Report - Risk Management in Brazilian Agriculture

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Risk</strong> <strong>Management</strong> <strong>in</strong> <strong>Brazilian</strong> <strong>Agriculture</strong>: Instruments, Public Policy, and Perspectives<br />

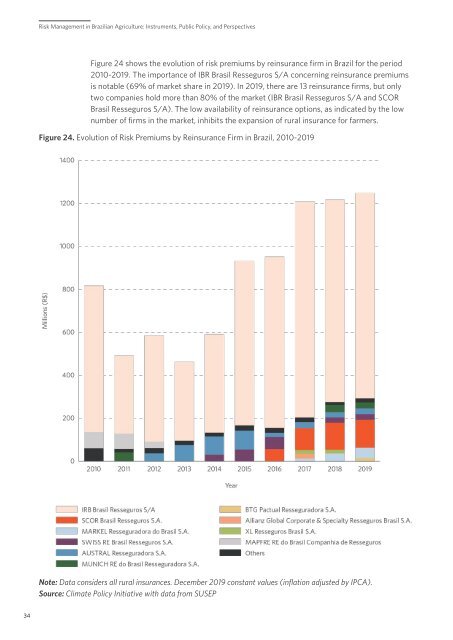

Figure 24 shows the evolution of risk premiums by re<strong>in</strong>surance firm <strong>in</strong> Brazil for the period<br />

2010-2019. The importance of IBR Brasil Resseguros S/A concern<strong>in</strong>g re<strong>in</strong>surance premiums<br />

is notable (69% of market share <strong>in</strong> 2019). In 2019, there are 13 re<strong>in</strong>surance firms, but only<br />

two companies hold more than 80% of the market (IBR Brasil Resseguros S/A and SCOR<br />

Brasil Resseguros S/A). The low availability of re<strong>in</strong>surance options, as <strong>in</strong>dicated by the low<br />

number of firms <strong>in</strong> the market, <strong>in</strong>hibits the expansion of rural <strong>in</strong>surance for farmers.<br />

Figure 24. Evolution of <strong>Risk</strong> Premiums by Re<strong>in</strong>surance Firm <strong>in</strong> Brazil, 2010-2019<br />

Note: Data considers all rural <strong>in</strong>surances. December 2019 constant values (<strong>in</strong>flation adjusted by IPCA).<br />

Source: Climate Policy Initiative with data from SUSEP<br />

34