GPP Commercial Property Market Germany´s top7 cities 2017/Q1-4

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

LOCAL EXPERTISE – ACROSS GERMANY<br />

MARKET SURVEY INVESTMENT/OFFICE LETTING <strong>2017</strong>/<strong>Q1</strong>-4<br />

INVESTMENT<br />

STUTTGART<br />

Some €1.2bn were invested in commercial real estate<br />

in Stuttgart in <strong>2017</strong>. The total fell far short of the prior<br />

year’s - contracting by €600m or 34 %.<br />

INVESTMENT PROPERTIES<br />

The following transactions accounted for some €320m<br />

in total. The “Mercedes-Benz-Bank” (Siemensstrasse 7)<br />

was bought by the Baden-Würtemmberg Stiftung gGmbH,<br />

a foundation, and the “City Plaza” (Rotebühlplatz) was<br />

sold again. The building at Mittlerer Pfad 13-15 in Stuttgart-Weilimdorf,<br />

also changed hands. Altogether, 65<br />

transactions were completed in the past twelve months,<br />

about 50 % of them priced in the two or three-figure millions.<br />

Once again, the focus of investment activity - partly<br />

as a result of the three large sales noted in the foregoing<br />

- lay on office properties, which accounted for around<br />

78 % of the total volume of transactions. Other sectors<br />

such as building sites, retail and hotel properties did not<br />

play a significant role this year. Portfolio trades accounted<br />

for some 10 % (by value) of properties sold. The prime net<br />

yield on office assets was 3.50 %, as it was in the prior<br />

year. Research showed a prime net yield on commercial<br />

buildings of 3.10 % and 4.50 % on logistics properties.<br />

INVESTORS AND VENDORS<br />

Amounting to 24 % of the total, open-end/specialist funds<br />

were the predominant buyers. Private investors/family offices<br />

followed with a share of 13 % and insurance companies<br />

with 11 %. Public administration and opportunity<br />

funds each accounted for a share of some 10 %.<br />

opportunity funds with some 13 % each. Foreign investors<br />

made up some 50 % of the total.<br />

OUTLOOK<br />

It is expected that several outstanding transactions will<br />

be completed in the 1st half of 2018, so that the final tally<br />

for the year should be comparable with the total in <strong>2017</strong>.<br />

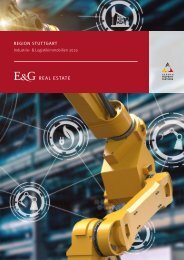

Transaction volume Stuttgart<br />

(in €bn)<br />

5-year average (2013-<strong>2017</strong>):<br />

ca. €1.3bn<br />

OFFICE LETTING<br />

STUTTGART<br />

<strong>2017</strong> closed with take-up of office space in Stuttgart at<br />

about 270,000 m². The result was thus some 38 % lower<br />

than the prior year’s.<br />

TAKE-UP OF SPACE<br />

In what remained the biggest single transaction of <strong>2017</strong>,<br />

Daimler AG decided in the 1st quarter to have a new<br />

building erected in Leinfelden-Echterdingen that will<br />

provide over 50,000 m² of space. The two biggest rental<br />

agreements were signed in the 3rd quarter. Daimler AG<br />

took about 11,500 m² in the industrial estate Stuttgart Vaihingen.<br />

And the law firm CMS Hasche Siegle took a lease<br />

for some 11,300 m² in a new build under development on<br />

Rotebühlplatz, Stuttgart City district. Strongly influenced<br />

by the Daimler AG development, Leinfelden-Echterdingen<br />

was the strongest sub-market with 61,300 m² of take-up.<br />

Around 52,000 m² of office space was let in the Vaihingen/<br />

Möhringen sub-market. Stuttgart City followed with<br />

51,600 m² of space newly taken up. Once again industrial<br />

firms formed the biggest group of new office occupants<br />

in <strong>2017</strong>.<br />

RENTS<br />

The premium rent rose by 6 % year on year to €24.30/m²/<br />

month. The average rent for the entire city area including<br />

Leinfelden-Echterdingen was about €13.70/m²/month,<br />

likewise a year on year increase of some 6 %.<br />

5-year average (2013-<strong>2017</strong>):<br />

ca. 305,600 m 2<br />

AVAILABLE AND VACANT SPACE<br />

By the end of <strong>2017</strong> the vacancy rate had reached 2.1 %,<br />

the lowest level for 16 years. The total space available at<br />

short notice stood at a mere 167,000 m². Meanwhile the<br />

shortage of space has spread beyond the City and central<br />

area. Peripheral locations likewise have little to offer.<br />

OUTLOOK<br />

In the next two years no significant increase in the meagre<br />

amount of space available in the City and central areas<br />

is expected. Those who need large amounts of space will<br />

increasingly look to the periphery, as the less central locations<br />

offer far more opportunities for new developments.<br />

This will lead to further price rises in such locations.<br />

Take-up of space in 2018 will probably be between<br />

230,000 m² and 250,000 m².<br />

TOP 3 SUB-MARKETS (take-up of space / average rent)<br />

LEINENFELDEN-ECHTERDINGEN / 61,300 m² / €12.20/m²/month<br />

VAIHINGEN/MÖHRINGEN / 52,000 m² / €12.30/m²/month<br />

CITY / 51,600 m² / €18.50/m²/month<br />

TOP 3 CONTRACTS<br />

1. DAIMLER AG (OWNER-OCCUPIER)<br />

Meisenweg / ca. 50,000 m²<br />

2. DAIMLER AG<br />

Industriestrasse / ca. 11,500 m²<br />

3. CMS HASCHE SIEGLE<br />

Rotebühlplatz / ca. 11,300 m²<br />

Take-up of space Stuttgart Rents Stuttgart<br />

(in 000s m 2 , incl. owner-occupiers) (net in €/m 2 /mth)<br />

20.00 20.00<br />

21.50<br />

22.80<br />

premium rent<br />

23.00<br />

24.30<br />

average rent<br />

Sales were very evenly distributed. Private sellers/family<br />

offices comprised about 14 % of the total traded, followed<br />

by corporates, project developers/builders and<br />

0.9 1.0 1.7 1.8 1.2 1.5<br />

2013 2014 2015 2016 <strong>2017</strong> 2018<br />

258 278 290 432 270 250<br />

2013 2014 2015 2016 <strong>2017</strong> 2018<br />

12.40<br />

2012<br />

12.00<br />

2013<br />

13.70<br />

12.50 12.50<br />

12.90<br />

2014 2015 2016 <strong>2017</strong><br />

18 19<br />

WWW.GERMANPROPERTYPARTNERS.DE