PSINovember2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

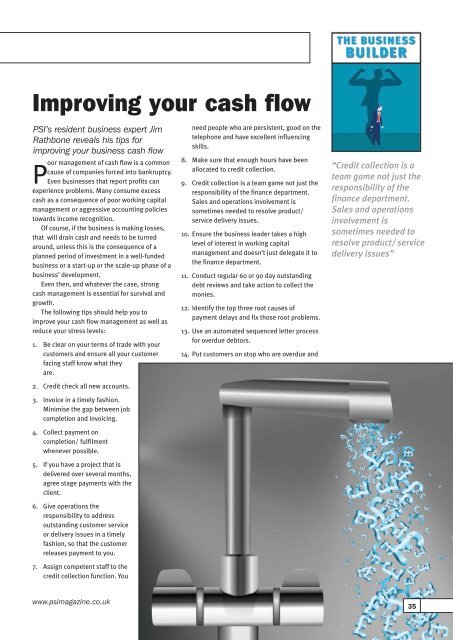

Improving your cash flow<br />

PSI’s resident business expert Jim<br />

Rathbone reveals his tips for<br />

improving your business cash flow<br />

oor management of cash flow is a common<br />

Pcause of companies forced into bankruptcy.<br />

Even businesses that report profits can<br />

experience problems. Many consume excess<br />

cash as a consequence of poor working capital<br />

management or aggressive accounting policies<br />

towards income recognition.<br />

Of course, if the business is making losses,<br />

that will drain cash and needs to be turned<br />

around, unless this is the consequence of a<br />

planned period of investment in a well-funded<br />

business or a start-up or the scale-up phase of a<br />

business’ development.<br />

Even then, and whatever the case, strong<br />

cash management is essential for survival and<br />

growth.<br />

The following tips should help you to<br />

improve your cash flow management as well as<br />

reduce your stress levels:<br />

1. Be clear on your terms of trade with your<br />

customers and ensure all your customer<br />

facing staff know what they<br />

are.<br />

2. Credit check all new accounts.<br />

3. Invoice in a timely fashion.<br />

Minimise the gap between job<br />

completion and invoicing.<br />

4. Collect payment on<br />

completion/ fulfilment<br />

whenever possible.<br />

5. If you have a project that is<br />

delivered over several months,<br />

agree stage payments with the<br />

client.<br />

6. Give operations the<br />

responsibility to address<br />

outstanding customer service<br />

or delivery issues in a timely<br />

fashion, so that the customer<br />

releases payment to you.<br />

7. Assign competent staff to the<br />

credit collection function. You<br />

need people who are persistent, good on the<br />

telephone and have excellent influencing<br />

skills.<br />

8. Make sure that enough hours have been<br />

allocated to credit collection.<br />

9. Credit collection is a team game not just the<br />

responsibility of the finance department.<br />

Sales and operations involvement is<br />

sometimes needed to resolve product/<br />

service delivery issues.<br />

10. Ensure the business leader takes a high<br />

level of interest in working capital<br />

management and doesn’t just delegate it to<br />

the finance department.<br />

11. Conduct regular 60 or 90 day outstanding<br />

debt reviews and take action to collect the<br />

monies.<br />

12. Identify the top three root causes of<br />

payment delays and fix those root problems.<br />

13. Use an automated sequenced letter process<br />

for overdue debtors.<br />

14. Put customers on stop who are overdue and<br />

“Credit collection is a<br />

team game not just the<br />

responsibility of the<br />

finance department.<br />

Sales and operations<br />

involvement is<br />

sometimes needed to<br />

resolve product/ service<br />

delivery issues”<br />

www.psimagazine.co.uk<br />

35