Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A N N U A L R E P O R T 2 0 1 9<br />

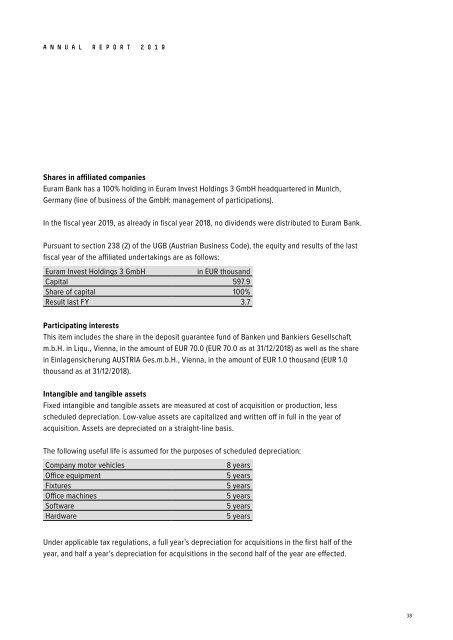

Shares in affiliated companies<br />

<strong>Euram</strong> <strong>Bank</strong> has a 100% holding in <strong>Euram</strong> Invest Holdings 3 GmbH headquartered in Munich,<br />

Germany (line <strong>of</strong> business <strong>of</strong> the GmbH: management <strong>of</strong> participations).<br />

In the fiscal year <strong>2019</strong>, as already in fiscal year 2018, no dividends were distributed to <strong>Euram</strong> <strong>Bank</strong>.<br />

Pursuant to section 238 (2) <strong>of</strong> the UGB (Austrian Business Code), the equity and results <strong>of</strong> the last<br />

fiscal year <strong>of</strong> the affiliated undertakings are as follows:<br />

<strong>Euram</strong> Invest Holdings 3 GmbH<br />

in EUR thousand<br />

Capital 597.9<br />

Share <strong>of</strong> capital 100%<br />

Result last FY 3.7<br />

Participating interests<br />

This item includes the share in the deposit guarantee fund <strong>of</strong> <strong>Bank</strong>en und <strong>Bank</strong>iers Gesellschaft<br />

m.b.H. in Liqu., Vienna, in the amount <strong>of</strong> EUR 70.0 (EUR 70.0 as at 31/12/2018) as well as the share<br />

in Einlagensicherung AUSTRIA Ges.m.b.H., Vienna, in the amount <strong>of</strong> EUR 1.0 thousand (EUR 1.0<br />

thousand as at 31/12/2018).<br />

Intangible and tangible assets<br />

Fixed intangible and tangible assets are measured at cost <strong>of</strong> acquisition or production, less<br />

scheduled depreciation. Low-value assets are capitalized and written <strong>of</strong>f in full in the year <strong>of</strong><br />

acquisition. Assets are depreciated on a straight-line basis.<br />

The following useful life is assumed for the purposes <strong>of</strong> scheduled depreciation:<br />

Company motor vehicles<br />

Office equipment<br />

Fixtures<br />

Office machines<br />

S<strong>of</strong>tware<br />

Hardware<br />

8 years<br />

5 years<br />

5 years<br />

5 years<br />

5 years<br />

5 years<br />

Under applicable tax regulations, a full year’s depreciation for acquisitions in the first half <strong>of</strong> the<br />

year, and half a year’s depreciation for acquisitions in the second half <strong>of</strong> the year are effected.<br />

38