BusinessDay 21 Aug 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Tuesday <strong>21</strong> <strong>Aug</strong>ust <strong>2018</strong><br />

28 BUSINESS DAY<br />

C002D5556<br />

BD<br />

Markets + Finance<br />

‘Providing proprietary research, commentary, analysis and financial news coverage unmatched in<br />

today’s market. Published weekly, Markets & Finance provides all the key intelligence you need.’<br />

FBN Holdings Plc: Profit growth driven by<br />

increase in non-interest income<br />

BALA AUGIE<br />

First Bank Nigeria<br />

(FBN) Holdings<br />

Plc just released<br />

its half year ended<br />

June 30th <strong>2018</strong> financial<br />

results that showed<br />

improvement in key ratio<br />

as the lender is gradually<br />

surmounting the headwinds<br />

caused by an economic<br />

downturn of 2016.<br />

For example, there have<br />

been remarkable improvements<br />

in asset quality as non<br />

performing loans (NPLs)<br />

and impairment on financial<br />

assets dropped, thanks to an<br />

excellent risk management<br />

strategy.<br />

Electronic banking was<br />

also a major driver of revenue<br />

growth as FirstBank opened a<br />

digital laboratory as part of its<br />

strategy to drive innovation<br />

in the digital banking space.<br />

The stellar performance<br />

means shareholders will<br />

drink from wine poured from<br />

a flagon into a golden goblet<br />

as the company’s consistent<br />

earnings growth in 2918 will<br />

result in share appreciation,<br />

hence magnifying earnings.<br />

Growth in non interest<br />

income underpins revenue<br />

For the first six months<br />

through June <strong>2018</strong>, gross<br />

earnings grew by 1.60 percent<br />

to N293 billion from N288.8<br />

billion as at June 2017; driven<br />

by a <strong>21</strong>.40 percent growth in<br />

non interest income.<br />

On the other hand, interest<br />

income declined by 3 percent<br />

to N225.40 billion in June<br />

<strong>2018</strong> from N232.37 billion the<br />

previous year. The drop was<br />

due to declining yields on<br />

investment securities as short<br />

term government securities<br />

have fallen to around 11 percent<br />

and 13 percent from an<br />

all time high of between 18<br />

percent and 22 peecent in the<br />

most part of 2017.<br />

Noninterest income (NII)<br />

rose by <strong>21</strong>.4 percent year on<br />

year (y-o-y) to close at N61.3<br />

billion as at June <strong>2018</strong>.<br />

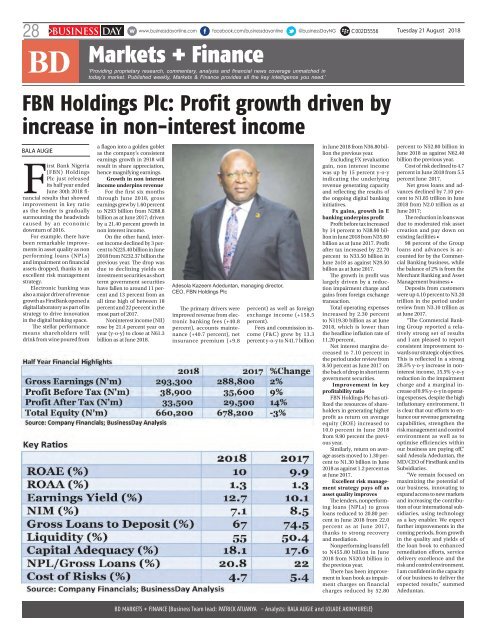

Adesola Kazeem Adeduntan, managing director,<br />

CEO, FBN Holdings Plc<br />

The primary drivers were<br />

improved revenue from electronic<br />

banking fees (+40.8<br />

percent), accounts maintenance<br />

(+40.7 percent), net<br />

insurance premium (+9.8<br />

percent) as well as foreign<br />

exchange income (+158.5<br />

percent).<br />

Fees and commission income<br />

(F&C) grew by 13.3<br />

percent y-o-y to N41.7 billion<br />

in June <strong>2018</strong> from N36.80 billion<br />

the previous year.<br />

Excluding FX revaluation<br />

gain, non interest income<br />

was up by 15 percent y-o-y<br />

indicating the underlying<br />

revenue generating capacity<br />

and reflecting the results of<br />

the ongoing digital banking<br />

initiatives.<br />

Fx gains, growth in E<br />

banking underpins profit<br />

Profit before tax increased<br />

by 14 percent to N38.90 billion<br />

in June <strong>2018</strong> from N35.60<br />

billion as at June 2017. Profit<br />

after tax increased by 22.70<br />

percent to N33.50 billion in<br />

June 2o18 as against N29.50<br />

billion as at June 2017.<br />

The growth in profit was<br />

largely driven by a reduction<br />

impairment charge and<br />

gains from foreign exchange<br />

transaction.<br />

Total operating expenses<br />

increased by 2.30 percent<br />

to N119.30 billion as at June<br />

<strong>2018</strong>, which is lower than<br />

the headline inflation rate of<br />

11.20 percent.<br />

Net interest margins decreased<br />

to 7.10 percent in<br />

the period under review from<br />

8.50 percent as June 2017 on<br />

the back of drop in short term<br />

government securities.<br />

Improvement in key<br />

profitability ratio<br />

FBN Holdings Plc has utilized<br />

the resources of shareholders<br />

in generating higher<br />

profit as return on average<br />

equity (ROE) increased to<br />

10.0 percent in June <strong>2018</strong><br />

from 9.90 percent the previous<br />

year.<br />

Similarly, return on average<br />

assets moved to 1.30 percent<br />

to N1.30 billion in June<br />

<strong>2018</strong> as against 1.2 percent as<br />

at June 2017.<br />

Excellent risk management<br />

strategy pays off as<br />

asset quality improves<br />

The lenders, nonperforming<br />

loans (NPLs) to gross<br />

loans reduced to 20.80 percent<br />

in June <strong>2018</strong> from 22.0<br />

percent as at June 2017,<br />

thanks to strong recovery<br />

and mediation.<br />

Nonperforming loans fell<br />

to N455.80 billion in June<br />

<strong>2018</strong> from N520.0 billion in<br />

the previous year.<br />

There has been improvement<br />

in loan book as impairment<br />

charges on financial<br />

charges reduced by 52.80<br />

percent to N52.80 billion in<br />

June <strong>2018</strong> as against N62.40<br />

billion the previous year.<br />

Cost of risk declined to 4.7<br />

percent in June <strong>2018</strong> from 5.5<br />

percent June 2017.<br />

Net gross loans and advances<br />

declined by 7.10 percent<br />

to N1.85 trillion in June<br />

<strong>2018</strong> from N2.0 trillion as at<br />

June 2017;<br />

The reduction in loans was<br />

due to moderated risk asset<br />

creation and pay down on<br />

existing facilities •<br />

98 percent of the Group<br />

loans and advances is accounted<br />

for by the Commercial<br />

Banking business, while<br />

the balance of 2% is from the<br />

Merchant Banking and Asset<br />

Management business •<br />

Deposits from customers<br />

were up 4.10 percent to N3.20<br />

trillion in the period under<br />

review from N3.10 trillion as<br />

at June 2017.<br />

“The Commercial Banking<br />

Group reported a relatively<br />

strong set of results<br />

and I am pleased to report<br />

consistent improvement towards<br />

our strategic objectives.<br />

This is reflected in a strong<br />

28.5% y-o-y increase in noninterest<br />

income, 15.5% y-o-y<br />

reduction in the impairment<br />

charge and a marginal increase<br />

of 0.9% y-o-y in operating<br />

expenses, despite the high<br />

inflationary environment. It<br />

is clear that our efforts to enhance<br />

our revenue generating<br />

capabilities, strengthen the<br />

risk management and control<br />

environment as well as to<br />

optimise efficiencies within<br />

our business are paying off,”<br />

said Adesola Adeduntan, the<br />

MD/CEO of FirstBank and its<br />

Subsidiaries.<br />

“We remain focused on<br />

maximizing the potential of<br />

our business, innovating to<br />

expand access to new markets<br />

and increasing the contribution<br />

of our international subsidiaries,<br />

using technology<br />

as a key enabler. We expect<br />

further improvements in the<br />

coming periods, from growth<br />

in the quality and yields of<br />

the loan book to enhanced<br />

remediation efforts, service<br />

delivery excellence and the<br />

risk and control environment.<br />

I am confident in the capacity<br />

of our business to deliver the<br />

expected results,” summed<br />

Adeduntan.<br />

BD MARKETS + FINANCE (Business Team lead: PATRICK ATUANYA - Analysts: BALA AUGIE and LOLADE AKINMURELE)