GPP Commercial Property Market Germany´s top7 cities 2017/Q1-4

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

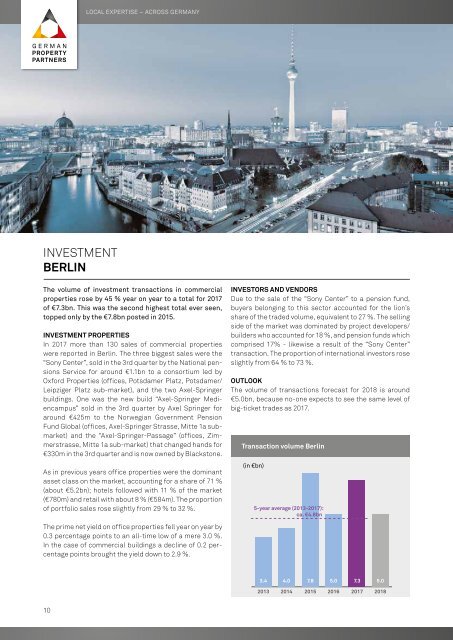

LOCAL EXPERTISE – ACROSS GERMANY<br />

MARKET SURVEY INVESTMENT/OFFICE LETTING <strong>2017</strong>/<strong>Q1</strong>-4<br />

OFFICE LETTING<br />

BERLIN<br />

INVESTMENT<br />

BERLIN<br />

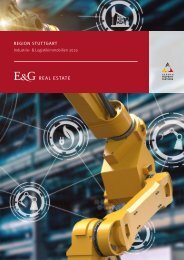

The volume of investment transactions in commercial<br />

properties rose by 45 % year on year to a total for <strong>2017</strong><br />

of €7.3bn. This was the second highest total ever seen,<br />

topped only by the €7.8bn posted in 2015.<br />

INVESTMENT PROPERTIES<br />

In <strong>2017</strong> more than 130 sales of commercial properties<br />

were reported in Berlin. The three biggest sales were the<br />

“Sony Center”, sold in the 3rd quarter by the National pensions<br />

Service for around €1.1bn to a consortium led by<br />

Oxford Properties (offices, Potsdamer Platz, Potsdamer/<br />

Leipziger Platz sub-market), and the two Axel-Springer<br />

buildings. One was the new build “Axel-Springer Mediencampus”<br />

sold in the 3rd quarter by Axel Springer for<br />

around €425m to the Norwegian Government Pension<br />

Fund Global (offices, Axel-Springer Strasse, Mitte 1a submarket)<br />

and the “Axel-Springer-Passage” (offices, Zimmerstrasse,<br />

Mitte 1a sub-market) that changed hands for<br />

€330m in the 3rd quarter and is now owned by Blackstone.<br />

INVESTORS AND VENDORS<br />

Due to the sale of the “Sony Center” to a pension fund,<br />

buyers belonging to this sector accounted for the lion’s<br />

share of the traded volume, equivalent to 27 %. The selling<br />

side of the market was dominated by project developers/<br />

builders who accounted for 18 %, and pension funds which<br />

comprised 17% - likewise a result of the “Sony Center”<br />

transaction. The proportion of international investors rose<br />

slightly from 64 % to 73 %.<br />

OUTLOOK<br />

The volume of transactions forecast for 2018 is around<br />

€5.0bn, because no-one expects to see the same level of<br />

big-ticket trades as <strong>2017</strong>.<br />

Transaction volume Berlin<br />

Year on year take-up of space in Berlin offices rose by<br />

10 % thanks to a high number of agreements to rent large<br />

amounts of space and construction starts for owner-occupiers;<br />

the total of 900,000 m² set another new record.<br />

The three biggest rental or owner-occupier transactions<br />

alone accounted for take-up of 129,000 m².<br />

TAKE-UP OF SPACE<br />

By the end of the year 32 agreements involving more<br />

than 5,000 m² had been recorded, and eleven for more<br />

than 10,000 m² of space, including the purchase of<br />

the former Vattenfall headquarters (about 47,000 m²,<br />

Puschkinallee 52, Periphery South) which the new<br />

owner, the Federal real estate corporation Bundesanstalt<br />

für Immobilienaufgaben, will use itself, and the two<br />

large premises let to Zalando (about 45,000 m² at Tamara-Danz-Strasse<br />

7, Friedrichshain, and about 42,000 m²<br />

at Koppenstrasse 8, Friedrichshain). The most popular<br />

sub-market was Friedrichshain with a share of some<br />

14.9 %, followed by Periphery South (about 12.4 %) and<br />

Kreuzberg (about 11.9 %). For the first time ever, the top 3<br />

sub-markets included neither Mitte nor Mitte 1a, thus underlining<br />

the shift in take-up locations. Public administration/federations/social<br />

facilities accounted for 23 % of<br />

the total take-up of space, dislodging the information and<br />

communications sector from the top slot it held in the year<br />

before.<br />

RENTS<br />

Within the space of a year the average rent rose by 21 %<br />

to the new record level of € 19.50/m²/month. The premium<br />

rent was 9 % higher and its new level of € 30.00/m²/month<br />

was last seen in 2000.<br />

Take-up of space Berlin<br />

AVAILABLE AND VACANT SPACE<br />

Empty space stood at a record low of 2.2 % or 430,000 m²,<br />

which was 39 % below the level noted in the prior year.<br />

Berlin therefore has almost no space left to rent, which<br />

makes life difficult for companies that wish to move<br />

premises or expand their offices. Many firms that need<br />

larger amounts of space are turning to new build developments.<br />

This trend is leading to a further rise in new space<br />

being built, but the effects will not be very noticeable until<br />

2019. In 2018 some 294,000 m² of office space will be<br />

completed, in 2019 the scheduled volume is 417,000 m².<br />

OUTLOOK<br />

In the medium to long term more space on the market will<br />

ease the situation for tenants and keep rents reasonable.<br />

In 2018 take-up is expected to total some 750,000 m² because<br />

so little space is available on the market.<br />

TOP 3 SUB-MARKETS (take-up of space / average rent)<br />

FRIEDRICHSHAIN / 134,100 m² / €25.50/m²/month<br />

PERIPHERY SOUTH / 111,600 m² / €13.20/m²/month<br />

KREUZBERG / 107,100 m² / €20.20/m²/month<br />

TOP 3 CONTRACTS<br />

1. FEDERAL INSTITUTE FOR REAL ESTATE MANAGEMENT<br />

Puschkinallee 52 / ca. 47,000 m²<br />

2. ZALANDO<br />

Tamara-Danz-Strasse 7 / ca. 45,000 m²<br />

3. ZALANDO<br />

Koppenstrasse 8 / ca. 42,000 m²<br />

Rents Berlin<br />

As in previous years office properties were the dominant<br />

asset class on the market, accounting for a share of 71 %<br />

(about €5.2bn); hotels followed with 11 % of the market<br />

(€780m) and retail with about 8 % (€584m). The proportion<br />

of portfolio sales rose slightly from 29 % to 32 %.<br />

The prime net yield on office properties fell year on year by<br />

0.3 percentage points to an all-time low of a mere 3.0 %.<br />

In the case of commercial buildings a decline of 0.2 percentage<br />

points brought the yield down to 2.9 %.<br />

(in €bn)<br />

5-year average (2013-<strong>2017</strong>):<br />

ca. €4.8bn<br />

(in 000s m 2 , incl. owner-occupiers) (net in €/m 2 /mth)<br />

5-year average (2013-<strong>2017</strong>):<br />

ca. 736,200 m 2<br />

22.00 22.00<br />

22.50<br />

24.00<br />

14.90<br />

premium rent<br />

30.00<br />

27.50<br />

average rent<br />

19.50<br />

16.10<br />

3.4 4.0 7.8 5.0 7.3 5.0<br />

521 630 810 820 900 750<br />

13.20<br />

12.30<br />

13.20<br />

2013 2014 2015 2016 <strong>2017</strong> 2018<br />

2013 2014 2015 2016 <strong>2017</strong> 2018<br />

2012<br />

2013<br />

2014 2015 2016 <strong>2017</strong><br />

10 11<br />

WWW.GERMANPROPERTYPARTNERS.DE