- Page 1 and 2: The e-Advocate Monthly …a Compend

- Page 3 and 4: The Advocacy Foundation, Inc. Helpi

- Page 5 and 6: Dedication ______ Every publication

- Page 7 and 8: The Transformative Justice Project

- Page 9 and 10: 1. The national average cost to tax

- Page 11 and 12: The Advocacy Foundation, Inc. Helpi

- Page 13 and 14: Biblical Authority ______ Luke 6:34

- Page 15 and 16: Table of Contents …a compilation

- Page 17 and 18: I. Introduction Predatory and Subpr

- Page 19 and 20: have not only misled borrowers but

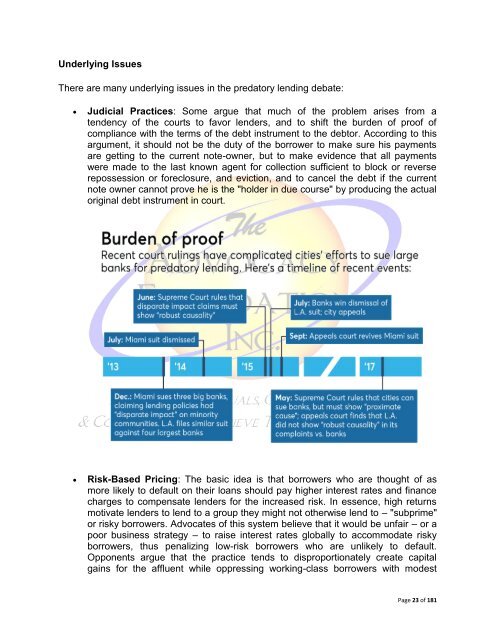

- Page 21: Predatory Lending Towards Minority

- Page 25 and 26: In an article in the January 17, 20

- Page 27 and 28: Ohio, Oklahoma, Oregon, Pennsylvani

- Page 29 and 30: United States Although there is no

- Page 31 and 32: II. The Poverty Industry, Economic

- Page 33 and 34: Individual earnings inequality amon

- Page 35 and 36: Changes in the structure of househo

- Page 37 and 38: substantial privilege". A 2017 repo

- Page 39 and 40: of 30 or above is considered medium

- Page 41 and 42: Theoretical Frameworks Neoclassical

- Page 43 and 44: explain the accumulation of wealth

- Page 45 and 46: economy. Lagerlof and Galor stated

- Page 47 and 48: On the other hand, Jonathan Rothwel

- Page 49 and 50: Economic Development A Kuznets Curv

- Page 51 and 52: Since rent seeking aims to "pluck t

- Page 53 and 54: In their book, Social Epidemiology,

- Page 55 and 56: economic inequality from previous r

- Page 57 and 58: Others dispute the importance of co

- Page 59 and 60: NYU economist William Baumol found

- Page 61 and 62: effects were eliminated by using pa

- Page 63 and 64: Equitable Growth While acknowledgin

- Page 65 and 66: cases, with great economic inequali

- Page 67 and 68: unequal. In both cases, the cause i

- Page 69 and 70: Social Justice Arguments Patrick Di

- Page 71 and 72: Well-targeted income-support polici

- Page 73 and 74:

Progressive taxation: the rich are

- Page 75 and 76:

cities; often they were also black

- Page 77 and 78:

African Americans in those neighbor

- Page 79 and 80:

Legislative Action In the United St

- Page 81 and 82:

Liquorlining Some service providers

- Page 83 and 84:

Mortgages Reverse Redlining occurs

- Page 85 and 86:

90s, showing an insensitivity to et

- Page 87 and 88:

III. Aprophobia and Economic Discri

- Page 89 and 90:

Animosity Racism, sexism, ageism, a

- Page 91 and 92:

Most wage discrimination is masked

- Page 93 and 94:

Against Businesses Minority owned b

- Page 95 and 96:

IV. Payday Lending A Payday Loan (a

- Page 97 and 98:

products were not as suggested by t

- Page 99 and 100:

orrower him or herself understood t

- Page 101 and 102:

Industry Profitability Proponents'

- Page 103 and 104:

A 2012 report produced by the Cato

- Page 105 and 106:

Australian payday lenders providing

- Page 107 and 108:

the practice. The annual percentage

- Page 109 and 110:

similar to those of a payday loan;

- Page 111 and 112:

V. Refund Anticipation Lending Refu

- Page 113 and 114:

would take on average two to three

- Page 115 and 116:

Taxpayers themselves will continue

- Page 117 and 118:

VI. Title Loans A Title Loan (also

- Page 119 and 120:

orrower to visit a store to pick up

- Page 121 and 122:

Some lenders can move around the Mi

- Page 123 and 124:

VII. Loan Sharks A Loan Shark is a

- Page 125 and 126:

lenders with a means of blackmailin

- Page 127 and 128:

ootleg lenders could not get credit

- Page 129 and 130:

Loan Sharks in Ireland The Central

- Page 131 and 132:

money", as well as the debtors' uni

- Page 133 and 134:

VIII. Usury Usury (/ˈjuːʒəri/)

- Page 135 and 136:

Certain negative historical renditi

- Page 137 and 138:

converts to Christianity were no lo

- Page 139 and 140:

And for practicing usury, which was

- Page 141 and 142:

eceived. The sin rests on the fact

- Page 143 and 144:

Federal Regulation On a federal lev

- Page 145 and 146:

effort, but is made to bear the ris

- Page 147 and 148:

IX. References 1. https://en.wikipe

- Page 149 and 150:

Notes _____________________________

- Page 151 and 152:

Attachment A What Is Predatory Lend

- Page 153 and 154:

How We Can Protect Ourselves from P

- Page 155 and 156:

Attachment B Predatory Lending and

- Page 157 and 158:

Predatory Lending and the Subprime

- Page 159 and 160:

combinations, and only to a specifi

- Page 161 and 162:

Our findings have important implica

- Page 163 and 164:

ange receive counseling if they cho

- Page 165 and 166:

to make approval and/or pricing dec

- Page 167 and 168:

operation. To provide some of the f

- Page 169 and 170:

the effects of the legislation. We

- Page 171 and 172:

is repeated for the next HB4050-are

- Page 173 and 174:

performance can be attributed to th

- Page 175 and 176:

skeptical of this. The treatment ar

- Page 177 and 178:

significantly lowered borrower appl

- Page 179 and 180:

standard deviations. Overall, this

- Page 181 and 182:

mortgages had adjustable-rate contr

- Page 183 and 184:

while Panel D is based on the match

- Page 185 and 186:

order to reach an average default r

- Page 187 and 188:

ased on soft information collected

- Page 189 and 190:

mortgage origination leading up to

- Page 191 and 192:

References Abadie, A., Gardeazabal,

- Page 193 and 194:

Yandle, B., 1983. Bootleggers and B

- Page 195 and 196:

November 2006: - A group of residen

- Page 197 and 198:

Table 1. Summary Statistics The tab

- Page 199 and 200:

Table 1. Summary Statistics (Cont.)

- Page 201 and 202:

Table 2. Effects of HB4050 on Marke

- Page 203 and 204:

Table 4. Exit of Lenders Due to HB4

- Page 205 and 206:

Table 5. The Effect of HB4050 on Bo

- Page 207 and 208:

Table 5. The Effect of HB4050 on Bo

- Page 209 and 210:

Table 6. Measuring the Default Rate

- Page 211 and 212:

Figure 2. HMDA Loan Application Fil

- Page 213 and 214:

Attachment C Subprime and Predatory

- Page 215 and 216:

2 C A R S E Y I N S T I T U T E The

- Page 217 and 218:

4 C A R S E Y I N S T I T U T E Fig

- Page 219 and 220:

6 C A R S E Y I N S T I T U T E •

- Page 221 and 222:

8 C A R S E Y I N S T I T U T E BUI

- Page 223 and 224:

available come from 357 foreclosure

- Page 225 and 226:

Advocacy Foundation Publishers Page

- Page 227 and 228:

Issue Title Quarterly Vol. I 2015 T

- Page 229 and 230:

Issue Title Quarterly Vol. V 2019 O

- Page 231 and 232:

LI Nonprofit Confidentiality In The

- Page 233 and 234:

Vol. XVIII 2032 Public Policy LXXVI

- Page 235 and 236:

African-American Youth in The May 2

- Page 237 and 238:

The e-Advocate Quarterly Special Ed

- Page 239 and 240:

Legal Missions International Page 1

- Page 241 and 242:

Vol. V 2019 XVII Russia Q-1 2019 XV

- Page 243 and 244:

The e-Advocate Newsletter Genesis o

- Page 245 and 246:

Extras The Nonprofit Advisors Group

- Page 247 and 248:

About The Author John C (Jack) John

- Page 249:

Page 181 of 181