NCFA Fintech Confidential December 2020 (Issue 3)

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited to present Vol. 1 Issue 3, FINTECH CONFIDENTIAL, a digital pop-up of the 6th annual 2020 Fintech & Financing Conference and Expo (FFCON20) held virtually across themed 8 weeks from July 9 to August 27 and co-hosted by NCFA and Toronto Finance International. The main theme of FFCON20 was “RISE”, reflecting the joint efforts of the two associations, NCFA and TFI, to build and increase the success and sustainability of Canada’s fintech and financial sector. There were many moving parts this year and a brand-new digital format with the event bringing together 100+ thought leaders, 50+ partners, and more than 500 attendees, 2 challenges and the inaugural Fintech Draft pitching and demo competitions. Congratulations to the winners: SolidBlock and MazumaGo (formerly DivDot)! Thanks to all the partners, speakers, attendees, volunteers and the entire organizing team for making FFCON20 an impactful and amazing online experience for Canada’s fintech and funding community. We hope you enjoy this issue of Fintech Confidential magazine – it certainly makes for great holiday reading! While everyone relentlessly strives to achieve success in 2021, we encourage you to bring in the new year with good health and to be mindful that we are all in this together, and to help others in your community more than ever before. Peace, happiness, and best wishes for an incredible year and journey ahead.

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited

to present Vol. 1 Issue 3, FINTECH CONFIDENTIAL, a digital pop-up of the 6th annual 2020 Fintech & Financing Conference and Expo (FFCON20) held virtually across themed 8 weeks from July 9 to August 27 and co-hosted by NCFA and Toronto Finance International.

The main theme of FFCON20 was “RISE”, reflecting the joint efforts of the two associations, NCFA and TFI, to build and increase the success and sustainability of Canada’s fintech and financial sector. There were many moving parts this year and a brand-new digital format with the event bringing together 100+ thought leaders, 50+ partners, and more than 500 attendees, 2 challenges and the inaugural Fintech Draft pitching and demo competitions. Congratulations to the winners: SolidBlock and MazumaGo (formerly DivDot)! Thanks to all the partners, speakers, attendees, volunteers and the entire organizing team for making FFCON20 an impactful and amazing online experience for Canada’s fintech and funding community.

We hope you enjoy this issue of Fintech Confidential magazine – it certainly makes for great holiday reading! While everyone relentlessly strives to achieve success in 2021, we encourage you to bring in the new year with good health and to be mindful that we are all in this together, and to help others in your community more than ever before. Peace, happiness, and best wishes for an incredible year and journey ahead.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

of the planet. Her terms and conditions, her<br />

rules, override all regulations.<br />

Secondary wealth is derived from the things<br />

we make from primary wealth. Ore becomes<br />

steel, plants become your dinner, trees are<br />

used to make lumber, paper, etc. Because<br />

we do not follow the rules set by Mother<br />

Nature, the conversion is 96% inefficient.<br />

Some experts say that is low, and it’s really<br />

98%. Simply stated, that means for every<br />

$100, you are getting $4 or $2 of value.<br />

The final layer, tertiary wealth are all the paper<br />

abstractions that we layer on top. Tertiary<br />

wealth is entirely dependent on the primary<br />

level being healthy, and rests precariously<br />

on top of the pyramid, only kept in place<br />

by trust. When we put the primary layer of<br />

wealth at risk by our decisions or actions, you<br />

can see where this is going.<br />

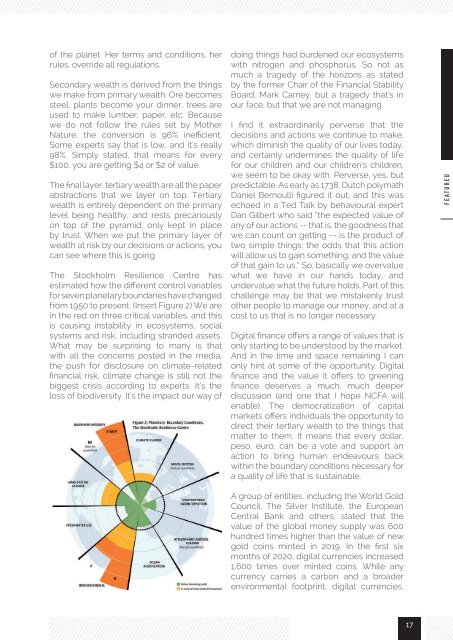

The Stockholm Resilience Centre has<br />

estimated how the different control variables<br />

for seven planetary boundaries have changed<br />

from 1950 to present. (Insert Figure 2) We are<br />

in the red on three critical variables, and this<br />

is causing instability in ecosystems, social<br />

systems and risk, including stranded assets.<br />

What may be surprising to many is that<br />

with all the concerns posted in the media,<br />

the push for disclosure on climate-related<br />

financial risk, climate change is still not the<br />

biggest crisis according to experts. It’s the<br />

loss of biodiversity. It’s the impact our way of<br />

doing things had burdened our ecosystems<br />

with nitrogen and phosphorus. So not as<br />

much a tragedy of the horizons as stated<br />

by the former Chair of the Financial Stability<br />

Board, Mark Carney, but a tragedy that’s in<br />

our face, but that we are not managing.<br />

I find it extraordinarily perverse that the<br />

decisions and actions we continue to make,<br />

which diminish the quality of our lives today,<br />

and certainly undermines the quality of life<br />

for our children and our children’s children,<br />

we seem to be okay with. Perverse, yes, but<br />

predictable. As early as 1738, Dutch polymath<br />

Daniel Bernoulli figured it out, and this was<br />

echoed in a Ted Talk by behavioural expert<br />

Dan Gilbert who said “the expected value of<br />

any of our actions -- that is, the goodness that<br />

we can count on getting -- is the product of<br />

two simple things: the odds that this action<br />

will allow us to gain something, and the value<br />

of that gain to us.” So, basically we overvalue<br />

what we have in our hands today, and<br />

undervalue what the future holds. Part of this<br />

challenge may be that we mistakenly trust<br />

other people to manage our money, and at a<br />

cost to us that is no longer necessary.<br />

Digital finance offers a range of values that is<br />

only starting to be understood by the market.<br />

And in the time and space remaining I can<br />

only hint at some of the opportunity. Digital<br />

finance and the value it offers to greening<br />

finance deserves a much, much deeper<br />

discussion (and one that I hope <strong>NCFA</strong> will<br />

enable). The democratization of capital<br />

markets offers individuals the opportunity to<br />

direct their tertiary wealth to the things that<br />

matter to them. It means that every dollar,<br />

peso, euro, can be a vote and support an<br />

action to bring human endeavours back<br />

within the boundary conditions necessary for<br />

a quality of life that is sustainable.<br />

FEATURED<br />

A group of entities, including the World Gold<br />

Council, The Silver Institute, the European<br />

Central Bank and others, stated that the<br />

value of the global money supply was 600<br />

hundred times higher than the value of new<br />

gold coins minted in 2019. In the first six<br />

months of <strong>2020</strong>, digital currencies increased<br />

1,600 times over minted coins. While any<br />

currency carries a carbon and a broader<br />

environmental footprint, digital currencies,<br />

17