EL Magazine JUL-AUG 2019 PAGETURNER

Are you looking for a trusted source of all things local to Milton Keynes, Stony Stratford, Wolverton and surrounds? Look no further as you have found Essentially Local magazine, which loved, kept and used by local readers. It's delivered through the doors of over 12,500 homes and businesses from Towcester to Milton Keynes and copies can be picked up from various places around the area. Take time to go through the comprehensive directory of local businesses and become one of the growing numbers of people who keep their business Essentially Local. Read the useful and interesting information and find out about places to go to. This magazine offers small to medium-sized businesses cost-effective advertising options to ensure they stand out from the crowd. Join the community and keep your business essentially local.

Are you looking for a trusted source of all things local to Milton Keynes, Stony Stratford, Wolverton and surrounds? Look no further as you have found Essentially Local magazine, which loved, kept and used by local readers. It's delivered through the doors of over 12,500 homes and businesses from Towcester to Milton Keynes and copies can be picked up from various places around the area. Take time to go through the comprehensive directory of local businesses and become one of the growing numbers of people who keep their business Essentially Local. Read the useful and interesting information and find out about places to go to. This magazine offers small to medium-sized businesses cost-effective advertising options to ensure they stand out from the crowd. Join the community and keep your business essentially local.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

New Employee Pension Tax Trap<br />

The start of the new tax year brought about an increase in the minimum<br />

contributions that need to be made to your workplace pension scheme.<br />

Whilst it’s good news that more money is going into your pension there<br />

can be a nasty tax trap for those earning over £150,000.<br />

At this level of earnings your £40,000 pension Annual Allowance (the<br />

amount that can be paid into a pension) starts to reduce by £1 for every<br />

£2 you are over, until you are left with an allowance of just £10,000 per<br />

annum. This is called the Tapered Annual Allowance.<br />

I have come across a number of clients whose employer is paying them<br />

much greater pension contributions based on full pay. Without realising<br />

it you could be contributing more than your reduced Annual Allowance.<br />

This will result in a nasty tax bill.<br />

As always you need to get informed. Pension taxation is a minefield and<br />

there are exams for Financial Advisers on pension taxation alone!<br />

Here are a few steps to<br />

take:<br />

#1 – Check with your<br />

company what pension<br />

contributions are being<br />

paid.<br />

#2 – Seek financial<br />

advice.<br />

#3 – Ask your employer<br />

for alternative<br />

remuneration if you are<br />

caught by the trap.<br />

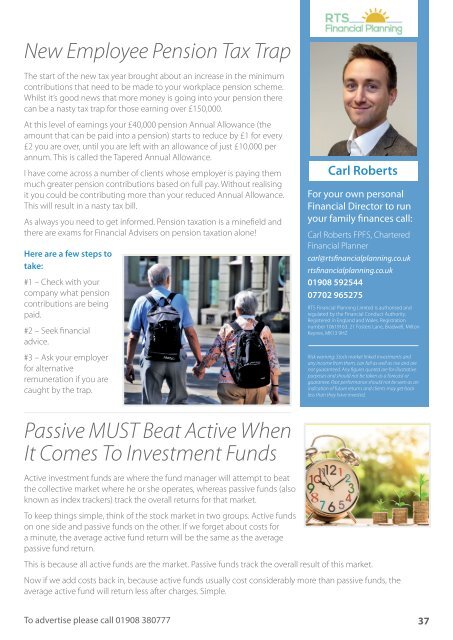

Carl Roberts<br />

For your own personal<br />

Financial Director to run<br />

your family finances call:<br />

Carl Roberts FPFS, Chartered<br />

Financial Planner<br />

carl@rtsfinancialplanning.co.uk<br />

rtsfinancialplanning.co.uk<br />

01908 592544<br />

07702 965275<br />

RTS Financial Planning Limited is authorised and<br />

regulated by the Financial Conduct Authority.<br />

Registered in England and Wales. Registration<br />

number 10619163. 21 Fosters Lane, Bradwell, Milton<br />

Keynes, MK13 9HZ<br />

Risk warning: Stock market linked investments and<br />

any income from them, can fall as well as rise and are<br />

not guaranteed. Any figures quoted are for illustrative<br />

purposes and should not be taken as a forecast or<br />

guarantee. Past performance should not be seen as an<br />

indication of future returns and clients may get back<br />

less than they have invested.<br />

Passive MUST Beat Active When<br />

It Comes To Investment Funds<br />

Active investment funds are where the fund manager will attempt to beat<br />

the collective market where he or she operates, whereas passive funds (also<br />

known as index trackers) track the overall returns for that market.<br />

To keep things simple, think of the stock market in two groups. Active funds<br />

on one side and passive funds on the other. If we forget about costs for<br />

a minute, the average active fund return will be the same as the average<br />

passive fund return.<br />

This is because all active funds are the market. Passive funds track the overall result of this market.<br />

Now if we add costs back in, because active funds usually cost considerably more than passive funds, the<br />

average active fund will return less after charges. Simple.<br />

To advertise please call 01908 380777<br />

37