interest rate at which banks borrow from the<br />

BoE.<br />

What happens when interest rates rise?<br />

Banks are not obliged to follow Bank of England interest rate decisions, but they<br />

can influence the cost of borrowing, or how much interest you earn on savings.<br />

Interest rate rises and mortgages<br />

When, and if, your mortgage repayments are affected by an interest rate change<br />

will depend on the type of mortgage deal you have and/or when your current deal<br />

ends.<br />

If you have a variable rate tracker mortgage, linked to the BoE base rate you are<br />

likely to see an immediate impact on your mortgage repayments if there is an interest<br />

rate rise.<br />

Those on standard variable rate mortgage will probably see an increase in their rate<br />

in line with any interest rate rise. These rate decisions are made by the lender but will<br />

be influenced by the Bank of Englands ratesetters.<br />

People with fixed rate mortgages are likely to be affected once they reach the end<br />

of their current deal. An interest rate rise could make re-mortgaging more expensive.<br />

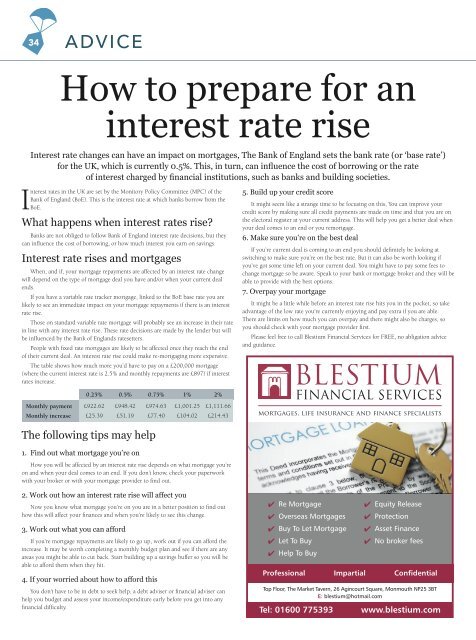

The table shows how much more you’d have to pay on a £200,000 mortgage<br />

(where the current interest rate is 2.5% and monthly repayments are £897) if interest<br />

rates increase.<br />

5. Build up your credit score<br />

It might seem like a strange time to be focusing on this, You can improve your<br />

credit score by making sure all credit payments are made on time and that you are on<br />

the electoral register at your current address. This will help you get a better deal when<br />

your deal comes to an end or you remortgage.<br />

6. Make sure you’re on the best deal<br />

If you’re current deal is coming to an end you should definitely be looking at<br />

switching to make sure you’re on the best rate. But it can also be worth looking if<br />

you’ve got some time left on your current deal. You might have to pay some fees to<br />

change mortgage so be aware. Speak to your bank or mortgage broker and they will be<br />

able to provide with the best options.<br />

7. Overpay your mortgage<br />

It might be a little while before an interest rate rise hits you in the pocket, so take<br />

advantage of the low rate you’re currently enjoying and pay extra if you are able.<br />

There are limits on how much you can overpay and there might also be charges, so<br />

you should check with your mortgage provider first.<br />

Please feel free to call Blestium Financial Services for FREE, no abligation advice<br />

and guidance.<br />

0.25%<br />

0.5%<br />

0.75%<br />

1%<br />

2%<br />

Monthly payment<br />

Monthly increase<br />

£922.62<br />

£25.39<br />

£948.42<br />

£51.19<br />

£974.63<br />

£77.40<br />

£1,001.25<br />

£104.02<br />

£1,111.66<br />

£214.43<br />

mortgages, life insurance and finance specialists<br />

The following tips may help<br />

1. Find out what mortgage you’re on<br />

How you will be affected by an interest rate rise depends on what mortgage you’re<br />

on and when your deal comes to an end. If you don’t know, check your paperwork<br />

with your broker or with your mortgage provider to find out.<br />

2. Work out how an interest rate rise will affect you<br />

Now you know what mortgage you’re on you are in a better position to find out<br />

how this will affect your finances and when you’re likely to see this change.<br />

3. Work out what you can afford<br />

If you’re mortgage repayments are likely to go up, work out if you can afford the<br />

increase. It may be worth completing a monthly budget plan and see if there are any<br />

areas you might be able to cut back. Start building up a savings buffer so you will be<br />

able to afford them when they hit.<br />

4. If your worried about how to afford this<br />

You don’t have to be in debt to seek help, a debt adviser or financial adviser can<br />

help you budget and assess your income/expenditure early before you get into any<br />

financial difficulty.<br />

4 Re Mortgage<br />

4 Overseas Mortgages<br />

4 Buy To Let Mortgage<br />

4 Let To Buy<br />

4 Help To Buy<br />

Top Floor, The Market Tavern, 26 Agincourt Square, Monmouth NP25 3BT<br />

E: blestium@hotmail.com<br />

Tel: 0<strong>16</strong>00 775393<br />

4 Equity Release<br />

4 Protection<br />

4 Asset Finance<br />

4 No broker fees<br />

Professional Impartial Confidential<br />

www.blestium.com