RHM Pension Plan 35 and Plan 45 - RHM Pension Scheme - UK.com

RHM Pension Plan 35 and Plan 45 - RHM Pension Scheme - UK.com

RHM Pension Plan 35 and Plan 45 - RHM Pension Scheme - UK.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Two-part pension<br />

◆<br />

8<br />

◆<br />

◆<br />

The State <strong>Pension</strong> <strong>Scheme</strong><br />

There are two parts to the State <strong>Pension</strong> <strong>Scheme</strong>:<br />

◆ The State Basic <strong>Pension</strong> <strong>Scheme</strong>.<br />

◆ The State Earnings-Related <strong>Pension</strong> <strong>Scheme</strong> (SERPS), which will be<br />

replaced, from April 2002, by the State Second <strong>Pension</strong>.<br />

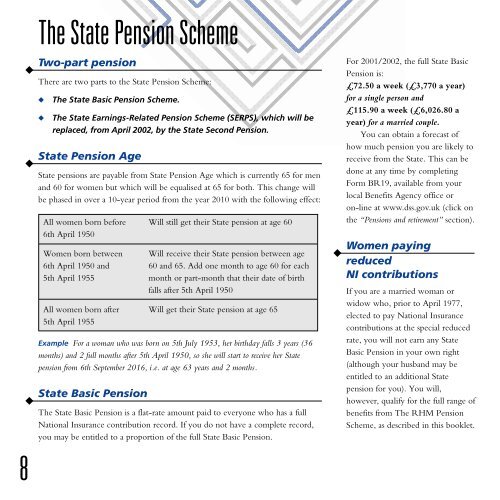

State <strong>Pension</strong> Age<br />

State pensions are payable from State <strong>Pension</strong> Age which is currently 65 for men<br />

<strong>and</strong> 60 for women but which will be equalised at 65 for both. This change will<br />

be phased in over a 10-year period from the year 2010 with the following effect:<br />

All women born before<br />

6th April 1950<br />

Women born between<br />

6th April 1950 <strong>and</strong><br />

5th April 1955<br />

All women born after<br />

5th April 1955<br />

Example For a woman who was born on 5th July 1953, her birthday falls 3 years (36<br />

months) <strong>and</strong> 2 full months after 5th April 1950, so she will start to receive her State<br />

pension from 6th September 2016, i.e. at age 63 years <strong>and</strong> 2 months.<br />

State Basic <strong>Pension</strong><br />

Will still get their State pension at age 60<br />

Will receive their State pension between age<br />

60 <strong>and</strong> 65. Add one month to age 60 for each<br />

month or part-month that their date of birth<br />

falls after 5th April 1950<br />

Will get their State pension at age 65<br />

The State Basic <strong>Pension</strong> is a flat-rate amount paid to everyone who has a full<br />

National Insurance contribution record. If you do not have a <strong>com</strong>plete record,<br />

you may be entitled to a proportion of the full State Basic <strong>Pension</strong>.<br />

◆<br />

For 2001/2002, the full State Basic<br />

<strong>Pension</strong> is:<br />

£72.50 a week (£3,770 a year)<br />

for a single person <strong>and</strong><br />

£115.90 a week (£6,026.80 a<br />

year) for a married couple.<br />

You can obtain a forecast of<br />

how much pension you are likely to<br />

receive from the State. This can be<br />

done at any time by <strong>com</strong>pleting<br />

Form BR19, available from your<br />

local Benefits Agency office or<br />

on-line at www.dss.gov.uk (click on<br />

the “<strong>Pension</strong>s <strong>and</strong> retirement” section).<br />

Women paying<br />

reduced<br />

NI contributions<br />

If you are a married woman or<br />

widow who, prior to April 1977,<br />

elected to pay National Insurance<br />

contributions at the special reduced<br />

rate, you will not earn any State<br />

Basic <strong>Pension</strong> in your own right<br />

(although your husb<strong>and</strong> may be<br />

entitled to an additional State<br />

pension for you). You will,<br />

however, qualify for the full range of<br />

benefits from The <strong>RHM</strong> <strong>Pension</strong><br />

<strong>Scheme</strong>, as described in this booklet.