RHM Pension Plan 35 and Plan 45 - RHM Pension Scheme - UK.com

RHM Pension Plan 35 and Plan 45 - RHM Pension Scheme - UK.com

RHM Pension Plan 35 and Plan 45 - RHM Pension Scheme - UK.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Tax-free cash sum<br />

Cash sum<br />

◆<br />

18<br />

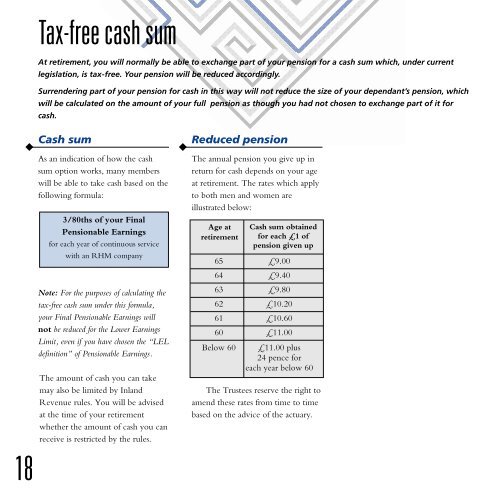

At retirement, you will normally be able to exchange part of your pension for a cash sum which, under current<br />

legislation, is tax-free. Your pension will be reduced accordingly.<br />

Surrendering part of your pension for cash in this way will not reduce the size of your dependant’s pension, which<br />

will be calculated on the amount of your full pension as though you had not chosen to exchange part of it for<br />

cash.<br />

As an indication of how the cash<br />

sum option works, many members<br />

will be able to take cash based on the<br />

following formula:<br />

3/80ths of your Final<br />

<strong>Pension</strong>able Earnings<br />

for each year of continuous service<br />

with an <strong>RHM</strong> <strong>com</strong>pany<br />

Note: For the purposes of calculating the<br />

tax-free cash sum under this formula,<br />

your Final <strong>Pension</strong>able Earnings will<br />

not be reduced for the Lower Earnings<br />

Limit, even if you have chosen the “LEL<br />

definition” of <strong>Pension</strong>able Earnings.<br />

The amount of cash you can take<br />

may also be limited by Inl<strong>and</strong><br />

Revenue rules. You will be advised<br />

at the time of your retirement<br />

whether the amount of cash you can<br />

receive is restricted by the rules.<br />

◆<br />

Reduced pension<br />

The annual pension you give up in<br />

return for cash depends on your age<br />

at retirement. The rates which apply<br />

to both men <strong>and</strong> women are<br />

illustrated below:<br />

Age at<br />

retirement<br />

Cash sum obtained<br />

for each £1 of<br />

pension given up<br />

65 £9.00<br />

64 £9.40<br />

63 £9.80<br />

62 £10.20<br />

61 £10.60<br />

60 £11.00<br />

Below 60 £11.00 plus<br />

24 pence for<br />

each year below 60<br />

The Trustees reserve the right to<br />

amend these rates from time to time<br />

based on the advice of the actuary.