RHM Pension Plan 35 and Plan 45 - RHM Pension Scheme - UK.com

RHM Pension Plan 35 and Plan 45 - RHM Pension Scheme - UK.com

RHM Pension Plan 35 and Plan 45 - RHM Pension Scheme - UK.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Eligibility 10<br />

◆<br />

4<br />

◆<br />

◆<br />

◆<br />

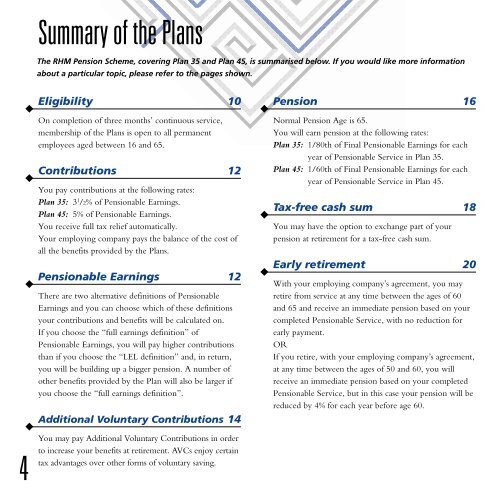

Summary of the <strong>Plan</strong>s<br />

The <strong>RHM</strong> <strong>Pension</strong> <strong>Scheme</strong>, covering <strong>Plan</strong> <strong>35</strong> <strong>and</strong> <strong>Plan</strong> <strong>45</strong>, is summarised below. If you would like more information<br />

about a particular topic, please refer to the pages shown.<br />

On <strong>com</strong>pletion of three months’ continuous service,<br />

membership of the <strong>Plan</strong>s is open to all permanent<br />

employees aged between 16 <strong>and</strong> 65.<br />

Contributions 12<br />

You pay contributions at the following rates:<br />

<strong>Plan</strong> <strong>35</strong>: 3 1 /2% of <strong>Pension</strong>able Earnings.<br />

<strong>Plan</strong> <strong>45</strong>: 5% of <strong>Pension</strong>able Earnings.<br />

You receive full tax relief automatically.<br />

Your employing <strong>com</strong>pany pays the balance of the cost of<br />

all the benefits provided by the <strong>Plan</strong>s.<br />

<strong>Pension</strong>able Earnings 12<br />

There are two alternative definitions of <strong>Pension</strong>able<br />

Earnings <strong>and</strong> you can choose which of these definitions<br />

your contributions <strong>and</strong> benefits will be calculated on.<br />

If you choose the “full earnings definition” of<br />

<strong>Pension</strong>able Earnings, you will pay higher contributions<br />

than if you choose the “LEL definition” <strong>and</strong>, in return,<br />

you will be building up a bigger pension. A number of<br />

other benefits provided by the <strong>Plan</strong> will also be larger if<br />

you choose the “full earnings definition”.<br />

Additional Voluntary Contributions 14<br />

You may pay Additional Voluntary Contributions in order<br />

to increase your benefits at retirement. AVCs enjoy certain<br />

tax advantages over other forms of voluntary saving.<br />

◆<br />

◆<br />

◆<br />

<strong>Pension</strong> 16<br />

Normal <strong>Pension</strong> Age is 65.<br />

You will earn pension at the following rates:<br />

<strong>Plan</strong> <strong>35</strong>: 1/80th of Final <strong>Pension</strong>able Earnings for each<br />

year of <strong>Pension</strong>able Service in <strong>Plan</strong> <strong>35</strong>.<br />

<strong>Plan</strong> <strong>45</strong>: 1/60th of Final <strong>Pension</strong>able Earnings for each<br />

year of <strong>Pension</strong>able Service in <strong>Plan</strong> <strong>45</strong>.<br />

Tax-free cash sum 18<br />

You may have the option to exchange part of your<br />

pension at retirement for a tax-free cash sum.<br />

Early retirement 20<br />

With your employing <strong>com</strong>pany’s agreement, you may<br />

retire from service at any time between the ages of 60<br />

<strong>and</strong> 65 <strong>and</strong> receive an immediate pension based on your<br />

<strong>com</strong>pleted <strong>Pension</strong>able Service, with no reduction for<br />

early payment.<br />

OR<br />

If you retire, with your employing <strong>com</strong>pany’s agreement,<br />

at any time between the ages of 50 <strong>and</strong> 60, you will<br />

receive an immediate pension based on your <strong>com</strong>pleted<br />

<strong>Pension</strong>able Service, but in this case your pension will be<br />

reduced by 4% for each year before age 60.