Competition Report 2006 - Deutsche Bahn AG

Competition Report 2006 - Deutsche Bahn AG

Competition Report 2006 - Deutsche Bahn AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

increa singly also for east- and westbound traffi c. The<br />

German market has already attracted two Polish railways:<br />

the state-owned PKP Cargo, and also the private<br />

freight railway CTL, which is expanding its business<br />

with bulk freight and special transports: “Our target is<br />

to be one of the leading private providers of rail-bound<br />

freight transport and ancillary logistics services in<br />

Germany within three years,” states Jaroslaw Pawluk,<br />

CEO of CTL.<br />

Rail networks in Europe continue to open up<br />

Ongoing liberalisation of the European rail markets –<br />

for cross-border freight transports since <strong>2006</strong> and domestic<br />

transports as from 2007– provides the freight<br />

railways with new opportunities in the international<br />

transport market. Particularly attractive routes include<br />

the high-volume European corridor from the ARA ports<br />

(Antwerp – Rotterdam – Amsterdam) to the Ruhr area<br />

and on to Italy. The Eastern European market will become<br />

even more interesting for freight railways, as a<br />

great deal of freight is handled by rail despite increasing<br />

intermodal competition.<br />

France is seen as one of the most diffi cult railway<br />

markets in Central and Western Europe. The most common<br />

obstacles for newcomers are administrative barriers:<br />

it is extremely expensive and time-consuming, for<br />

example, to obtain all the necessary safety certifi cates.<br />

Moreover, licensing a locomotive in France costs more<br />

than in any other European country.<br />

Ongoing expansion of European networks<br />

Rail customers expect Europe-wide transport management<br />

of high quality and at a competitive price in relation<br />

to road haulage. In 2005, the railways consequently<br />

again expanded their international and logistics<br />

activities, in the form of cooperation agreements and<br />

takeovers. Foreign business meanwhile accounts for almost<br />

60 per cent of Railion’s transport performance.<br />

With the foundation of the national company Railion<br />

Italia, the DB subsidiary is now in a position to off er<br />

continuous freight trains from Italy to Germany, Scandinavia<br />

and the Netherlands as a one-stop shop.<br />

Thanks to cooperation with SNCF Fret, freight trains<br />

between Germany and France have been interoperable<br />

since 2005. Journeys are noticeably shorter, as there is<br />

Market and <strong>Competition</strong><br />

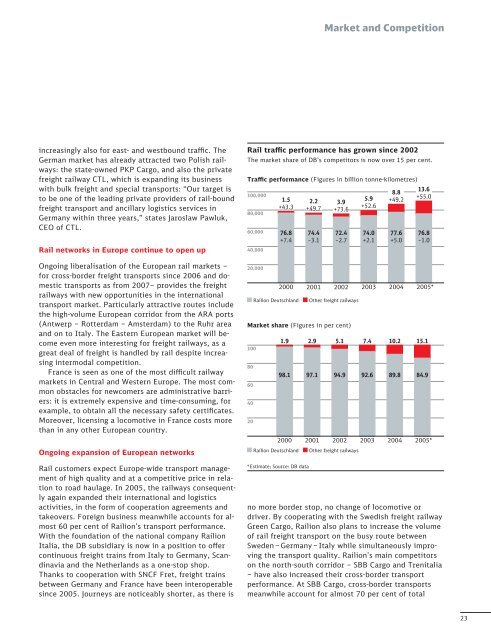

Rail traffi c performance has grown since 2002<br />

The market share of DB’s competitors is now over 15 per cent.<br />

Traffi c performance (Figures in billion tonne-kilometres)<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

Market share (Figures in per cent)<br />

100<br />

80<br />

60<br />

40<br />

20<br />

1.5<br />

+43.3<br />

76.8<br />

+7.4<br />

2000<br />

* Estimate; Source: DB data<br />

2.2<br />

+49.7<br />

74.4<br />

–3.1<br />

2001<br />

3.9<br />

+73.6<br />

72.4<br />

–2.7<br />

2002<br />

Railion Deutschland Other freight railways<br />

1.9<br />

98.1<br />

2000<br />

2.9<br />

97.1<br />

2001<br />

5.1<br />

94.9<br />

2002<br />

Railion Deutschland Other freight railways<br />

5.9<br />

+52.6<br />

74.0<br />

+2.1<br />

2003<br />

92.6<br />

2003<br />

8.8<br />

+49.2<br />

77.6<br />

+5.0<br />

2004<br />

13.6<br />

+55.0<br />

76.8<br />

–1.0<br />

2005*<br />

no more border stop, no change of locomotive or<br />

driver. By cooperating with the Swedish freight railway<br />

Green Cargo, Railion also plans to increase the volume<br />

of rail freight transport on the busy route between<br />

Sweden – Germany – Italy while simultaneously improving<br />

the transport quality. Railion’s main competitors<br />

on the north-south corridor – SBB Cargo and Trenitalia<br />

– have also increased their cross-border transport<br />

perform ance. At SBB Cargo, cross-border transports<br />

meanwhile account for almost 70 per cent of total<br />

7.4<br />

10.2<br />

89.8<br />

2004<br />

15.1<br />

84.9<br />

2005*<br />

23