Competition Report 2006 - Deutsche Bahn AG

Competition Report 2006 - Deutsche Bahn AG

Competition Report 2006 - Deutsche Bahn AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Deutsche</strong> <strong>Bahn</strong> <strong>AG</strong><br />

Communications<br />

Potsdamer Platz 2<br />

10785 Berlin<br />

www.db.de<br />

<strong>Deutsche</strong> <strong>Bahn</strong> <strong>AG</strong> <strong>Competition</strong> <strong>Report</strong> <strong>2006</strong><br />

Offi cial mobility and<br />

logistics provider<br />

<strong>Competition</strong> <strong>Report</strong> <strong>2006</strong>

“Nowhere else in Europe are so<br />

many competitors active on the<br />

rail network.”<br />

Hartmut Mehdorn,<br />

Chairman of the Management Board<br />

and CEO of <strong>Deutsche</strong> <strong>Bahn</strong> <strong>AG</strong><br />

Over the last decade, <strong>Deutsche</strong> <strong>Bahn</strong> has undergone radical changes. It was founded<br />

in 1994 as a merger between two defi cit-ridden state-owned railways. Today,<br />

<strong>Deutsche</strong> <strong>Bahn</strong> <strong>AG</strong> is a global player which booked its most successful year ever<br />

in 2005. Amongst other things, this is the result of a corporate strategy which<br />

has extended DB’s rail freight and passenger transport activities and now off ers<br />

comprehensive services along the entire mobility and logistics chains. Rail activities<br />

in Germany, however, still are and will remain the backbone of the company.<br />

This <strong>Competition</strong> <strong>Report</strong> presents the current status of competition on the rail<br />

network. One conclusion is already clear: contrary to a widely held prejudice,<br />

competition in Germany continues to increase. In the fi ercely contested regional<br />

transport sector, the competitors of DB had a market share of 13 per cent. In the<br />

year under review, they won 65 per cent of the tendered train kilometres. In just<br />

one year, DB’s competitors in the freight sector booked a substantial growth in<br />

market share, from 10 to 15 per cent.<br />

In a nutshell, railways in Germany can do business in a market and regulatory<br />

framework which is conducive to competition. Non-discriminatory access to rail<br />

infrastructure has been systematically implemented. In the third amendment of<br />

the General Railway Act, the legislator greatly extended the powers of the regulatory<br />

authority, far surpassing the standards demanded by European law. Since the<br />

beginning of this year, the Federal Network Agency has also been responsible for<br />

the rail market, in addition to the electricity, gas, telecommunications and post<br />

markets. This means there is a strong and independent regulatory authority that<br />

has already proved its ability to ensure eff ective competition in other sectors of<br />

industry.<br />

The market results in Germany speak for themselves. Nowhere else in Europe<br />

are so many competitors active on the rail network. <strong>Competition</strong> thus works<br />

effi ciently in the existing structures here in Germany. We should be delighted if<br />

we had even remotely the same opportunities in the rest of Europe that our European<br />

competitors have in this country.<br />

Foreword<br />

1

2<br />

Impressum<br />

Published by<br />

<strong>Deutsche</strong> <strong>Bahn</strong> <strong>AG</strong><br />

Potsdamer Platz 2, 10785 Berlin<br />

Oliver Schumacher, Group Spokesman (responsible for the contents)<br />

Editorial Board<br />

Joachim Fried, Corporate Representative for European Aff airs,<br />

<strong>Competition</strong> and Regulatory Aff airs<br />

Coordination<br />

Alexandra Bals, <strong>Competition</strong> and Regulatory Aff airs<br />

Consultant<br />

Alexandra Weiß, Head of Corporate Print Media<br />

Copy Editor<br />

Bettina von Gaisberg, Corporate Communications<br />

External Editor<br />

Stephan M. Götz<br />

Photos<br />

DB <strong>AG</strong>, except: Alexander Louvet (Interview),<br />

Michael Stähle (P. 3, 35), SBB (P. 5), Hupac (P. 6), idea Kommunikation<br />

(P. 20), ecb/Claudio Hils (P. 32), studio-koslowski.de (P. 39)<br />

Design and Layout<br />

Kircher Burkhardt, Editorial & Corporate<br />

Communication GmbH, Berlin (002404)<br />

Lithography<br />

highlevel gmbh, digitale mediaproduktion, Berlin<br />

Printers<br />

DB Services Technische Dienste GmbH, Karlsruhe<br />

Please submit any suggestions or comments on this report to<br />

wettbewerbsbericht@bahn.de<br />

All information correct at March <strong>2006</strong>

Market and <strong>Competition</strong><br />

Dynamic Developments in an Attractive Market<br />

Market trends and new legal framework 5<br />

High demand for train paths 10<br />

Rail transport still on a successful course 12<br />

Positive trends in the long-distance sector 14<br />

Dynamic competition in regional transport 16<br />

Public road transport under pressure 20<br />

Ongoing positive trend for freight transport 22<br />

Logistics – Germany’s strong boom industry 26<br />

Interview<br />

In Dialogue with a Scientifi c Expert<br />

“Sustainable and durable growth cannot be realised with an ineffi cient<br />

transport system” 29<br />

Regulatory Policies<br />

Equal Rules for Opening the Transport Markets<br />

Fair competition remains a central issue 33<br />

Equal conditions for all modes are vital 34<br />

New national regulatory framework 36<br />

Cartel Offi ce has its sights on market structure 43<br />

Special Areas of Discussion<br />

Movement in the European Rail Market<br />

British rail reform under scrutiny 45<br />

Fair prices safeguard infrastructure 48<br />

EU initiative for public transport reform 52<br />

Germany-wide maintenance depot network 53<br />

Overview of Companies 54<br />

More competitors operate in<br />

the German rail market than<br />

anywhere else in Europe.<br />

3

4<br />

Dynamic Developments in<br />

an Attractive Market<br />

The high level of demand for train paths and continuing keen interest of both national<br />

and international railway undertakings confi rm that in terms of market opening, the<br />

German rail transport market holds a leading role worldwide. The railway undertakings<br />

in the diff erent markets are faced with new challenges in view of the dynamic<br />

developments and divergent regulatory practice in Europe.

With market shares of approx. 80 per cent of passenger and approx 70 per cent of<br />

freight transport volumes, road continues to dominate the market. However, the<br />

volume of private motorised traffi c fell by 1.5 per cent in 2005. Traffi c performance<br />

in the public road transport sector declined by 0.5 per cent, whereas inner-<br />

German air traffi c increased by 2.5 per cent, and rail by 3.5 per cent.<br />

In the freight transport market, traffi c performance rose by a total of 2.7 per<br />

cent according to the provisional data available. The highest growth was achieved<br />

by rail, at 4.7 per cent. Road traffi c performance increased by 2.5 per cent, inland<br />

shipping by 0.8 per cent.<br />

The growth in performance by all transport modes can be attributed to the<br />

increasing transport distances, with rail booking the largest growth in average<br />

transport distance – from 279 kilometres in 2004 to the present fi gure of 292<br />

kilo metres. By contrast, the freight volume (in tonnes) dropped by 0.2 per cent<br />

in 2005 according to the Federal Statistical Offi ce. Only inland shipping achieved<br />

growth in freight quantities.<br />

In 2005, the freight transport market was aff ected primarily by the sharp increase<br />

in energy costs. The introduction of truck tolls did not lead to any signifi -<br />

cant shift of freight to rail or inland shipping. According to surveys conducted by<br />

the Federal Offi ce for Freight Transport, the market players believe that the toll<br />

levels are generally too low to achieve the intended modal shift.<br />

Both intermodal and intramodal competition remained intense in the rail<br />

freight market in 2005, thus keeping up the pressure on prices. There is fi erce<br />

competition between the railways especially on the high-volume north and southbound<br />

routes. Furthermore, the trend towards internationalisation continued in<br />

2005. The freight railways expanded their European networks further and are also<br />

increa singly tapping into the transport markets of Central and Eastern Europe.<br />

Logistics companies have continued to grow in size. In 2005, numerous forwarding<br />

and logistics companies optimised their corporate size by way of mergers<br />

and acquisitions, building up networks which enable them to participate in the<br />

growing international fl ow of goods.<br />

Regulation in tandem with liberalisation<br />

The ongoing European liberalisation agenda has provided transport undertakings<br />

with new market potential. Freight transport will be the fi rst sector to benefi t<br />

from market opening for cross-border and domestic transports in the years <strong>2006</strong><br />

and 2007. This is sure to lead to even more intensive competition. The European<br />

passenger transport market will not be opened until much later. The fi rst liberalisation<br />

measures are not expected before 2010, and even then they will remain<br />

behind what is already standard practice in Germany. All EU Member States have<br />

meanwhile formally notifi ed Brussels that they have transposed the First EU Rail-<br />

Market and <strong>Competition</strong><br />

Market trends and new legal framework<br />

In 2005, the transport and logistics markets again benefi ted from steadily growing world trade, the<br />

enlargement of the EU and the progress made in European liberalisation. A study conducted by IBM<br />

was the fi rst to investigate the infl uence of regulation on the rail markets.<br />

Liberalisation in Europe means<br />

new market opportunities for<br />

transport undertakings.<br />

5

6<br />

Keen competition and the trend towards internationalisation are defi ning features of the rail freight market.<br />

In the transposition of the<br />

EU Package divergent regulatory<br />

practices are emerging in<br />

the diff erent countries.<br />

way Infrastructure Package. However, it is already apparent that the diff erent<br />

transposition models in the individual countries will lead to divergent regulatory<br />

practice. The German legislator transposed the European directives into national<br />

law by amending the General Railway Act (AEG) and the Railway Infrastructure<br />

Usage Regulations (EIBV). The new statutory regulations refer to non-discriminatory<br />

access to rail infrastructure, which also includes stations and service facilities<br />

such as stabling sidings, fuel stations and loading lanes.<br />

Initial experience with European rail regulation<br />

A central instrument used by the EU to enforce market opening is the compulsory<br />

introduction of national regulatory authorities in the individual Member States.<br />

Article 30 of Directive 2001/14/EC obliges all EU states to establish an independent<br />

regulatory body which ensures non-discriminatory access to rail infrastructure<br />

and resolves potential confl icts between railway undertakings and infrastructure<br />

managers. In Germany, the Federal Network Agency took over this task from<br />

the Federal Railway Offi ce at the start of <strong>2006</strong>. Apart from rail, the Agency is also<br />

responsible for regulation of the electricity and gas networks, and for the post and<br />

telecommunications markets.<br />

Regulation is necessary, especially as market opening progresses, because infrastructure<br />

per se involves a natural monopoly. In the interests of entitled users, it<br />

is on the one hand the duty of the regulatory body to provide the infrastructure<br />

managers with incentives for ensuring non-discriminatory and cost-effi cient access<br />

to its services. Vice versa, the regulator should also support the infrastructure<br />

managers by ensuring that user fees remain stable and can be planned over the<br />

long term, as the infrastructure managers are dependent on such income in view<br />

of the long payback period and the high risk of achieving adequate capacity utilisation.<br />

In addition to the Rail Liberalisation Index which has been prepared regularly<br />

since 2002, IBM Business Consulting Services has now devoted a separate<br />

study to rail regulation in Europe. Based on data captured from 60 regulatory<br />

bodies, market players and other experts, it examined how the EU Member States,<br />

Switzerland and Norway have transposed the requirements of Article 30. The<br />

study investigated the institutional design of the regulatory bodies, but did not<br />

judge the diff erent regulation methods.

As benchmarks for an effi cient regulatory body, the study used a number of bestpractice<br />

criteria. These are based on generally accepted principles such as independence,<br />

expertise, responsibility and adequate legal resources for enforcing<br />

decisions. In addition, it also took into account practical empirical values, such<br />

as a transparent, objective working method, competent employees and, not least,<br />

the extent to which the authority regards itself as a customer-friendly service<br />

provider, which is easy to contact and which publishes reports on its decisions<br />

and methods of operation.<br />

Correlation between market opening and regulation model<br />

The study revealed three typical organisational forms. In the “Ministry” model,<br />

the regulatory body is not a separate entity. Instead, the Ministry of Transport<br />

relies on a committee which meets as necessary to advise on regulatory issues.<br />

Twelve of the countries investigated belong to this category and thus satisfy only<br />

the minimum legal requirements. Seven countries can be allocated to the “Railway<br />

Offi ce” model, in which the regulatory tasks have been entrusted to a conventional<br />

authority which otherwise deals with technical and safety-relevant aspects.<br />

Only six countries have a separate regulatory authority staff ed with specialists<br />

Eff ective regulatory bodies where market opening is advanced<br />

The progress made in liberalisation of the rail markets is refl ected in the design of the regulatory bodies.<br />

Degree of Liberalisation 2004<br />

On Schedule<br />

Delayed<br />

Pending Departure<br />

Rail Regulation Models <strong>2006</strong><br />

Separate Regulatory Authority<br />

National Railway Offi ce<br />

Ministry<br />

Source: Comparison of the regulation of access to rail infrastructure in EU 25, Switzerland and Norway, IBM Business Consulting Services <strong>2006</strong><br />

Market and <strong>Competition</strong><br />

7

8<br />

who have the power to make decisions. Of that group, the IBM study concludes<br />

that Germany, Austria and the UK comply most closely with the best-practice<br />

principles. These are simultaneously the countries which already have signifi cant<br />

practical experience of rail regulation.<br />

A comparison of these fi ndings with the Rail Liberalisation Index 2004 shows<br />

that those states in which market opening is well advanced have also given their<br />

regulatory bodies particularly strong powers. The number of confl icts in those<br />

countries is by no means a sign of poorly functioning competition; on the contrary,<br />

it is proof of the dynamic market development. Conversely, other countries<br />

have only a few or even no cases of confl ict simply because in some, market access<br />

is not at all possible – so that no confl icts can arise. Most of these states have<br />

opted for a “weak” regulation model which is unlikely to bring about any change<br />

in that situation, as it does not off er a point of contact for potential newcomers.<br />

Particularly strict regulation in Germany<br />

Germany’s leading position in Europe in terms of the regulation intensity of the<br />

rail sector is proven: on the one hand, the German legislator has vested the regulatory<br />

authority with considerable powers of intervention based on the amendment<br />

of AEG and EIBV, which in some cases far surpass the EU requirements. On<br />

the other hand, on assuming its new duties, the Federal Network Agency profi ted<br />

from the fact that German rail infrastructure began to be opened up as part of the<br />

rail reform back in 1994. Many employees of the Federal Railway Offi ce, which<br />

was initially responsible, have transferred to the new regulator, which thus has<br />

recourse to well developed structures and practical experience. The Network<br />

Agency can also draw on its own experience of regulating other sectors (telecommunications,<br />

post, energy). Although the regulation methods used in those sectors<br />

can only be applied to rail to a limited extent, certain market liberalisa tion patterns<br />

nevertheless exhibit clear parallels.<br />

Regulatory authority has to proceed judiciously<br />

The specifi c experience acquired in other network industries is evident in the<br />

survey: the railway undertakings confi rm that the German regulatory authority is<br />

easily accessible and has reliable communication structures. Its working methods<br />

and decisions are regarded as transparent. Other positive comments are that the<br />

Agency is run in accordance with corporate governance regulations and provides<br />

regular information about its decisions and pending procedures.<br />

However, whether the quality – which was not assessed in the study – of the<br />

regulation decisions based on the new legislation confi rm these positive impressions<br />

will not become apparent until several months have elapsed. In view of the<br />

far-reaching legal powers vested in the Agency, the risk of over-regulation in<br />

par ticular has to be avoided, as that would ultimately harm the entire market.<br />

Initial experience gives reason to hope that the Federal Network Agency will take<br />

a pragmatic approach and use the resources at its disposal judiciously.

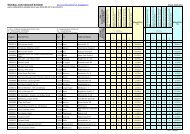

Regulation of infrastructure access is particularly intensive in Germany<br />

Results of a recent study comparing regulation of access to rail infrastructure in EU 25, Switzerland and Norway.<br />

Rail network in km ‘000<br />

(Source: UIC)<br />

No. of licensed RUs1) (Source: EU)<br />

Where is the regulatory body<br />

located in organisational terms?<br />

Does the regulatory body<br />

fully examine the network<br />

statement?<br />

Is the regulatory body obliged<br />

to conduct investigations on<br />

request by an RU?<br />

Source: Comparison of the regulation of access to rail infrastructure in EU 25, Switzerland and Norway, IBM Business Consulting Services <strong>2006</strong><br />

Can it take both ex-post and<br />

ex-ante decisions? 2)<br />

Are its decisions immediately<br />

enforceable despite objections/<br />

legal action? 3)<br />

Market and <strong>Competition</strong><br />

Can the regulatory body<br />

enforce compulsory measures?<br />

Are both rail expertise and<br />

responsibility for decisions<br />

in the same hands?<br />

Austria 5.7 15 RA + + – – + + 10 +<br />

Belgium 3.5 5 MI + – + + + – 6 –<br />

Switzerland 3.0 44 NRO – + + – – + 7 –<br />

Czech Republic 9.5 17 NRO – + + – + + 4 +<br />

Germany 36 361 RA + + + + + + 46 4) +<br />

Denmark 2.4 25 MI – – – + – + 5 –<br />

Estonia 1.0 28 MI + + – – + – 6 –<br />

Greece 2.4 4 MI + – – – – – 0 –<br />

Finland 5.8 1 MI – + – – – – 0 –<br />

France 29 4 MI + – – – – – 7 –<br />

United Kingdom 17 54 RA + – + + + + 35 +<br />

Hungary 7.7 6 NRO – – – + + + 9 –<br />

Ireland 2.0 1 MI – – – – – – 0 –<br />

Italy 16 40 RA + + + + – + 10 +<br />

Lithuania 1.8 1 MI – + – – – – 8 –<br />

Luxembourg 0.3 2 MI – – – – – – 0 –<br />

Latvia 2.3 9 RA + + – – + + 3 +<br />

Netherlands 2.3 16 RA + + + – + + 10 +<br />

Norway 4.0 6 MI * – * * + – 5 *<br />

Poland 20 60 NRO + + – – + + 10 +<br />

Portugal 3.0 2 NRO * * * * * + * *<br />

Sweden 9.9 15 NRO + – + – – + 8 +<br />

Slovenia 1.2 1 MI + * * – + – * *<br />

Slovakia 3.7 18 NRO + + + – + + 12 –<br />

Spain 13 3 MI + + – – – – 6 –<br />

1) Railway undertakings; 2) i.e. reviewing decisions or measures taken by the infrastructure manager before (ex-ante) or after (ex-post)<br />

they come into force or are applied; 3) without a suspensive eff ect; 4) currently 21 employees, a further 25 new positions are planned for<br />

the near future<br />

+ criterion satisfi ed; – criterion not satisfi ed or not clearly satisfi ed; * no data available<br />

RA=separate regulatory authority, NRO=National Railway Offi ce, MI=Ministry<br />

How many employees<br />

deal with rail regulation?<br />

Do they include experts<br />

who deal with regulatory<br />

issues full time?<br />

9

10<br />

The attractiveness of the German market is also refl ected in the growing volume of non-DB operating performance.<br />

High demand for train paths<br />

The trend towards continually growing operating performance by non-DB railway undertakings on the<br />

German rail network continues steadily. Nevertheless, almost all customer applications for train paths<br />

could be satisfi ed in the <strong>2006</strong> timetable.<br />

Operating performance by non-DB railways on the<br />

<strong>Deutsche</strong> <strong>Bahn</strong> network rose by almost a quarter in<br />

2005 once again, as it did in 2004. The present level<br />

of 109.8 million train-path kilometres is eight times<br />

higher than in 1998.<br />

Additional demand thanks to World Cup and new lines<br />

Train path applications from non-DB railways in the<br />

<strong>2006</strong> annual timetable rose from 8,707 to 10,310 yearon-year<br />

(+ 18.4 per cent). Despite that substantial increase,<br />

with the exception of 101 cases DB Netz was<br />

able to satisfy all train path applications or reach amicable<br />

solutions in coordination proceedings. The growing<br />

number of satisfi ed non-DB applications confi rms<br />

the attractiveness of the German market as well as the<br />

fairness and non-discriminatory nature of infrastructure<br />

allocation. The number of train path applications<br />

submitted by all railway undertakings (including DB)<br />

for the <strong>2006</strong> annual timetable amounted to 48,617, an<br />

increase of 4.9 per cent year-on-year.<br />

One reason for this increase is rising demand owing<br />

to the World Cup. Moreover, attractive and effi cient<br />

new lines will go into operation on inauguration of<br />

the North-South tunnel in Berlin and the Nuremberg –<br />

Ingolstadt (– Munich) new-build line in summer <strong>2006</strong>.<br />

The share of non-DB train paths in the total number<br />

of applications already amounts to 21.2 per cent in<br />

the timetable year <strong>2006</strong>. A total of 101 train path appli<br />

cations could not be met for the following reasons:<br />

Owing to a total engineering work blockade on the<br />

Berlin – Rostock line (Lalendorf Ost – Kavelstorf) and<br />

the resulting diver sions via the Schwaan – Güstrow –<br />

Lalendorf Ost line, DB Netz was unable to off er any<br />

train path at all in 28 cases and make only a restricted<br />

off er in 20 cases. The timetable compilers had informed<br />

the customers in good time before the train<br />

path applications were submitted, so that they could<br />

take the above closure into account in their plans.<br />

As one of the railway under takings was either unable<br />

or unwilling to accept the diversion, DB Netz had to<br />

re fuse its applications.<br />

In 53 cases, the train path applications from railway undertakings<br />

could not be satisfi ed because they were incompatible<br />

with other applications (26 cases in the Hamburg<br />

area and 27 cases on the Elmshorn – Westerland route).<br />

The coordination proceedings failed to reach an amicable<br />

solution between the parties in volved. DB Netz therefore<br />

ruled on the basis of the valid priority criteria for the timetable<br />

period <strong>2006</strong> in accordance with the General Terms<br />

and Con ditions for the Use of Rail infrastructure.

In com pliance with its reporting obligation pursuant to<br />

Section 14 d No. 1 AEG, DB Netz informed the Federal<br />

Railway Offi ce (EBA), the competent regulatory authority<br />

at the time, that it intended to refuse the train<br />

path applications. The authority thereupon initiated<br />

infrastructure access proceedings in six cases.<br />

DB Netz appealed and in summary proceedings,<br />

Cologne Administrative Court overruled the order of<br />

the EBA owing to obvious unlawfulness. A complaint<br />

fi led by the EBA with the Higher Administrative Court<br />

in Münster did not yield any diff erent decision. In the<br />

meantime, DB Netz has drawn up alternative solutions<br />

in consultation with the railway undertakings involved<br />

– for instance by changing the station of departure.<br />

The railway undertakings have already been using the<br />

resulting train paths since the <strong>2006</strong> timetable came<br />

into force.<br />

Double compilation of the <strong>2006</strong> timetable<br />

The working timetable is a highly complex system<br />

which has to take far-reaching reciprocal eff ects into<br />

account. The timetables have to satisfy the train path<br />

wishes of the railway undertakings, the infrastructure<br />

available and also meet high quality standards.<br />

The lengthy and complicated coordination process<br />

required to do so lasted from April until May. The solutions<br />

that were fi nally reached do justice to the diverse<br />

requirements of the customers. The train path com pilers<br />

were faced with a very special challenge: they had to<br />

prepare large sections of the timetable in duplicate, as<br />

widespread changes will take place when several newbuild<br />

lines go into operation in May <strong>2006</strong> and in view of<br />

the additional trains required for the World Cup.<br />

As in previous years, DB Netz examined the feasibility<br />

of the required timetable slots at an early stage on<br />

request by its customers, thus enabling them to submit<br />

qualifi ed train path applications.<br />

Market and <strong>Competition</strong><br />

Share of non-DB railways continuously increasing<br />

The openness of the German rail network is impressively clear<br />

rom the constant growth rates of non-DB railways.<br />

(Figures in million train-path kilometres, growth rates in per cent)<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20 13.3<br />

20.4<br />

+53%<br />

26.0<br />

+27%<br />

39.0<br />

+50%<br />

Change from previous year; Source: DB data<br />

50.1<br />

+28%<br />

70.3<br />

+40%<br />

87.8<br />

+25%<br />

109.8<br />

+25%<br />

1998 1999 2000 2001 2002 2003 2004 2005<br />

Almost all train path applications feasible in <strong>2006</strong><br />

Although the number of applications from non-DB railways has<br />

increased by 61 per cent compared with 2003 and new, complex<br />

infrastructure will be inaugurated in <strong>2006</strong>, the share of train paths<br />

which cannot be fully or partly realised is still very low.<br />

50,000<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

46,045<br />

39,642<br />

2.1%<br />

6,403<br />

2003<br />

46,782<br />

39,139<br />

1.9%<br />

7,643<br />

2004<br />

46,283<br />

37,576<br />

1.1%<br />

8,707<br />

2005<br />

Applications by non-DB railways Applications by <strong>Deutsche</strong> <strong>Bahn</strong><br />

Share of non-realised train paths for non-DB railways<br />

Source: DB data<br />

48,617<br />

38,307<br />

1.3%<br />

10,310<br />

<strong>2006</strong><br />

11

12<br />

Del dit loreet ametum etum quipit lor sendionum ipit delisi bla feugait prat. Non ent lut la conum vel ipis nostru.<br />

Of all the competitors in the German passenger transport market, rail has maintained a successful position.<br />

Rail transport still on a successful course<br />

In an overall market which showed lower growth than in 2004, rail freight transport continued to<br />

grow in 2005 and increased its market share to a good 16 per cent. In the passenger transport sector,<br />

rail performance increased in a generally declining market, benefi ting from the rise in fuel prices.<br />

In 2005, gross domestic product in Germany rose by<br />

0.9 per cent in real terms, which was far weaker than<br />

the previous year (1.6 per cent). Amongst other things,<br />

this poor growth was attributable to the steady decline<br />

in building investments and, in particular, consumption<br />

by private households, which remained stagnant at the<br />

2004 level.<br />

The repeated increase in oil prices meant that<br />

consumers in Germany had to spend an even greater<br />

proportion of their disposable income on energy. Moreover,<br />

consumer spending was very cautious in view of<br />

the political uncertainty. Positive factors for the economic<br />

development were the export sector, thanks to the<br />

stable world economy, and increasing investments in<br />

plant and equipment.<br />

Rail passenger transport expands its market share<br />

The German passenger transport market covers private<br />

motorised traffi c, rail, public road transport, including<br />

tram and underground, and inner-German air traffi c.<br />

2005 saw a downturn of roughly one per cent in traffi c<br />

performance (in passenger-kilometres) for the overall<br />

market. 1 According to <strong>Deutsche</strong> <strong>Bahn</strong> <strong>AG</strong> fi gures, the<br />

passenger transport market thus declined for the sixth<br />

year in succession. As in previous years, this drop can<br />

be at tributed primarily to the negative trend in private<br />

motorised traffi c (–1.5 per cent). The principal causes<br />

were stagnant real income and correspondingly stagnant<br />

con sump tion. The recent sharp rise in fuel prices<br />

has also curbed the demand for private motorised<br />

traffi c to the advantage of rail, which could increase<br />

its traffi c performance by 3.5 per cent against the<br />

previous year. Rail thus expanded its share of the total<br />

market to nine per cent.<br />

Demand for public road transport dropped by around<br />

0.5 per cent, a trend which was due predominantly to<br />

the declining volume of occasional bus traffi c. Demand<br />

in the scheduled traffi c sector, on the other hand, in<br />

particular for tram and underground, showed a slight<br />

increase. Inner-German air traffi c performance rose<br />

in 2005, with demand a good 2.5 per cent up on the<br />

previous year.<br />

This means that, by comparison, development for<br />

inner-German lines had less dynamic than for international<br />

air traffi c. There has been a sharp increase<br />

in costs for passengers at some airlines, resulting in<br />

par ticular from the higher costs of kerosene. This eff ect<br />

is, however, not always noticeable, as some low-cost<br />

carriers continue to advertise low fares, but have in<br />

fact reduced the proportion of low-cost seats available<br />

to passengers.

Freight traffi c growth roughly halved<br />

In the year under review, there was less positive impetus<br />

from the economic environment than in 2004,<br />

which led to a more moderate increase in traffi c performance<br />

in the overall German market (rail, inland<br />

shipping, pipelines and road 2 ).Growth totalled approx.<br />

2.7 per cent, based on provisional data, and is thus<br />

around only half the previous year’s level (5.9 per cent).<br />

After an increase of 8.2 per cent in 2004, traffi c performance<br />

in the rail freight market rose by 4.7 per cent<br />

in the year under review. This means that rail enjoyed<br />

better growth than all other transport modes and<br />

succeeded in expanding its market share for the third<br />

year in succession. For the non-DB railways in Germany,<br />

this increase in traffi c performance soared to<br />

approx. 55 per cent, so that their market share of rail<br />

freight transport has increased once again, and now<br />

accounts for around 15.1 per cent.<br />

In the road haulage market, traffi c performance grew<br />

by only an estimated 2.5 per cent against 4.8 per cent in<br />

2004. The reason for this slower growth is again less impetus<br />

from the economic environment. Compared with<br />

their German competitors, foreign trucks booked a far<br />

steeper increase in traffi c performance, again expanding<br />

their market share. Both intra- and intermodal competitive<br />

pressure and pressure on prices remained high.<br />

In the year under review, inland shipping achieved<br />

only a slight increase of 0.8 per cent, far lower than in<br />

2004 (+ 9.5 per cent). Following substantial growth<br />

rates in the fi rst half of the year as part of the recovery<br />

process after the eff ects of the low water in 2003, performance<br />

by inland shipping dropped substantially in<br />

the following months. In addition to declining impetus<br />

from the economy, the fi gures were adversely aff ected<br />

by the extremely low water levels during the last<br />

quarter.<br />

1) Taking into account the review of traffi c performance calculation<br />

by the German Institute of Economic Research (DIW), the<br />

trend for private motorised traffi c, and thus in the overall market,<br />

have been far better since 1994 than previously indicated in the<br />

offi cial statistics. However, owing to several methodological weaknesses<br />

in the calculation of traffi c performance by DIW, the<br />

un revised fi gures still serve as a basis.<br />

2) Road inclusive of local traffi c performance by German trucks<br />

and excluding cabotage traffi c by foreign trucks in Germany.<br />

Market and <strong>Competition</strong><br />

Rail expands its passenger transport market share<br />

Economic environment: low positive impetus. (Change from 2004<br />

in per cent)<br />

Gainfully employed*<br />

Disposable income<br />

– nominal<br />

Private consumption – real<br />

Fuel price – nominal<br />

Modal Split: shares of rail and public road transport rose again<br />

at the expense of private car traffi c. (Figures in per cent, basis:<br />

traffi c performance, fi gures rounded)<br />

8.2<br />

8.3<br />

8.6 9.0<br />

100<br />

80<br />

1.0 1.1 1.1 1.1<br />

60<br />

40<br />

20<br />

82.2<br />

8.7<br />

8.9 9.0 9.0<br />

2002 2003<br />

2004 2005**<br />

Rail expands its freight transport market share<br />

Economic environment: slight downturn from previous year.<br />

(Change from 2004 in per cent)<br />

Manufacturing industry<br />

Automotive industry<br />

Crude steel (in tonnes)<br />

Building investments –2.3<br />

81.7<br />

3.1<br />

81.3<br />

4.0<br />

3.6<br />

–4.0<br />

–3.4<br />

80.9<br />

2004 2005*<br />

Modal Split: rail increased at the expense of inland shipping<br />

and road. (Figures in per cent, basis: traffi c performance,<br />

fi gures rounded)<br />

100 15.0 15.5 15.8 16.1<br />

80<br />

60<br />

40<br />

20<br />

0.4<br />

0.6<br />

2004<br />

rail air private car public road<br />

2005**<br />

* new defi nition as from 2005, e.g. including “one-euro jobs”; ** prov. fi gures<br />

Sources: Federal Statistical Offi ce and DB data<br />

69.5 70.3 69.6 69.5<br />

3.9<br />

4.0<br />

12.6 3.0 11.3 3.0 11.7 3.0 11.4 3.0<br />

2002 2003<br />

2004 2005*<br />

*Estimate; Sources: Fed. Statistical Offi ce, Fed. Offi ce for Motor Traffi c and DB data<br />

2.2<br />

rail inland shipping road pipelines<br />

4.4<br />

–0.3<br />

0.0<br />

1.4<br />

8.1<br />

13

14<br />

More and more passengers use <strong>Deutsche</strong> <strong>Bahn</strong> long-distance trains.<br />

Positive trends in the long-distance sector<br />

DB Fernverkehr continued the positive trend with traffi c performance up by 4.1 per cent. The main<br />

reasons for this development are amongst other things the attractive off ers and targeted marketing<br />

activities.<br />

DB Fernverkehr growth was up again in 2005: including<br />

night trains and motorail services, traffi c performance<br />

rose to 33.6 billion passenger-kilometres (2004: 32.3<br />

bn). At 4.1 per cent, growth was higher than 2004 (2.2<br />

per cent). Taking into account fl uctuations in product<br />

volume, growth in traffi c performance units per opera-<br />

DB Fernverkehr increases traffi c performance<br />

Taking operating performance into account, the fi gures have<br />

reached a new record. (Figures for traffi c performance in billion<br />

passenger-kilometres)<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

36.2<br />

206<br />

2000<br />

35.3<br />

219<br />

2001<br />

33.2<br />

213<br />

2002<br />

31.6<br />

204<br />

2003<br />

32.3<br />

210<br />

2004<br />

traffi c performance traffi c performance per operating performance unit<br />

(in pkm/t-p km) Source: DB data<br />

33.6<br />

224<br />

2005<br />

ting performance unit was actually seven per cent.<br />

With approx. 224 passenger-kilometres per train-path<br />

kilometre in 2005, DB Fernverkehr booked the highest<br />

fi gures since the rail reform. This parameter is more<br />

reliable for comparisons in view of the constantly<br />

changing train products off ered in the non-subsidised<br />

long-distance sector.<br />

This positive development can be attributed to a<br />

number of diff erent factors. Some major upgrading<br />

projects that have been executed over the past few<br />

years are starting to bear fruit. The Cologne – Rhine/<br />

Main and Hamburg – Berlin new-build and upgraded<br />

lines brought substantial growth. In the corridor<br />

between Cologne and the Rhine-Main area, longdistance<br />

traffi c performance has risen by almost<br />

20 per cent since inauguration of the high-speed line<br />

in December 2002.<br />

Traffi c performance between Hamburg and Berlin<br />

actually increased by 29 per cent in the fi rst year after<br />

inauguration of the upgraded line. DB also undoubtedly<br />

benefi ted from the high petrol prices, although the<br />

company itself con sumes large energy quantities and<br />

consequently suff ers from the high fuel costs. Many<br />

customers switched to rail not only because of the high<br />

petrol prices, but in response to the long-distance rail<br />

marketing and pricing policies. Special campaigns have

Higher traffi c performance and revenues<br />

In 2005, DB Fernverkehr again increased traffi c performance and<br />

fare revenues, although specifi c fare revenues were still below the<br />

record level of 2002. (Figures for DB Fernverkehr scheduled daytime<br />

125 services in per cent, index 100 = 1998)<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

1998 1999 2000 2001 2002 2003 2004 2005<br />

traffi c performance per operating unit (p km/t-p km)<br />

average revenue rate (euro cent/p km)<br />

Source: DB data<br />

drawn the attention of more and more passengers who<br />

would other wise rarely or never travel by rail. Some<br />

special off ers actually led to an increase in passengers<br />

of almost 60 per cent. DB Fernverkehr was equally successful<br />

with its regular customers. <strong>Bahn</strong>Card holders<br />

rose by approx. 10 per cent in 2005 compared with<br />

2004. The Mobility <strong>Bahn</strong>Card 100 boasted the strongest<br />

growth, with sales up almost 30 per cent year-onyear.<br />

The introduction of the bahn.bonus programme<br />

on 1 September 2005 also contributed to the positive<br />

trend in both traffi c performance and revenues.<br />

Arriva joins the long-distance market<br />

Last year, another railway undertaking joined the<br />

German long-distance market: Vogtlandbahn, which<br />

belongs to the British company Arriva. It operates<br />

one train pair which runs daily between Hof and Berlin.<br />

Market and <strong>Competition</strong><br />

High-speed line boosts growth pace<br />

Since inauguration of the Cologne – Rhine/Main high-speed<br />

line, long-distance traffi c performance on this route has risen<br />

by 19 per cent.<br />

(Figures in million passenger-kilometres)<br />

3.000<br />

2.500<br />

2.000<br />

1.500<br />

1.000<br />

500<br />

2,312<br />

910<br />

1,402<br />

2003<br />

+19%<br />

2,583<br />

915<br />

1,668<br />

2004<br />

Rhine valley lines Cologne – Rhine/Main HS line<br />

Source: DB data<br />

2,748<br />

921<br />

1,827<br />

2005<br />

This has led to the interesting situation that three longdistance<br />

trains run by diff erent railway under takings<br />

(Connex, Arriva and <strong>Deutsche</strong> <strong>Bahn</strong>) now depart from<br />

Leipzig central station for Berlin in the space of just<br />

eight minutes. Connex already fears a drop in passenger<br />

quantities between Leipzig and Berlin owing to the<br />

competition from Vogtlandbahn and will fi nd it diffi cult<br />

to maintain the less busy Gera – Leipzig section over<br />

the long term.<br />

According to <strong>Deutsche</strong> <strong>Bahn</strong> estimates, its competitors<br />

achieved hardly any growth in long-distance<br />

traffi c performance last year, despite the new product<br />

off ered by Vogtlandbahn, and in contrast to the rising<br />

fi gures for DB Fernverkehr. This is borne out by the<br />

fact that Connex again changed train movements and<br />

running days. The market share of DB’s competitors in<br />

the long-distance market is therefore likely to remain<br />

below one per cent.<br />

15

16<br />

The high number of operators indicates the attractiveness of the German regional rail markets.<br />

Dynamic competition in regional transport<br />

Last year, <strong>Deutsche</strong> <strong>Bahn</strong> competitors achieved substantial growth in both train services and traffi c<br />

performance. These other railways are increasingly operating lines with strong demand.<br />

Abellio has made a surprisingly rapid ascent to become one of the most serious competitors of DB.<br />

Despite declining train services, last year DB was able<br />

to increase its traffi c performance in the regional transport<br />

sector (DB Regio and DB Stadtverkehr) from 37.9<br />

to 38.9 billion passenger-kilometres. This corresponds<br />

to a growth of 2.6 per cent. The decline in train services<br />

results from lost tenders over the past few years.<br />

The market share of other railways in ordered train<br />

services (in train-kilometres) rose from 11.9 per cent<br />

in 2004 to 13.2 per cent in 2005, although the total<br />

ordered volume remained virtually constant.<br />

For <strong>2006</strong>, DB forecasts the market share of other<br />

railways at 15 per cent. In terms of traffi c performance<br />

(in passenger-kilometres), the share of other railways<br />

rose from 6.3 to 6.8 per cent. Over the past six years,<br />

<strong>Deutsche</strong> <strong>Bahn</strong>’s competitors have thus obtained an<br />

average of 17 per cent growth in train services and<br />

23 per cent in traffi c performance, clear proof of the<br />

dynamic pace of competition in the German regional<br />

transport market.<br />

The rise in traffi c performance per train service unit<br />

(passenger-kilometres per train-kilometre) also confi<br />

rms the rapid growth of DB’s competitors. Compared<br />

with 2001, that fi gure had risen by almost 30 per cent<br />

by 2005. This huge growth can be explained by the fact<br />

that other railways have increasingly taken over highdemand<br />

lines, e.g. Munich to Oberstdorf, or between<br />

Hamburg, Bremen and Uelzen. This trend is likely to<br />

become even more pronounced as soon as other long<br />

routes, such as Hamburg to Sylt or Uelzen to Göttingen,<br />

go into operation.<br />

In 2005, the Federal Laender and orderers awarded<br />

contracts for 22.9 million train-kilometres following<br />

invitations to tender. <strong>Deutsche</strong> <strong>Bahn</strong> won only three<br />

of these tenders, with a volume of 7.9 million trainkilometres<br />

per annum – a success rate of 35 per cent.<br />

In 2005, DB Regio, Rheinisch-Bergische Eisenbahn,<br />

NordWest<strong>Bahn</strong> and Rhenus Keolis signed a total of<br />

13 contracts outside the scope of formal award<br />

pro cedures pursuant to Section 15 (2) AEG. These<br />

contracts have an initial volume of 40 million trainkilometres,<br />

of which 34.6 million train-kilometres<br />

went to DB Regio. On the cut-off date of 31 December<br />

2005, seven part networks with a volume of approx.<br />

23 mil lion train-kilometres were up for tender. The<br />

contract award decision is still pending in each case.<br />

Regional transport as capital investment<br />

The regional transport company Abellio has found a<br />

strong fi nancial backer for its expansion policy. In June<br />

2005, the British investment fund Star Capital Partners,<br />

which is owned by banks such as The Royal Bank

of Scotland and the Spanish Santander Central Hispano,<br />

took over 75 per cent of the Abellio shares. Until<br />

that takeover, Abellio had been owned by Essener<br />

Versorgungs- und Verkehrsgesellschaft, the municipal<br />

utilities and transport company. Within just six<br />

months, Abellio has won three tender procedures with<br />

a volume of 8.7 million train-kilometres and has thus<br />

become one of the major competitors of <strong>Deutsche</strong><br />

<strong>Bahn</strong> in the regional transport sector. This commitment<br />

by Star Capital Partners is clear evidence that the<br />

German re gional transport market can be a worthwhile<br />

propo sition for investors.<br />

Supplements on regional transport fares<br />

On taking over Marschbahn regional transport services<br />

(Hamburg – Westerland) in December 2005, Nord-Ostsee-<strong>Bahn</strong><br />

(NOB) announced that it would charge a supplement<br />

of three euros per person on DB long-distance<br />

tickets as from April <strong>2006</strong>. NOB justifi ed that step on<br />

the grounds of the declining fare curve charged by DB<br />

Fernverkehr. However, NOB had been aware of that situation<br />

when it submitted its bid. It is thus reasonable<br />

to assume that NOB had planned to levy a supplement<br />

on DB tickets right from the start or that its calculation<br />

of the potential fare revenues had been wrong. This<br />

last alternative seems plausible as NOB had based its<br />

bid for the Marschbahn contract on far higher fare<br />

revenues than DB Regionalbahn Schleswig-Holstein,<br />

which failed to win the tender.<br />

The fare agreement between NOB and DB shows<br />

that the railway undertakings are nevertheless willing<br />

and able to negotiate fare cooperation agreements<br />

with out intervention from the authorities and thus<br />

satisfy their legal obligation to cooperate in order to<br />

achieve consistent fare systems. It is therefore neither<br />

necessary to set up a fare authority nor to prescribe<br />

standard fares for all railway undertakings.<br />

Market and <strong>Competition</strong><br />

5-stage model ensures transparency<br />

In future, all contracts for regional transport services<br />

pursuant to Section 15 (2) AEG are to be<br />

awarded in accordance with the “5-stage paper”.<br />

The 5-stage model guarantees full compliance<br />

with all the requirements of European primary<br />

law which could aff ect the orderers as a result<br />

of the recent rulings by the European Court of<br />

Justice. These rulings state that contract award<br />

procedures which are not covered by public<br />

procurement law nevertheless have to be nondiscriminatory<br />

and transparent. Under the 5stage<br />

model, the orderers must principally<br />

1. invite Europe-wide statements of interest for<br />

the intended contract award,<br />

2. review these statements of interest,<br />

3. select the further negotiation partner(s) on a<br />

non-discriminatory basis,<br />

4. enter into negotiations,<br />

5. publish the contract award decision after the<br />

contract has been signed.<br />

Good price/quality ratio in Germany<br />

In the passenger market, German regional and local rail<br />

services off er the best value for money anywhere in Europe,<br />

stated a study conducted by IBM Business Consulting<br />

Services which compared regional and local rail fares and<br />

fare struct ures in nine European countries. The fi ndings<br />

revealed that Germany off ers the best quality and, after<br />

adjustment for infl ation, has had the third-lowest fare increases<br />

of all the countries (2.7 per cent per annum) since<br />

1999. The study found that the fares for long routes in<br />

the leisure transport sector are particularly low, where as<br />

ticket prices within the transport associations are comparatively<br />

high in relation to the other countries.<br />

17

18<br />

Market share of other railways increases further<br />

In an overall market which remains virtually unchanged, the<br />

market share of DB competitors is steadily rising.<br />

(Train services in million train-kilometres)<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

599<br />

49<br />

550<br />

8.2%<br />

2001<br />

604<br />

52<br />

552<br />

8.6%<br />

2002<br />

619<br />

61<br />

558<br />

9.9%<br />

2003<br />

628<br />

2004<br />

<strong>Deutsche</strong> <strong>Bahn</strong><br />

Source: DB data<br />

competitors market share of competitors<br />

75<br />

553<br />

11.9%<br />

632<br />

84<br />

549<br />

13.2%<br />

2005<br />

Three railways win 70 per cent of all contracts<br />

Abellio won three tenders and has evolved into one of the major<br />

railways within a year. (Success rates in tender procedures, fi gures<br />

in per cent, rounded)<br />

other railways 17.6<br />

Hamburger<br />

Hochbahn 3.9<br />

Hessische<br />

Landesbahn 4.2<br />

Arriva 4.3<br />

Abellio 7.6<br />

Connex 17.2<br />

Train services by bidding syndicates/joint ventures allocated to the groups in<br />

accordance with their shares. Basis: 131.7 million train-kilometres 1995–2005;<br />

Source: Federal Statistical Offi ce and DB data<br />

0.20<br />

DB Regio 45.1<br />

DB Regio raises traffi c performance<br />

<strong>Deutsche</strong> <strong>Bahn</strong> has raised its regional transport traffi c<br />

performance despite lower contract volume.<br />

(Figures in billion passenger-kilometres)<br />

40<br />

30<br />

20<br />

10<br />

40.4<br />

1.3<br />

39.1<br />

38.2<br />

1.5<br />

39.6 40.5 41.8<br />

1.7 2.6 2.8<br />

36.7 37.9 37.9 38.9<br />

3.2% 3.9% 4.3%<br />

6.3%<br />

6.8%<br />

2001 2002 2003 2004 2005*<br />

Competitors thronging onto high-demand lines<br />

Trends in traffi c performance per train service. (Figures in<br />

passenger-kilometres per train-kilometre; index 100 = 2001)<br />

130<br />

120<br />

110<br />

100<br />

2001 2002 2003 2004 2005*<br />

*Estimate; Source: Federal Statistical Offi ce and DB data<br />

European comparison of passenger market fares and regional transport quality<br />

Germany comes off best in the comparison. (Fares* in EUR/kilometre, quality rated from 1.0 [low] to 4.0 [high])<br />

EUR/Kilometre<br />

0.15<br />

0.10<br />

tendency towards<br />

poorer price/quality<br />

level<br />

1.0 1.5 2.0 2.5 3.0 3.5 4.0<br />

Source: IBM Business Consulting Services; *fares adjusted for infl ation and on all regional transport routes<br />

<strong>Deutsche</strong> <strong>Bahn</strong> competitors market share of competitors<br />

* Estimate; Source: Federal Statistical Offi ce and DB data<br />

tendency<br />

towards better<br />

price/quality<br />

level<br />

Quality

Still fi erce competition<br />

Regional transport contract award in 2005.<br />

Contract<br />

awarded in<br />

Jan 05<br />

Jan 05<br />

Contract award procedure<br />

Federal<br />

Land Procedure Network/Routes Previous operator Operator<br />

HE,<br />

BW<br />

NI,<br />

HB,<br />

NW<br />

Jan 05 NI<br />

Mar 05<br />

NW,<br />

NI<br />

Market and <strong>Competition</strong><br />

New contract<br />

million<br />

train km Begins<br />

Tender Odenwaldbahn DB Regio Vias 1.8 Dec 05 10<br />

Discretionary<br />

award<br />

Discretionary<br />

award<br />

Part network Weser-Ems NordWest<strong>Bahn</strong> NordWest<strong>Bahn</strong> 4.1 Dec 05 12<br />

DB lines in the greater<br />

Braun schweig (ZGB) SPA<br />

area<br />

Tender Teutoburger-Wald-Netz<br />

DB Regio DB Regio 5.9* Jan 03 12<br />

DB Regionalbahn<br />

Westfalen<br />

Westfalenbahn 4.0 Dec 07 10<br />

Apr 05 NI Tender Leer – Grenze DB/NS DB Regio Arriva 0.1 Dec 05 15<br />

Apr 05 NW<br />

Apr 05 SN<br />

Jun 05<br />

HE,<br />

BY<br />

Jun 05 NW<br />

Jun 05 NW<br />

Jun 05 NW<br />

Jun 05 NW<br />

Jun 05 NW<br />

Discretionary<br />

award<br />

Discretionary<br />

award<br />

Mettmann – Kaarst<br />

DB lines in the Oberlausitz-<br />

Niederschlesien (ZVON)<br />

SPA area<br />

Tender Kahlgrundbahn<br />

Discretionary<br />

award<br />

Discretionary<br />

award<br />

Discretionary<br />

award<br />

Discretionary<br />

award<br />

Discretionary<br />

award<br />

DB lines in the Münsterland<br />

(ZVM) SPA area<br />

DB lines in the Verkehrsverbund<br />

Ostwestfalen-Lippe<br />

(VVOWL) SPA area<br />

DB lines in the Westfalen<br />

Süd (ZWS) SPA area<br />

DB lines in the Paderborn-<br />

Höxter (NPH) SPA area<br />

DB lines in the Ruhr-Lippe<br />

(ZRL) SPA area<br />

Rheinisch-Bergische<br />

Eisenbahn<br />

Rheinisch-<br />

Bergische<br />

Eisenbahn<br />

1.2 Dec 05 3<br />

DB Regio DB Regio 2.6* Jan 05 10<br />

Kahlgrund Verkehrs<br />

gesellschaft<br />

Hessische<br />

Landesbahn<br />

0.3 Dec 05 10<br />

DB Regio NRW DB Regio NRW 5.3* Dec 04 11<br />

DB Regio NRW DB Regio NRW 3.7* Dec 04 11<br />

DB Regio NRW DB Regio NRW 1.6* Dec 04 11<br />

DB Regio NRW DB Regio NRW 2.0* Dec 04 11<br />

DB Regio NRW DB Regio NRW 8.2* Dec 04 11<br />

Jun 05 NW Tender Ruhr-Sieg-Netz DB Regio Abellio 3.7 Dec 07 12<br />

Jul 05<br />

BE,<br />

BB<br />

Tender Ostbahn DB Regio<br />

Niederbarnimer<br />

Eisenbahn<br />

Jul 05<br />

NW,<br />

NI<br />

Sep 05 NW Tender Emscher-Münsterland-Netz DB Regio NordWest<strong>Bahn</strong><br />

1.0 Dec 06 8<br />

Tender Haller Willem NordWest<strong>Bahn</strong> NordWest<strong>Bahn</strong> 0.8 Dec 06 7<br />

1.0<br />

0.6<br />

Dec 06<br />

Dec 06<br />

Nov 05 BY Tender Nuremberg diesel network DB Regio DB Regio 3.2 Dec 08 10<br />

Nov 05 BY Tender<br />

Nov 05 BY Tender<br />

Nov 05<br />

MV,<br />

SH,<br />

HH<br />

Nov 05 HB<br />

Nov 05 HE<br />

Nov 05 BY<br />

Munich – Hof/ Furth im<br />

Wald<br />

Nuremberg – Ingolstadt<br />

– Munich<br />

DB Regio Regentalbahn 1.8 Dec 07 10<br />

– DB Regio 1.7 Dec 06 7<br />

Tender Baltic coast DB Regio DB Regio 3.0 Dec 07 12<br />

Discretionary<br />

award<br />

Discretionary<br />

award<br />

Discretionary<br />

award<br />

DB lines in Bremen DB Regio DB Regio 2.4* Jan 03 10<br />

DB lines in Mittelhessen DB Regio DB Regio 2.4 Dec 06 5<br />

Hof – Regensburg DB Regio DB Regio 0.5 Dec 05 12<br />

Discretionary<br />

Dec 05 RP<br />

Alzey – Kirchheimbolanden Rhenus Keolis Rhenus Keolis 0.2 Dec 05 9<br />

award<br />

*Performance volume drops owing to cancellations during contract term<br />

SPA = Special purpose association<br />

The criterion “discretionary award” includes contracts which were awarded in an informal procedure after direct contact<br />

with a capable potential operator<br />

Source: DB data<br />

Term<br />

(years)<br />

12<br />

2<br />

19

20<br />

Unresolved legal issues and a diffi cult fi nancial position defi ne the public road transport environment.<br />

Public road transport under pressure<br />

<strong>Competition</strong> drivers in the local road transport market are currently the legal developments in Germany and<br />

Europe, as well as continuing scant fi nancial resources from the public purse. Hesse is the only Federal Land<br />

to award transportation contracts solely in the form of tender procedures.<br />

The transport undertakings and orderers are constantly<br />

faced with new challenges, whether an unforeseen high<br />

rise in the cost of diesel, increasingly scarce fi nancial<br />

resources or the growing quantities of traffi c performance<br />

up for tender. This is aggravated by the unresolved<br />

legal issues, such as the debate on permissible<br />

award mechanisms for these services. National courts<br />

have to issue rulings governing the details of the re-<br />

Municipal companies booked the highest growth<br />

Results of tenders in 2004/2005: international groups have also<br />

had high growth. (Figures in thousand bus kilometres)<br />

6,000<br />

4,000<br />

2,000<br />

Source: DB data<br />

5,875<br />

–2,000<br />

–4,000<br />

–10,311<br />

–6,000<br />

–8,000<br />

–10,000<br />

DB Stadtverkehr municipal<br />

–2,074<br />

Land-owned<br />

5,163<br />

international<br />

1,954<br />

private<br />

quirements defi ned by the European Court of Justice 1<br />

relating to the fi nancing of local public transport. Appeal<br />

proceedings which have been pending before the<br />

Federal Administrative Court 2 since November 2005<br />

may fi nally clarify the situation.<br />

OVG Koblenz 3 ruled that the re-award of line concessions<br />

was inadmissible in one case in which a municipal<br />

company – in line with common practice – received<br />

payments from the owner as part of the municipal tax<br />

arrangements for public service conglomerates. That<br />

judgement has restricted the scope for municipal<br />

authorities to award transportation contracts to their<br />

own companies. The European Court of Justice has<br />

issued similar rulings governing the conditions of<br />

contract award by municipal authorities to their own<br />

companies without competition. This increases the<br />

pressure on municipal transport undertakings to seek<br />

more commercially viable solutions for urban transport.<br />

The formation of ordering organisations following the<br />

separation of the duty holders’ remit (orderers) and<br />

ownership of transport undertakings (providers) has<br />

promoted market opening even more. Approx. 46 million<br />

bus kilometres have been awarded in Germany to<br />

date in tenders for transportation contracts. The highest<br />

numbers of tender procedures are currently held in the<br />

Federal Laender of Hesse, Schleswig-Holstein and in

some rural districts of Bavaria. Initial tenders involve<br />

a drastic drop in prices of 20 to 30 per cent.<br />

Hesse still pursuing its own course<br />

Hesse is the only Federal Land which has opted for<br />

open tender procedures as the sole method of contract<br />

award, and has done so since 1998. The eff ects of that<br />

decision on the transport market are meanwhile apparent.<br />

Those companies which are owned by municipal<br />

or Land authorities won 31 per cent of the total volume<br />

in 2004/2005. However, almost the only services<br />

up for tender to date have been the regional bus services<br />

previously operated by private and DB-owned<br />

companies.<br />

Other characteristic features of the tender procedures<br />

to date are that central elements of the value<br />

added chain such as marketing or sales are prescribed<br />

in absolute detail, so that the operators cannot impose<br />

their own commercial policies. In many cases, there is<br />

little or no incentive to attract more passengers, as the<br />

railway undertakings rarely participate in fare revenues.<br />

Other typical eff ects of this price-focused competition<br />

are drastic pay reductions for the bus drivers. In<br />

some cases, these are calculated on the wage agreements<br />

specifi ed in the temporary manpower hire sector.<br />

With this type of competition, the company’s product<br />

competence is no longer in demand; there is<br />

consequently a risk that valuable expertise will be lost,<br />

which it will not be possible to regain over the short<br />

term. At the start of the large wave of tenders in 2004,<br />

<strong>Competition</strong> for shareholdings now consolidating<br />

Only a few providers dominated the transactions market in 2004/2005.<br />

NDA: no data available; Source: DB data<br />

Market and <strong>Competition</strong><br />

municipal transport undertakings in particular submitted<br />

low-priced bids. Kraftverkehr Kinzigtal in Bad Hersfeld,<br />

for example, won the tender at a price that was<br />

25 per cent below the bid submitted by the incumbent<br />

and 15 per cent lower than DB Stadtverkehr. Meanwhile,<br />

criminal proceedings are pending against the<br />

responsible managers, accusing them of deliberately<br />

undercalculating. The risk of undercalculated bids now<br />

appears to have been recognised: in 2005, contracts<br />

were awarded to municipal companies in just four of<br />

28 procedures in Hesse. Hesse’s Ministry of Transport<br />

rates the results of its strict tender policy as a success,<br />

referring to savings of approx. EUR 6 million in the bus<br />

sector. The transport undertakings, however, fear that<br />

a “competition bureaucracy” will become established,<br />

eating into funds that could be used to provide local<br />

transport services.<br />

As regards the competition for shares in companies,<br />

only a few providers dominate the current transactions.<br />

These shareholdings enable international corporations<br />

to enter the market or expand their market<br />

position. In 2005, the transaction volume was slightly<br />

down on previous years.<br />

1) Eur. Court of Justice, ruling of 24.07.2003,<br />

Rs. C-280/00 Altmark Trans<br />

2) Fed. Admin. Court, decision of 24.11.2005, 3 B 17.05<br />

(3 C 33.05)<br />

3) Koblenz Higher Admin. Court, decision of 04.11.2005,<br />

7 B 11329/05.OVG (fi nal).<br />

Company/bidding syndicate purchased share in with a transport volume<br />

of (in million bus-km)<br />

Rhenus Keolis GmbH & Co. KG Niederrheinische Verkehrsbetriebe <strong>AG</strong> 13<br />

Regionalbus Oberlausitz GmbH 8.2<br />

Stadtwerke Bonn GmbH/ Verkehrsbetriebe Westfalen-Süd GmbH 12<br />

SZ Verkehrsbetriebe GmbH & Co. KG Ahrweiler Verkehrs-GmbH 1.5<br />

Hamburger Hochbahn <strong>AG</strong> Wiesbadener Busgesellschaft mbH 12<br />

Ingolstädter Verkehrsgesellschaft mbH Kieler Verkehrsgesellschaft mbH 8.3<br />

DB Stadtverkehr GmbH Husumer Verkehrsgesellschaft mbH 0.9<br />

Heider Stadtverkehr GmbH 2.4<br />

Eisenhüttenstädter Personenverkehrs GmbH 1.3<br />

Fa. Omnibusverkehr Nölte NDA<br />

Connex Verkehr GmbH Niederschlesische Verkehrsgesellschaft mbH 3.3<br />

Personenverkehr GmbH Müritz NDA<br />

Autobus Oberbayern GmbH Kahlgrund Verkehrsgesellschaft mbH 2<br />

Verkehrsholding Nord GmbH & Co. KG Verkehrsbetriebe des Kreises Schleswig-Flensburg 1.9<br />

Arriva plc. Autobus Sippel GmbH NDA<br />

Star Capital Partners Ltd. Abellio GmbH NDA<br />

Abellio GmbH Kraftverkehrsgesellschaft Dreiländereck mbH NDA<br />

Abellio GmbH/Hallesche Verkehrs-<strong>AG</strong> /Vetter GmbH Omnibusbetriebe Saalkreis mbH NDA<br />

Regionalbus Braunschweig GmbH Haller Busbetrieb GmbH NDA<br />

21

22<br />

Fair framework conditions are vital to attract more freight from road onto rail.<br />

Ongoing positive trend for freight transport<br />

2005 again saw an increase in competition in the rail freight sector. The market shares held by the<br />

competitors of Railion Deutschland <strong>AG</strong> reached record values and the freight railways are steadily<br />

expanding their European business.<br />

With a volume of approx. 90.5 billion tonne-kilometres,<br />

freight transport performance by the railways in Germany<br />

is expected to be 4.7 per cent up year-on-year.<br />

The competitors of Railion Deutschland again achieved<br />

far above average growth rates, with an increase of approx.<br />

55 per cent. Their market share is now 15.1 per<br />

cent, which is eight times higher than the 2000 level.<br />

As well as keen intramodal competition, continuing<br />

high intermodal competitive pressure has left its mark<br />

on the rail freight market. The electronic truck toll system<br />

introduced at the start of 2005 failed to change<br />

that situation. At an average of 12.4 euro cents per kilo-<br />

Other railways achieve above average growth<br />

The total rail freight transport volume on rail in 2005 rose by<br />

almost fi ve per cent. (Change from previous year in per cent,<br />

basis: traffi c performance in tonne-kilometres)<br />

Total rail<br />

Railion<br />

Deutschland<br />

Other railways<br />

Source: DB data<br />

2004<br />

Actual<br />

8.2<br />

5.0<br />

49.2<br />

2005<br />

Estimate<br />

4.7<br />

–1.0<br />

55.0<br />

metre, the truck toll rate in Germany is too low to shift<br />

any noticeable quantities of freight from road to rail.<br />

The railways still suff er from discrimination compared<br />

with road haulage: while the use of all railway tracks<br />

and assets is subject to payment, truck tolls apply only<br />

on German motorways and only to trucks with a gross<br />

weight of twelve tonnes or more. The levels and scope<br />

of application of the present tolls are insuffi cient and<br />

can thus only be a fi rst step towards fair allocation of<br />

infrastructure costs based on the “user-pays” principle.<br />

German market especially attractive<br />

The development of traffi c and competition confi rms<br />

that the German rail freight market is one of the most<br />

attractive in Europe. In 2005, the activities of foreign<br />

railways increased once again. During the fi rst six<br />

months, SBB Cargo Deutschland almost trebled its traffi<br />

c performance on the German sections of the northsouth<br />

corridor. The Italian company Trenitalia increased<br />

its shareholding in the German company TX<br />

Logistik <strong>AG</strong> to 51 per cent in 2005 and is planning a<br />

full takeover by 2011. British EuroCargo Rail has also<br />

announced plans to join the German market. As a<br />

transit country, Germany is not only interesting for<br />

the expansion of north and southbound routes, but

increa singly also for east- and westbound traffi c. The<br />

German market has already attracted two Polish railways:<br />

the state-owned PKP Cargo, and also the private<br />

freight railway CTL, which is expanding its business<br />

with bulk freight and special transports: “Our target is<br />

to be one of the leading private providers of rail-bound<br />

freight transport and ancillary logistics services in<br />

Germany within three years,” states Jaroslaw Pawluk,<br />

CEO of CTL.<br />

Rail networks in Europe continue to open up<br />

Ongoing liberalisation of the European rail markets –<br />

for cross-border freight transports since <strong>2006</strong> and domestic<br />

transports as from 2007– provides the freight<br />

railways with new opportunities in the international<br />

transport market. Particularly attractive routes include<br />

the high-volume European corridor from the ARA ports<br />

(Antwerp – Rotterdam – Amsterdam) to the Ruhr area<br />

and on to Italy. The Eastern European market will become<br />

even more interesting for freight railways, as a<br />

great deal of freight is handled by rail despite increasing<br />

intermodal competition.<br />

France is seen as one of the most diffi cult railway<br />

markets in Central and Western Europe. The most common<br />

obstacles for newcomers are administrative barriers:<br />

it is extremely expensive and time-consuming, for<br />

example, to obtain all the necessary safety certifi cates.<br />

Moreover, licensing a locomotive in France costs more<br />

than in any other European country.<br />

Ongoing expansion of European networks<br />

Rail customers expect Europe-wide transport management<br />

of high quality and at a competitive price in relation<br />

to road haulage. In 2005, the railways consequently<br />

again expanded their international and logistics<br />

activities, in the form of cooperation agreements and<br />

takeovers. Foreign business meanwhile accounts for almost<br />

60 per cent of Railion’s transport performance.<br />

With the foundation of the national company Railion<br />

Italia, the DB subsidiary is now in a position to off er<br />

continuous freight trains from Italy to Germany, Scandinavia<br />

and the Netherlands as a one-stop shop.<br />

Thanks to cooperation with SNCF Fret, freight trains<br />

between Germany and France have been interoperable<br />

since 2005. Journeys are noticeably shorter, as there is<br />

Market and <strong>Competition</strong><br />

Rail traffi c performance has grown since 2002<br />

The market share of DB’s competitors is now over 15 per cent.<br />

Traffi c performance (Figures in billion tonne-kilometres)<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

Market share (Figures in per cent)<br />

100<br />

80<br />

60<br />

40<br />

20<br />

1.5<br />

+43.3<br />

76.8<br />

+7.4<br />

2000<br />

* Estimate; Source: DB data<br />

2.2<br />

+49.7<br />

74.4<br />

–3.1<br />

2001<br />

3.9<br />

+73.6<br />

72.4<br />

–2.7<br />

2002<br />

Railion Deutschland Other freight railways<br />

1.9<br />

98.1<br />

2000<br />

2.9<br />

97.1<br />

2001<br />

5.1<br />

94.9<br />

2002<br />

Railion Deutschland Other freight railways<br />

5.9<br />

+52.6<br />

74.0<br />

+2.1<br />

2003<br />

92.6<br />

2003<br />

8.8<br />

+49.2<br />

77.6<br />

+5.0<br />

2004<br />

13.6<br />

+55.0<br />

76.8<br />

–1.0<br />

2005*<br />

no more border stop, no change of locomotive or<br />

driver. By cooperating with the Swedish freight railway<br />