GPP Commercial Property Market Germany´s top7 cities 2017/Q1-4

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

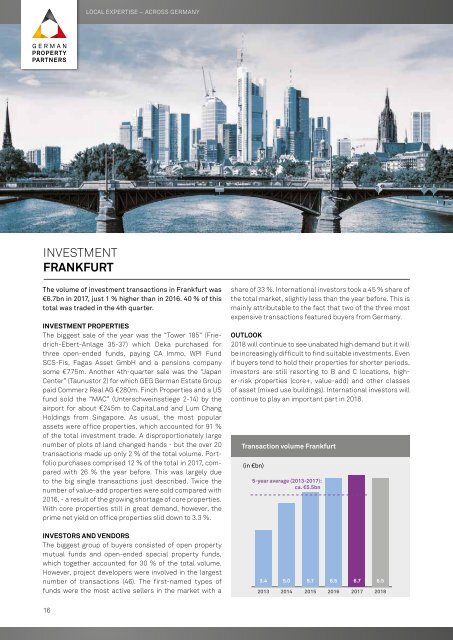

LOCAL EXPERTISE – ACROSS GERMANY<br />

MARKET SURVEY INVESTMENT/OFFICE LETTING <strong>2017</strong>/<strong>Q1</strong>-4<br />

INVESTMENT<br />

FRANKFURT<br />

The volume of investment transactions in Frankfurt was<br />

€6.7bn in <strong>2017</strong>, just 1 % higher than in 2016. 40 % of this<br />

total was traded in the 4th quarter.<br />

INVESTMENT PROPERTIES<br />

The biggest sale of the year was the “Tower 185” (Friedrich-Ebert-Anlage<br />

35-37) which Deka purchased for<br />

three open-ended funds, paying CA Immo, WPI Fund<br />

SCS-Fis, Fagas Asset GmbH and a pensions company<br />

some €775m. Another 4th-quarter sale was the “Japan<br />

Center” (Taunustor 2) for which GEG German Estate Group<br />

paid Commerz Real AG €280m. Finch Properties and a US<br />

fund sold the “MAC” (Unterschweinsstiege 2-14) by the<br />

airport for about €245m to CapitaLand and Lum Chang<br />

Holdings from Singapore. As usual, the most popular<br />

assets were office properties, which accounted for 91 %<br />

of the total investment trade. A disproportionately large<br />

number of plots of land changed hands - but the over 20<br />

transactions made up only 2 % of the total volume. Portfolio<br />

purchases comprised 12 % of the total in <strong>2017</strong>, compared<br />

with 26 % the year before. This was largely due<br />

to the big single transactions just described. Twice the<br />

number of value-add properties were sold compared with<br />

2016, - a result of the growing shortage of core properties.<br />

With core properties still in great demand, however, the<br />

prime net yield on office properties slid down to 3.3 %.<br />

share of 33 %. International investors took a 45 % share of<br />

the total market, slightly less than the year before. This is<br />

mainly attributable to the fact that two of the three most<br />

expensive transactions featured buyers from Germany.<br />

OUTLOOK<br />

2018 will continue to see unabated high demand but it will<br />

be increasingly difficult to find suitable investments. Even<br />

if buyers tend to hold their properties for shorter periods,<br />

investors are still resorting to B and C locations, higher-risk<br />

properties (core+, value-add) and other classes<br />

of asset (mixed use buildings). International investors will<br />

continue to play an important part in 2018.<br />

Transaction volume Frankfurt<br />

(in €bn)<br />

5-year average (2013-<strong>2017</strong>):<br />

ca. €5.5bn<br />

OFFICE LETTING<br />

FRANKFURT<br />

In Frankfurt around 729,100 m² of office space was let,<br />

30 % more than in 2016. The result is comparable to<br />

volumes seen in the early 2000s.<br />

TAKE-UP OF SPACE<br />

Railway operator Deutsche Bahn AG was the biggest<br />

player on the Frankfurt office market in <strong>2017</strong>, just as it<br />

had been in 2016. As of 2020 the firm will be occupying<br />

some 52,600 m² in “The Brick” (Europa-Allee 70-76) and<br />

the neighbouring “Office Tower”, two building developments<br />

in the Europaviertel district (City Periphery). The<br />

next biggest transaction of the year was an agreement<br />

by the central bank Deutsche Bundesbank to take some<br />

44,400 m² in the “FBC” (Mainzer Landstrasse 46, Financial<br />

District). Demand was greatest in the Central Business<br />

District (CBD), where 42 % of the total was registered. Because<br />

Deutsche Bahn AG selected property in the City<br />

periphery district, this sub-market accounted for 17 %.<br />

Financial services comprised the biggest group of new<br />

tenants, taking a good quarter of the total space. Transport<br />

and construction & property firms shared second place.<br />

Deutsche Bahn AG was by far the biggest of the transport<br />

companies; the good result returned by property services<br />

is partly a result of a vast increase in demand by the providers<br />

of co-working space, who secured over 40,000 m²<br />

of space compared with 7,500 m² the year before.<br />

RENTS<br />

Several rental agreements for large amounts of space in<br />

top-quality properties in the CBD pushed the average rent<br />

up by 13 % to € 20.30/m²/month. The premium rent rose by<br />

3 % to € 39.75/m²/month.<br />

5-year average (2013-<strong>2017</strong>):<br />

ca. 498,820 m 2<br />

AVAILABLE AND VACANT SPACE<br />

The vacancy rate at the end of <strong>2017</strong> was 8.7 % and thus<br />

1.8 percentage points below the prior year’s figure. Less<br />

space stood empty in almost all the sub-markets. The<br />

biggest reduction was in the Banking District, where<br />

only half as much space stood empty as 12 months ago.<br />

Frankfurt North was the only sub-market to register an increase<br />

in empty space (+11 %). Following the low level of<br />

completions in <strong>2017</strong>, when 81,100 m² came onto the market,<br />

the figure for 2018 will be around 138,200 m²; however, 73<br />

% of this space has already been pre-let. As of 2019 considerably<br />

more building projects will be completed.<br />

OUTLOOK<br />

Demand will remain high in 2018. Considering that some<br />

clients are still searching for large premises, the annual<br />

total take-up of space could be just under 600,000 m².<br />

TOP 3 SUB-MARKETS (take-up of space / average rent)<br />

FINANCIAL DISTRICT / 193,100 m² / € 31.00/m²/month<br />

CITY PERIPHERY / 127,300 m² / € 18.00/m²/month<br />

WESTEND / 60,400 m² / € 21.00/m²/month<br />

TOP 3 CONTRACTS<br />

Take-up of space Frankfurt Rents Frankfurt<br />

(in 000s m 2 , incl. owner-occupiers) (net in €/m 2 /mth)<br />

1. DEUTSCHE BAHN AG<br />

“The Brick”/”Office-Tower”, Europa-Allee / ca. 52,600 m²<br />

2. DEUTSCHE BUNDESBANK<br />

“FBC”, Mainzer Landstrasse 46 / ca. 44,400 m²<br />

3. HELABA LANDESBANK HESSEN-THÜRINGEN<br />

“Mainblick³”, Kaiserleistrasse 26 / ca. 26,500 m²<br />

35.00<br />

38.00 38.00<br />

39.50<br />

premium rent<br />

38.50<br />

39.75<br />

INVESTORS AND VENDORS<br />

The biggest group of buyers consisted of open property<br />

mutual funds and open-ended special property funds,<br />

which together accounted for 30 % of the total volume.<br />

However, project developers were involved in the largest<br />

number of transactions (46). The first-named types of<br />

funds were the most active sellers in the market with a<br />

3.4 5.0 5.7 6.5 6.7 6.5<br />

2013 2014 2015 2016 <strong>2017</strong> 2018<br />

448 368 389 561 729 575<br />

2013 2014 2015 2016 <strong>2017</strong> 2018<br />

17.50<br />

2012<br />

18.50<br />

2013<br />

average rent<br />

19.50<br />

20.30<br />

18.00 18.00<br />

2014 2015 2016 <strong>2017</strong><br />

16 17<br />

WWW.GERMANPROPERTYPARTNERS.DE