NCFA Fintech Confidential December 2020 (Issue 3)

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited to present Vol. 1 Issue 3, FINTECH CONFIDENTIAL, a digital pop-up of the 6th annual 2020 Fintech & Financing Conference and Expo (FFCON20) held virtually across themed 8 weeks from July 9 to August 27 and co-hosted by NCFA and Toronto Finance International. The main theme of FFCON20 was “RISE”, reflecting the joint efforts of the two associations, NCFA and TFI, to build and increase the success and sustainability of Canada’s fintech and financial sector. There were many moving parts this year and a brand-new digital format with the event bringing together 100+ thought leaders, 50+ partners, and more than 500 attendees, 2 challenges and the inaugural Fintech Draft pitching and demo competitions. Congratulations to the winners: SolidBlock and MazumaGo (formerly DivDot)! Thanks to all the partners, speakers, attendees, volunteers and the entire organizing team for making FFCON20 an impactful and amazing online experience for Canada’s fintech and funding community. We hope you enjoy this issue of Fintech Confidential magazine – it certainly makes for great holiday reading! While everyone relentlessly strives to achieve success in 2021, we encourage you to bring in the new year with good health and to be mindful that we are all in this together, and to help others in your community more than ever before. Peace, happiness, and best wishes for an incredible year and journey ahead.

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited

to present Vol. 1 Issue 3, FINTECH CONFIDENTIAL, a digital pop-up of the 6th annual 2020 Fintech & Financing Conference and Expo (FFCON20) held virtually across themed 8 weeks from July 9 to August 27 and co-hosted by NCFA and Toronto Finance International.

The main theme of FFCON20 was “RISE”, reflecting the joint efforts of the two associations, NCFA and TFI, to build and increase the success and sustainability of Canada’s fintech and financial sector. There were many moving parts this year and a brand-new digital format with the event bringing together 100+ thought leaders, 50+ partners, and more than 500 attendees, 2 challenges and the inaugural Fintech Draft pitching and demo competitions. Congratulations to the winners: SolidBlock and MazumaGo (formerly DivDot)! Thanks to all the partners, speakers, attendees, volunteers and the entire organizing team for making FFCON20 an impactful and amazing online experience for Canada’s fintech and funding community.

We hope you enjoy this issue of Fintech Confidential magazine – it certainly makes for great holiday reading! While everyone relentlessly strives to achieve success in 2021, we encourage you to bring in the new year with good health and to be mindful that we are all in this together, and to help others in your community more than ever before. Peace, happiness, and best wishes for an incredible year and journey ahead.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TRENDING<br />

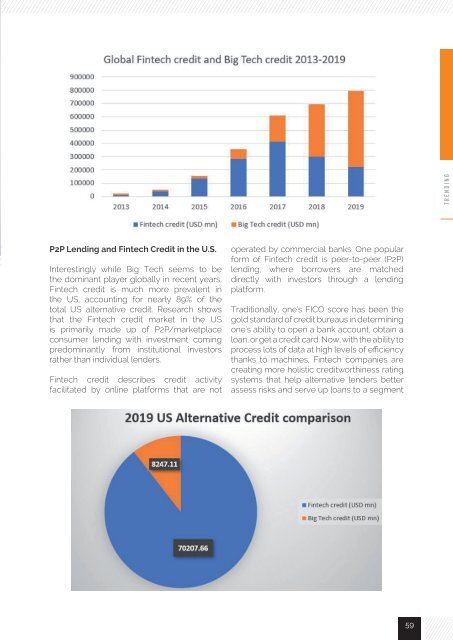

P2P Lending and <strong>Fintech</strong> Credit in the U.S.<br />

Interestingly while Big Tech seems to be<br />

the dominant player globally in recent years,<br />

<strong>Fintech</strong> credit is much more prevalent in<br />

the US, accounting for nearly 89% of the<br />

total US alternative credit. Research shows<br />

that the <strong>Fintech</strong> credit market in the US<br />

is primarily made up of P2P/marketplace<br />

consumer lending with investment coming<br />

predominantly from institutional investors<br />

rather than individual lenders.<br />

<strong>Fintech</strong> credit describes credit activity<br />

facilitated by online platforms that are not<br />

operated by commercial banks. One popular<br />

form of <strong>Fintech</strong> credit is peer-to-peer (P2P)<br />

lending, where borrowers are matched<br />

directly with investors through a lending<br />

platform.<br />

Traditionally, one’s FICO score has been the<br />

gold standard of credit bureaus in determining<br />

one’s ability to open a bank account, obtain a<br />

loan, or get a credit card. Now, with the ability to<br />

process lots of data at high levels of efficiency<br />

thanks to machines, <strong>Fintech</strong> companies are<br />

creating more holistic creditworthiness rating<br />

systems that help alternative lenders better<br />

assess risks and serve up loans to a segment<br />

59