Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NEWS SPECIAL<br />

Solid Foundations<br />

Phil Andrew speaks to Sean Feast FCI<strong>CM</strong> about his first<br />

full year as Chief Executive of StepChange Debt Charity.<br />

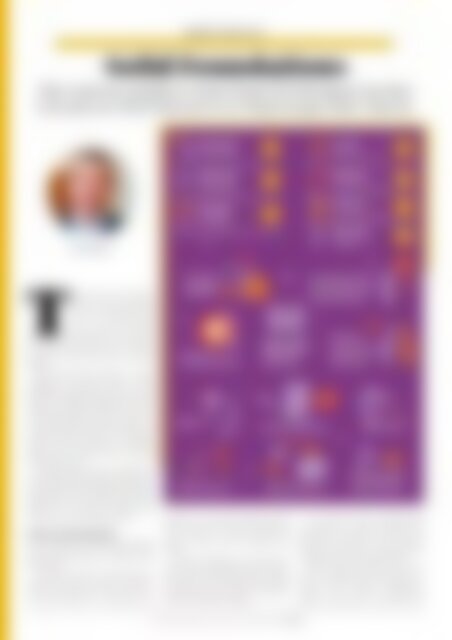

657,930<br />

clients contacted us<br />

+<br />

6.1%<br />

6,315<br />

Debt relief orders set up<br />

+<br />

40%<br />

306,391<br />

clients completed a<br />

debt advice session<br />

+<br />

0.3%<br />

£432m<br />

of debt repaid by our clients<br />

+<br />

0.8%<br />

Phil Andrew<br />

56,660<br />

clients started a<br />

managed solution<br />

-<br />

8.3%<br />

£110m<br />

written off with our support<br />

24,310<br />

became debt free with<br />

our support<br />

+<br />

7%<br />

+<br />

15%<br />

THE need for debt advice<br />

in this country is growing<br />

– and growing rapidly. By<br />

2022 it is estimated that<br />

more than two million<br />

people in the UK will need<br />

debt advice every single year. At present<br />

the entire debt advice sector has the<br />

capacity to help less than one million<br />

people.<br />

Phil Andrew believes there is a moral<br />

obligation to meet the needs of those<br />

struggling with problem debt; it’s why<br />

he’s set out ambitious plans to double the<br />

number of people StepChange can help:<br />

“Inextricably linked to this,” he says, “is<br />

the need to help people before they fall in<br />

to crisis and also to ensure we continue to<br />

provide consistent advice, of the highest<br />

quality, at a cost that allows us to help as<br />

many people as possible with the limited<br />

funding we receive.”<br />

In its latest impact report, published in<br />

May, StepChange revealed the huge strides<br />

it is taking towards helping more people,<br />

reflecting also on the people it has already<br />

helped, how they have been helped, and<br />

what steps it is taking to build a more<br />

effective and efficient organisation.<br />

ADVICE AND SOLUTIONS<br />

In 2018, Phil says that StepChange helped<br />

more people than ever, with 657,930<br />

people getting in contact – someone every<br />

48 seconds.<br />

“And we continued to offer that support<br />

right from the first contact through to<br />

someone becoming debt free,” he says.<br />

“We also kicked off a landmark new<br />

We reduced our<br />

client advice cost by<br />

4.2%<br />

We supported the<br />

development of the Single<br />

Financial Statement (SFS)<br />

major policy<br />

4 wins<br />

influential research<br />

8 and data reports<br />

Our partners referred<br />

154,611<br />

clients to us for<br />

telephone advice<br />

initiative to track what difference debt<br />

advice makes. This looks at the wellbeing<br />

of our clients on various measures at<br />

different times after receiving debt<br />

advice.”<br />

Its initial findings set out the real areas<br />

where it has a significant positive impact<br />

for its clients and looks honestly at where<br />

debt advice is less effective, particularly<br />

noting less positive results for vulnerable<br />

clients with negative budgets.<br />

Government introduced the<br />

No Interest Loan Scheme pilot<br />

major FCA interventions<br />

4 matching our goals<br />

We continued to collaborate<br />

with Citizens Advice and<br />

Business Debtline to direct<br />

clients to the right advice<br />

provider for their needs<br />

We continued<br />

to develop our<br />

customer relationship<br />

management system<br />

(CRM) to better<br />

serve our clients<br />

10 consultation<br />

responses<br />

Parliament legislated for<br />

Breathing Space within<br />

the Financial Guidance<br />

and Claims Act 2018<br />

“As a charity we have a responsibility<br />

to manage our money effectively and<br />

efficiently,” he continues. “We want our<br />

partners and funders to have complete<br />

confidence that their contributions are<br />

having the greatest impact possible.”<br />

What is clear, he believes, is that the<br />

sector is significantly underfunded. “In<br />

2018 we’ve been leading conversations<br />

around Fair Share contributions<br />

whilst also calling for an effective and<br />

The Recognised Standard / www.cicm.com / <strong>July</strong>/<strong>August</strong> <strong>2019</strong> / PAGE 10