GPP Commercial Property Market Germany´s top7 cities 2017/Q1-4

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

LOCAL EXPERTISE – ACROSS GERMANY<br />

MARKET SURVEY INVESTMENT/OFFICE LETTING <strong>2017</strong>/<strong>Q1</strong>-4<br />

TOP-7<br />

INVESTMENT<br />

OFFICE LETTING<br />

At the close of <strong>2017</strong> the volume of investment transactions<br />

in commercial properties (excluding buy-to-let residential)<br />

located in Germany’s top 7 <strong>cities</strong> had reached a<br />

total of €29.9bn. Compared with the prior year’s €28.8bn,<br />

this represented an increase of 4 %. Not only did the top<br />

7 <strong>cities</strong> surpass the prior year’s volume of transactions,<br />

but the result was also the second highest since 2007.<br />

TRANSACTION VOLUME<br />

At the end of <strong>2017</strong> Berlin posted the biggest increase in<br />

the volume of transactions, which rose by 45 % to €7.3bn.<br />

Five transactions, each priced at over €200m, were partly<br />

behind this result, the capital city’s second highest ever.<br />

The “Sony Center” on Potsdamer Platz was one such sale;<br />

a consortium headed by Oxford Properties paid €1.1bn for<br />

this complex alone. In <strong>2017</strong> it was the biggest single commercial<br />

investment transaction in any of the top 7 <strong>cities</strong>.<br />

Cologne also set a new record with year-on-year growth<br />

of 28 %. The transaction volume of €2.3bn was some<br />

20 % higher than the previous record set in 2015. A new<br />

record was also set in Düsseldorf, where the sales of commercial<br />

properties reached a total of €3.0bn by the end<br />

of the year. The result in Frankfurt rose year on year by<br />

a moderate 3 % to €6.7bn. Despite a 9 % drop compared<br />

with 2016, sales in Munich totalled €5.9bn. With a transactions<br />

result of €3.6bn, Hamburg slipped 20 % short of<br />

the record €4.5bn posted in the prior year. Stuttgart generated<br />

a transaction volume of €1.2bn and thus attracted<br />

much less investment activity than in prior years.<br />

INVESTORS AND VENDORS<br />

International investors continued to take a great interest<br />

in commercial properties located in Germany’s top 7 <strong>cities</strong><br />

and, having increased their activities somewhat, these<br />

players accounted for nearly half of the total volume<br />

traded. Berlin remained the hot spot for international<br />

capital, where foreign investors accounted for 73 % of<br />

total trades. Year on year portfolio sales in the top 7 <strong>cities</strong><br />

accounted for the same proportion of transactions by<br />

value, at 23 % of the total.<br />

YIELDS<br />

In view of the mismatch between supply and demand,<br />

the prime net yield continued its downward slide across<br />

all asset classes and top 7 <strong>cities</strong>. The lowest prime net<br />

yield was the 2.45 % noted for commercial buildings in<br />

Munich, followed by 2.90 % for commercial buildings in<br />

Hamburg and Berlin. Yields on offices ranged from 2.90 %<br />

in Hamburg to 3.70 % in Cologne. The most expensive city<br />

for logistics properties was Stuttgart, where the yield was<br />

4.50 %.<br />

OUTLOOK<br />

In 2018 commercial properties in Germany’s top 7 <strong>cities</strong><br />

are set to remain a good investment. However, this presupposes<br />

a stable, predictable environment on the capital<br />

markets and on the political stage. In view of the remarkably<br />

high demand and the glut of cash for investment<br />

it is unlikely that there will be any great atmospheric<br />

changes this year on the property investment markets<br />

in the top 7 <strong>cities</strong>. Due to the shortage of real estate, the<br />

transaction volume is not expected to be as high in 2018.<br />

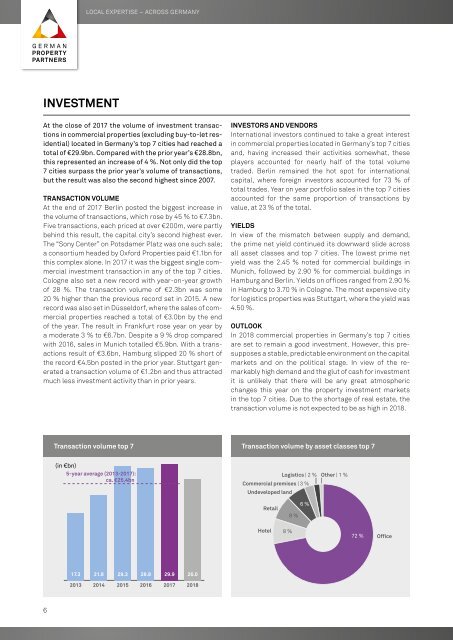

Transaction volume top 7 Transaction volume by asset classes top 7<br />

(in €bn)<br />

5-year average (2013-<strong>2017</strong>):<br />

ca. €25.4bn<br />

17.3 21.8 29.3 28.8 29.9 26.0<br />

2013 2014 2015 2016 <strong>2017</strong> 2018<br />

Logistics | 2 %<br />

<strong>Commercial</strong> premises | 3 %<br />

Undeveloped land<br />

Retail<br />

Hotel<br />

8 %<br />

8 %<br />

6 %<br />

Other | 1 %<br />

72 %<br />

Office<br />

At the close of the year <strong>2017</strong> a new record take-up of<br />

4.1m m² was announced for Germany’s top 7 office<br />

letting markets. This result was the best in over ten<br />

years and for the first time in history the four-million<br />

mark was passed.<br />

TAKE-UP OF SPACE<br />

By the end of <strong>2017</strong>, office-letting in Frankfurt had reached<br />

an all-time high of 729,100 m², which was 30 % above<br />

the figure for 2016 and on a par with the property market’s<br />

high-water mark in 2000. In Hamburg the take-up of<br />

space rose by 16 % in <strong>2017</strong>, reaching a new record level<br />

of 640,000 m². Year on year 15 % more office space was<br />

taken up in Munich, leading to a total of 878,000 m². The<br />

office market in Berlin surged forward to the best result<br />

of the 7 <strong>cities</strong> and total take-up of 900,000 m², (+10 %) to<br />

place ahead of Munich. The year-end total for Düsseldorf<br />

was 358,700 m² of office space taken up. This translated<br />

into an 8 % higher result than in 2016. In Cologne, however,<br />

the take-up of office space fell by 30 % to 310,000 m²,<br />

largely due to outlier transactions in the record year of<br />

2016. In Stuttgart the take-up of office space declined by<br />

38 % year on year to 270,000 m².<br />

In <strong>2017</strong> the operators of co-working space or business<br />

centres were very active in the pursuit of new premises<br />

to rent. In almost all the top 7 <strong>cities</strong> these enterprises<br />

posted rising shares of total take-up. The industry’s total<br />

of 214,000 m² represented some 5 % of the total take-up<br />

of space or nearly three times the amount rented in 2016.<br />

RENTS<br />

As a result of tight supply and a shortage of vacant space,<br />

almost all the top 7 <strong>cities</strong> reported rising office rents in<br />

<strong>2017</strong>. The biggest leap was seen in Berlin, where the average<br />

rent rose by 21 % to €19.50/m²/month and the<br />

premium rent rose by 9 %, thus reaching €30.00/m²/<br />

month for the first time. Two other factors, apart from the<br />

mismatch between supply and demand, are driving up<br />

office rents: owners and landlords are passing on to their<br />

tenants both the ever higher prices for building land as<br />

well as the rising construction costs.<br />

AVAILABLE AND VACANT SPACE<br />

With the total stock of office space including sub-let<br />

space standing at 90.7m m², the reserve of available<br />

space in the top 7 <strong>cities</strong> has contracted further to total<br />

a mere 3.7m m² at the end of the 4th quarter. This translates<br />

into 4.1 % of the total stock of office space. The<br />

most dramatic decline in office space available at short<br />

notice was seen in Berlin, where supply contracted by<br />

39 %. Munich (-31 %) and Stuttgart (-24 %) also struggled<br />

with appreciably reduced amounts of vacant space. The<br />

other top 7 <strong>cities</strong> saw vacancies drop by between 22 % Cologne)<br />

and 15 % (Hamburg). Some 260 office new builds<br />

are scheduled for completion this year and next, offering<br />

a total rental space of around 2.5m m². A majority of this<br />

space has, however, been pre-let or is being constructed<br />

for an owner-occupier.<br />

OUTLOOK<br />

In view of the economic stability, the market for office lettings<br />

in Germany will continue to boom in 2018. However, it<br />

is to be expected that total take-up of space will be lower<br />

than in <strong>2017</strong> because the shortage of available property<br />

will become more acute. In view of burgeoning demand<br />

and the low rates of completion scheduled for this year,<br />

speculative new builds would possibly serve to steady<br />

office rents but would not ease the situation in the short<br />

to medium term.<br />

Clients in Cologne, Düsseldorf and Frankfurt are still<br />

looking for large suites of offices, which may result in<br />

agreements in 2018. Considering that supply is becoming<br />

ever shorter, it is unlikely that this year’s take-up totals in<br />

the top 7 office-letting locations will match the record results<br />

of <strong>2017</strong>. Nevertheless, the office-letting business is<br />

set to have a very good year because the overall stability<br />

of the economy and a resilient labour market will continue<br />

to fuel demand for office space.<br />

Take-up of space top 7<br />

(in 000s m 2 , incl. owner-occupiers)<br />

5-year average (2013-<strong>2017</strong>):<br />

ca. 3.5 million m 2<br />

2.9 2.9 3.5 3.9 4.1 3.5<br />

2013 2014 2015 2016 <strong>2017</strong> 2018<br />

6 7<br />

WWW.GERMANPROPERTYPARTNERS.DE