CONNECTIONS_57_e

Specialist magazine CONNECTIONS no. 57

Specialist magazine CONNECTIONS no. 57

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Focus<br />

030.5665<br />

The big and the small<br />

Let’s take a look at the individual categories.<br />

At the top, the radar screen shows the<br />

hyperscale data centers – the jumbo jets in<br />

the cloud so to speak. Further categories:<br />

colocation, edge, enterprise and micro data<br />

centers. And then there are the systems of<br />

the major network operators: telecom data<br />

centers, carrier hotels, exchange points.<br />

By 2023, the hyperscale market will reach<br />

a volume of almost 360 billion $ according<br />

to Research and Markets. The growth rate<br />

is 26 %. In 2018, Synergy Research recorded<br />

worldwide 430 hyperscale data centers (or<br />

HDC for short), 40 % of which are in the US,<br />

$ 600<br />

Telecom<br />

8 % in China, 6 % in Japan. And a further 132<br />

were in the planning stages.<br />

The HDCs belong to a few companies:<br />

Alibaba, Amazon, Baidu, Facebook, Google,<br />

Microsoft, Tencent etc. The revenue from<br />

their systems is growing 20 % annually. In<br />

2018, the operators invested 120 billion $ in<br />

HDC projects – an increase of 45 %.<br />

The sector of colocation data centers (or colo<br />

for short) is characterized by diverse operating<br />

models. BCC Research says that this<br />

fragmented market sees an annual expansion<br />

of 15.4 %. It is likely to reach a volume of 54.8<br />

billion $ in 2020. The demand is booming<br />

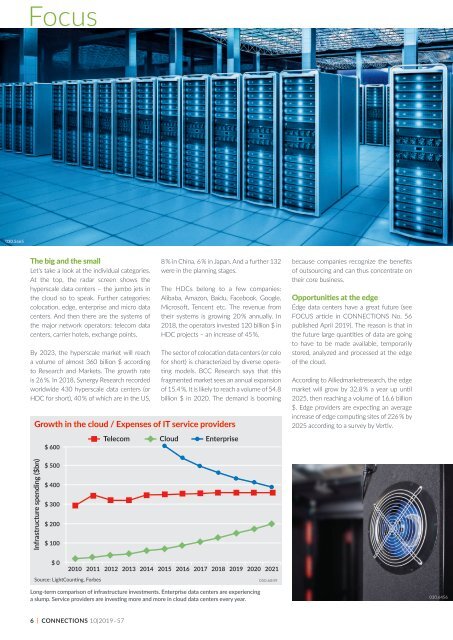

Growth in the cloud / Expenses of IT service providers<br />

Cloud<br />

Enterprise<br />

because companies recognize the benefits<br />

of outsourcing and can thus concentrate on<br />

their core business.<br />

Opportunities at the edge<br />

Edge data centers have a great future (see<br />

FOCUS article in <strong>CONNECTIONS</strong> No. 56<br />

published April 2019). The reason is that in<br />

the future large quantities of data are going<br />

to have to be made available, temporarily<br />

stored, analyzed and processed at the edge<br />

of the cloud.<br />

According to Alliedmarketresearch, the edge<br />

market will grow by 32.8 % a year up until<br />

2025, then reaching a volume of 16.6 billion<br />

$. Edge providers are expecting an average<br />

increase of edge computing sites of 226 % by<br />

2025 according to a survey by Vertiv.<br />

Infrastructure spending ($bn)<br />

$ 500<br />

$ 400<br />

$ 300<br />

$ 200<br />

$ 100<br />

$ 0<br />

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021<br />

Source: LightCounting, Forbes<br />

050.6849<br />

Long-term comparison of infrastructure investments. Enterprise data centers are experiencing<br />

a slump. Service providers are investing more and more in cloud data centers every year.<br />

030.6456<br />

6 | <strong>CONNECTIONS</strong> 10|2019–<strong>57</strong>