Style: June 02, 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

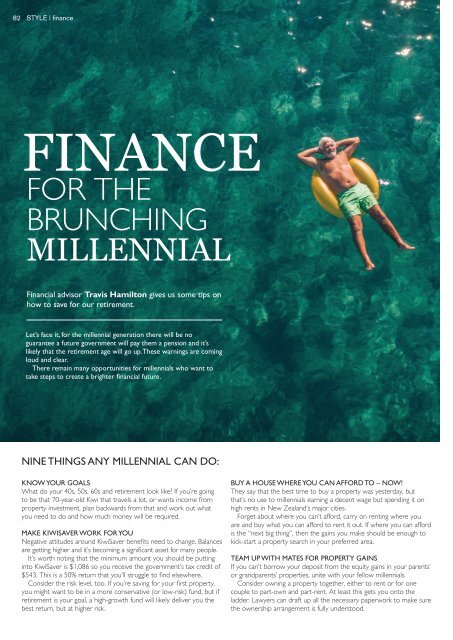

82 STYLE | finance<br />

FINANCE<br />

FOR THE<br />

BRUNCHING<br />

MILLENNIAL<br />

Financial advisor Travis Hamilton gives us some tips on<br />

how to save for our retirement.<br />

Let’s face it, for the millennial generation there will be no<br />

guarantee a future government will pay them a pension and it’s<br />

likely that the retirement age will go up. These warnings are coming<br />

loud and clear.<br />

There remain many opportunities for millennials who want to<br />

take steps to create a brighter financial future.<br />

NINE THINGS ANY MILLENNIAL CAN DO:<br />

KNOW YOUR GOALS<br />

What do your 40s, 50s, 60s and retirement look like? If you’re going<br />

to be that 70-year-old Kiwi that travels a lot, or wants income from<br />

property investment, plan backwards from that and work out what<br />

you need to do and how much money will be required.<br />

MAKE KIWISAVER WORK FOR YOU<br />

Negative attitudes around KiwiSaver benefits need to change. Balances<br />

are getting higher and it’s becoming a significant asset for many people.<br />

It’s worth noting that the minimum amount you should be putting<br />

into KiwiSaver is $1,086 so you receive the government’s tax credit of<br />

$543. This is a 50% return that you’ll struggle to find elsewhere.<br />

Consider the risk level, too. If you’re saving for your first property,<br />

you might want to be in a more conservative (or low-risk) fund, but if<br />

retirement is your goal, a high-growth fund will likely deliver you the<br />

best return, but at higher risk.<br />

BUY A HOUSE WHERE YOU CAN AFFORD TO – NOW!<br />

They say that the best time to buy a property was yesterday, but<br />

that’s no use to millennials earning a decent wage but spending it on<br />

high rents in New Zealand’s major cities.<br />

Forget about where you can’t afford, carry on renting where you<br />

are and buy what you can afford to rent it out. If where you can afford<br />

is the “next big thing”, then the gains you make should be enough to<br />

kick-start a property search in your preferred area.<br />

TEAM UP WITH MATES FOR PROPERTY GAINS<br />

If you can’t borrow your deposit from the equity gains in your parents’<br />

or grandparents’ properties, unite with your fellow millennials.<br />

Consider owning a property together, either to rent or for one<br />

couple to part-own and part-rent. At least this gets you onto the<br />

ladder. Lawyers can draft up all the necessary paperwork to make sure<br />

the ownership arrangement is fully understood.