Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ke a difference in so many ways<br />

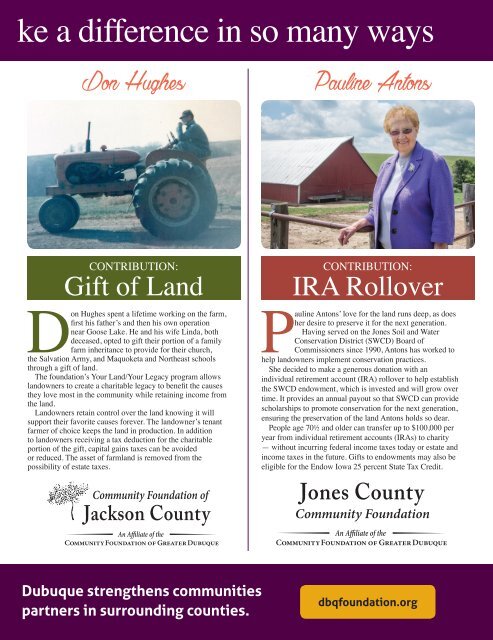

Don Hughes<br />

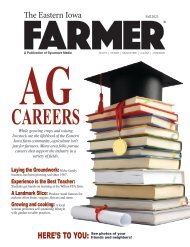

Pauline Antons<br />

Contribution:<br />

Gift of Land<br />

Don Hughes spent a lifetime working on the farm,<br />

first his father’s and then his own operation<br />

near Goose Lake. He and his wife Linda, both<br />

deceased, opted to gift their portion of a family<br />

farm inheritance to provide for their church,<br />

the Salvation Army, and Maquoketa and northeast schools<br />

through a gift of land.<br />

the foundation’s Your Land/Your Legacy program allows<br />

landowners to create a charitable legacy to benefit the causes<br />

they love most in the community while retaining income from<br />

the land.<br />

Landowners retain control over the land knowing it will<br />

support their favorite causes forever. the landowner’s tenant<br />

farmer of choice keeps the land in production. in addition<br />

to landowners receiving a tax deduction for the charitable<br />

portion of the gift, capital gains taxes can be avoided<br />

or reduced. the asset of farmland is removed from the<br />

possibility of estate taxes.<br />

Community Foundation of<br />

Jackson County<br />

An Affiliate of the<br />

Community Foundation of Greater Dubuque<br />

Contribution:<br />

irA rollover<br />

Pauline Antons’ love for the land runs deep, as does<br />

her desire to preserve it for the next generation.<br />

Having served on the Jones Soil and Water<br />

Conservation District (SWCD) board of<br />

Commissioners since 1990, Antons has worked to<br />

help landowners implement conservation practices.<br />

She decided to make a generous donation with an<br />

individual retirement account (irA) rollover to help establish<br />

the SWCD endowment, which is invested and will grow over<br />

time. it provides an annual payout so that SWCD can provide<br />

scholarships to promote conservation for the next generation,<br />

ensuring the preservation of the land Antons holds so dear.<br />

People age 70½ and older can transfer up to $100,000 per<br />

year from individual retirement accounts (irAs) to charity<br />

— without incurring federal income taxes today or estate and<br />

income taxes in the future. Gifts to endowments may also be<br />

eligible for the Endow iowa 25 percent State tax Credit.<br />

Jones County<br />

Community Foundation<br />

An Affiliate of the<br />

Community Foundation of Greater Dubuque<br />

Dubuque strengthens communities<br />

partners in surrounding counties.<br />

dbqfoundation.org