BusinessDay 21 Aug 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Tuesday <strong>21</strong> <strong>Aug</strong>ust <strong>2018</strong><br />

A8 BUSINESS DAY<br />

C002D5556<br />

Live @ The Exchanges<br />

Top Gainers/Losers as at Monday 20 <strong>Aug</strong>ust <strong>2018</strong> Market Statistics as at Monday 20 <strong>Aug</strong>ust <strong>2018</strong><br />

GAINERS<br />

Company Opening Closing Change<br />

DANGCEM N220 N229.5 9.5<br />

AIRSERVICE N4.45 N4.85 0.4<br />

STANBIC N50.05 N50.3 0.25<br />

CADBURY N10 N10.1 0.1<br />

FCMB N1.7 N1.8 0.1<br />

LOSERS<br />

Company Opening Closing Change<br />

NB N103 N100 -3<br />

UNILEVER N55 N52.5 -2.5<br />

GUARANTY N38 N36.95 -1.05<br />

PZ N14.05 N13.05 -1<br />

ZENITHBANK N22.55 N<strong>21</strong>.85 -0.7<br />

ASI (Points) 35,341.90<br />

DEALS (Numbers) 3,054.00<br />

VOLUME (Numbers) 220,495,783.00<br />

VALUE (N billion) 3.187<br />

MARKET CAP (N Trn 12.902<br />

Customs Street edges lower by 1.71%<br />

...investors lose N2<strong>21</strong>bn in one day<br />

Stories by<br />

Iheanyi Nwachukwu<br />

Ni g e r i a<br />

stock index<br />

opened<br />

this week<br />

negative<br />

despite that some investors<br />

still raised wagers on<br />

stocks like Dangote Cement<br />

Plc, Airline Services<br />

& Logistics Plc, Stanbic<br />

IBTC Holdings Plc, FCMB<br />

Group Plc, and Cadbury<br />

Nigeria Plc. The Lagos<br />

Bourse was down by 1.71<br />

percent at the close of<br />

trading session on Monday<br />

<strong>Aug</strong>ust 20, <strong>2018</strong> as<br />

declining stocks outnumbered<br />

advancers.<br />

The Exchange’s trading<br />

statistics showed eleven<br />

stocks edged higher<br />

against 22 laggards, thus<br />

pushing Year-to-Date<br />

(YtD) negative returns<br />

higher to minus -9.36percent.<br />

“Given that the second-quarter<br />

(Q2) <strong>2018</strong><br />

earnings season is closing<br />

out, we expect geopolitical<br />

events and policy<br />

changes to impact more<br />

on global equity Indexes.<br />

However, in the near term,<br />

we expect the stronger<br />

economic outlook and<br />

double-digit earnings<br />

increases to provide support<br />

for rising stock prices<br />

in the U.S markets.<br />

“We also expect the<br />

market to remain largely<br />

downbeat in the local<br />

market due to a continued<br />

absence of bullish<br />

triggers. Also, we expect<br />

investors to take profit<br />

during early trades ahead<br />

of the holiday”, said the<br />

Kayode Tinuoye-led team<br />

of research analysts at<br />

United Capital Plc in their<br />

investment view for this<br />

week.<br />

The Nigerian stock<br />

market’s broad Index<br />

–the NSE All Share Index<br />

(ASI) depreciated by<br />

1.71percent to close at<br />

34,663.48points as against<br />

35,266.29 points at the beginning<br />

of trading while<br />

the value of listed equities<br />

measured as Market<br />

Capitalisation decreased<br />

from N12.875trillion to<br />

N12.654trillion, representing<br />

N2<strong>21</strong>billion decline.<br />

Despite the Dangote<br />

Cement-driven recovery<br />

witnessed last Friday,<br />

research analysts at Lagos-based<br />

Vetiva Capital<br />

Management foresee a<br />

return to negative territory<br />

this week “given that<br />

underlying investor apathy<br />

remains in the market”.<br />

They had expected milder<br />

losses on Monday <strong>Aug</strong>ust<br />

20, <strong>2018</strong> .<br />

In 3,054 deals, stock<br />

traders exchanged<br />

220,495,783 units valued<br />

at N3.187billion. Trading<br />

in banking stocks helped<br />

buoy market transaction<br />

volume. For instance,<br />

UBA Plc, Zenith Bank<br />

Plc, Access Bank Plc, Skye<br />

Bank Plc, and FBN Holdings<br />

Plc were the actively<br />

traded stocks on the Nigerian<br />

Stock Exchange on<br />

Monday.<br />

UBA and Access Bank<br />

Plc are among stocks in<br />

most analysts watch list as<br />

they are of the last Tier-1<br />

banking institutions that<br />

are yet to release their<br />

first-half (H1) <strong>2018</strong> financial<br />

statements.<br />

Dangote Cement Plc<br />

led the league of gainers<br />

after its share price<br />

increased from N220 to<br />

N229.5, up by N9.5 or<br />

4.32percent; while Airline<br />

Services & Logistics Plc<br />

advanced from N4.45 to<br />

N4.85, up by 40kobo or<br />

8.99percent.<br />

Stanbic IBTC Holdings<br />

Plc increased from N50.05<br />

to N50.3, up by 25kobo or<br />

0.50percent; FCMB Group<br />

Plc advanced from N1.7<br />

to N1.8, up by 10kobo or<br />

5.88percent; while Cadbury<br />

Nigeria Plc increased<br />

from N10 to N10.1, up by<br />

10kobo or 1percent.<br />

Nigerian Breweries<br />

Plc recorded the highest<br />

loss after its share price<br />

declined from N103 to<br />

N100, down by N3 or<br />

2.91percent; followed<br />

by Unilever Nigeria Plc<br />

which declined from N55<br />

to N52.5, down by N2.5 or<br />

4.55percent; and GTBank<br />

Plc which lost N1.05, from<br />

N38 to N36.95, down by<br />

2.76percent.<br />

Likewise, PZ Cussons<br />

Nigeria Plc stock price<br />

dropped from N14.05<br />

to N13.05, representing<br />

N1 or 7.12percent loss,<br />

while Zenith Bank Plc<br />

declined from N22.55 to<br />

N<strong>21</strong>.85, down by 70kobo<br />

or 3.10percent.<br />

RAK Unity Petroleum intensifies efforts to boost sales<br />

RAK Unity Petroleum<br />

Company<br />

Plc is determined<br />

to achieve its<br />

strategic objectives by<br />

driving growth inorganically<br />

through a merger<br />

or acquisition; thereby<br />

enabling the company<br />

to respond competitively<br />

to the emerging changes<br />

and trends in the business<br />

operating environment.<br />

As part of RAK Unity<br />

Petroleum Company<br />

Plc five-year business<br />

plan that commenced in<br />

January 2016, the company<br />

aims to boost sales<br />

through the production<br />

of branded lubricants and<br />

increase profit margins by<br />

investment in direct importation<br />

of Diesel (AGO).<br />

“There are currently<br />

ongoing plans to lease<br />

four new retail stations<br />

and refurbish the old retail<br />

stations. These plans will<br />

be executed on the back<br />

of the merger or acquisition,”<br />

Edo-Abasi Bassey<br />

Ukpong, chairman, RAK<br />

Unity Petroleum Company<br />

Plc told sharehold-<br />

ers at the company’s 15th<br />

annual general meeting<br />

held in Lagos on Thursday<br />

<strong>Aug</strong>ust 16, <strong>2018</strong>.<br />

He assured that going<br />

forward, with the anticipated<br />

improvement<br />

in the Nigerian economy<br />

facilitated by increasing<br />

oil production and revenue,<br />

growth in trade and<br />

investment, a stable and<br />

transparent FX market,<br />

“we will position your<br />

company to take advantage<br />

of opportunities and<br />

offer value to you.”<br />

“To continue to grow<br />

our business, despite<br />

the tough operating environment,<br />

RAK Unity<br />

Petroleum Company Plc<br />

board has begun a strategic<br />

review process of our<br />

business to evaluate all<br />

the options open to us to<br />

significantly improve our<br />

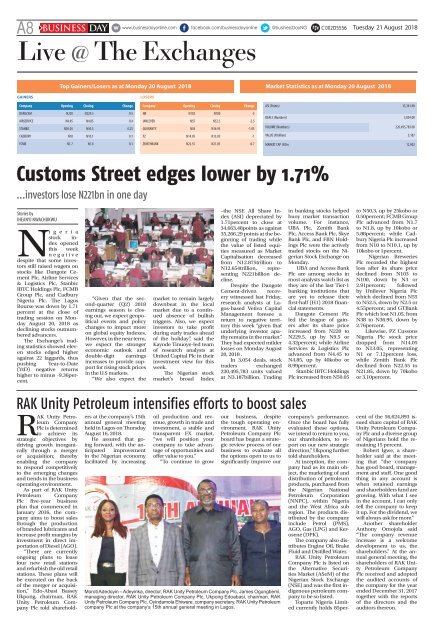

Moroti Adedoyin – Adeyinka, director, RAK Unity Petroleum Company Plc, James Ogungbemi,<br />

managing director, RAK Unity Petroleum Company Plc, Ukpong Edoabasi, chairman, RAK<br />

Unity Petroleum Company Plc, Oyindamola Ehiwere, company secretary, RAK Unity Petroleum<br />

company Plc at the company’s 15th annual general meeting in Lagos.<br />

company’s performance.<br />

Once the board has fully<br />

evaluated these options,<br />

we intend to return to you,<br />

our shareholders, to report<br />

on our new strategic<br />

direction,” Ukpong further<br />

told shareholders.<br />

At inception, the company<br />

had as its main object,<br />

the marketing of and<br />

distribution of petroleum<br />

products, purchased from<br />

the Nigerian National<br />

Petroleum Corporation<br />

(NNPC), within Nigeria<br />

and the West Africa sub<br />

region. The products distributed<br />

by the company<br />

include Petrol (PMS),<br />

AGO, Gas (LPG) and Kerosene<br />

(DPK).<br />

The company also distributes<br />

Engine Oil, Brake<br />

Fluid and Distilled Water.<br />

RAK Unity Petroleum<br />

Company Plc is listed on<br />

the Alternative Securities<br />

Market (ASeM) of the<br />

Nigerian Stock Exchange<br />

(NSE) and was the first indigenous<br />

petroleum company<br />

to be so listed.<br />

Toparte Nigeria Limited<br />

currently holds 85percent<br />

of the 56,624,893 issued<br />

share capital of RAK<br />

Unity Petroleum Company<br />

Plc and a diverse group<br />

of Nigerians hold the remaining<br />

15 percent.<br />

Robert Igwe, a shareholder<br />

said at the meeting<br />

that “the company<br />

has good board, management<br />

and staff. One good<br />

thing in any account is<br />

when retained earnings<br />

and shareholders fund are<br />

growing. With what I see<br />

in the account, I can only<br />

tell the company to keep<br />

it up. For the dividend, we<br />

will always ask for more.”<br />

Another shareholder<br />

Anthony Omojola said<br />

“The company revenue<br />

increase is a welcome<br />

development to us, the<br />

shareholders.” At the annual<br />

general meeting, the<br />

shareholders of RAK Unity<br />

Petroleum Company<br />

Plc received and adopted<br />

the audited accounts of<br />

the company for the year<br />

ended December 31, 2017<br />

together with the reports<br />

of the directors and the<br />

auditors thereon.