RHM Pension Plan 35 and Plan 45 - RHM Pension Scheme - UK.com

RHM Pension Plan 35 and Plan 45 - RHM Pension Scheme - UK.com

RHM Pension Plan 35 and Plan 45 - RHM Pension Scheme - UK.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

26<br />

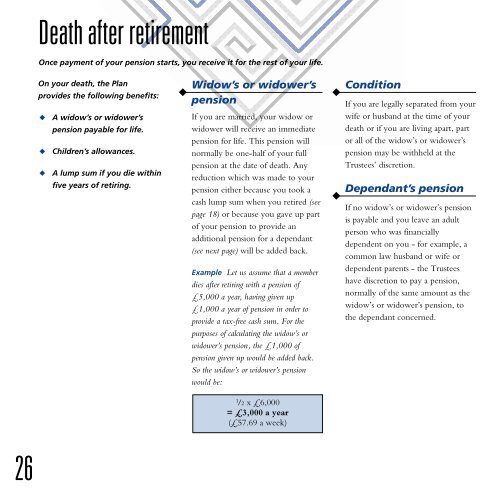

Death after retirement<br />

Once payment of your pension starts, you receive it for the rest of your life.<br />

On your death, the <strong>Plan</strong><br />

provides the following benefits:<br />

◆ A widow’s or widower’s<br />

pension payable for life.<br />

◆ Children’s allowances.<br />

◆ A lump sum if you die within<br />

five years of retiring.<br />

◆<br />

Widow’s or widower’s<br />

pension<br />

If you are married, your widow or<br />

widower will receive an immediate<br />

pension for life. This pension will<br />

normally be one-half of your full<br />

pension at the date of death. Any<br />

reduction which was made to your<br />

pension either because you took a<br />

cash lump sum when you retired (see<br />

page 18) or because you gave up part<br />

of your pension to provide an<br />

additional pension for a dependant<br />

(see next page) will be added back.<br />

Example Let us assume that a member<br />

dies after retiring with a pension of<br />

£5,000 a year, having given up<br />

£1,000 a year of pension in order to<br />

provide a tax-free cash sum. For the<br />

purposes of calculating the widow’s or<br />

widower’s pension, the £1,000 of<br />

pension given up would be added back.<br />

So the widow’s or widower’s pension<br />

would be:<br />

1 /2 x £6,000<br />

= £3,000 a year<br />

(£57.69 a week)<br />

◆ Condition<br />

If you are legally separated from your<br />

wife or husb<strong>and</strong> at the time of your<br />

death or if you are living apart, part<br />

or all of the widow’s or widower’s<br />

pension may be withheld at the<br />

Trustees’ discretion.<br />

◆<br />

Dependant’s pension<br />

If no widow’s or widower’s pension<br />

is payable <strong>and</strong> you leave an adult<br />

person who was financially<br />

dependent on you - for example, a<br />

<strong>com</strong>mon law husb<strong>and</strong> or wife or<br />

dependent parents - the Trustees<br />

have discretion to pay a pension,<br />

normally of the same amount as the<br />

widow’s or widower’s pension, to<br />

the dependant concerned.