NCFA Fintech Confidential December 2020 (Issue 3)

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited to present Vol. 1 Issue 3, FINTECH CONFIDENTIAL, a digital pop-up of the 6th annual 2020 Fintech & Financing Conference and Expo (FFCON20) held virtually across themed 8 weeks from July 9 to August 27 and co-hosted by NCFA and Toronto Finance International. The main theme of FFCON20 was “RISE”, reflecting the joint efforts of the two associations, NCFA and TFI, to build and increase the success and sustainability of Canada’s fintech and financial sector. There were many moving parts this year and a brand-new digital format with the event bringing together 100+ thought leaders, 50+ partners, and more than 500 attendees, 2 challenges and the inaugural Fintech Draft pitching and demo competitions. Congratulations to the winners: SolidBlock and MazumaGo (formerly DivDot)! Thanks to all the partners, speakers, attendees, volunteers and the entire organizing team for making FFCON20 an impactful and amazing online experience for Canada’s fintech and funding community. We hope you enjoy this issue of Fintech Confidential magazine – it certainly makes for great holiday reading! While everyone relentlessly strives to achieve success in 2021, we encourage you to bring in the new year with good health and to be mindful that we are all in this together, and to help others in your community more than ever before. Peace, happiness, and best wishes for an incredible year and journey ahead.

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited

to present Vol. 1 Issue 3, FINTECH CONFIDENTIAL, a digital pop-up of the 6th annual 2020 Fintech & Financing Conference and Expo (FFCON20) held virtually across themed 8 weeks from July 9 to August 27 and co-hosted by NCFA and Toronto Finance International.

The main theme of FFCON20 was “RISE”, reflecting the joint efforts of the two associations, NCFA and TFI, to build and increase the success and sustainability of Canada’s fintech and financial sector. There were many moving parts this year and a brand-new digital format with the event bringing together 100+ thought leaders, 50+ partners, and more than 500 attendees, 2 challenges and the inaugural Fintech Draft pitching and demo competitions. Congratulations to the winners: SolidBlock and MazumaGo (formerly DivDot)! Thanks to all the partners, speakers, attendees, volunteers and the entire organizing team for making FFCON20 an impactful and amazing online experience for Canada’s fintech and funding community.

We hope you enjoy this issue of Fintech Confidential magazine – it certainly makes for great holiday reading! While everyone relentlessly strives to achieve success in 2021, we encourage you to bring in the new year with good health and to be mindful that we are all in this together, and to help others in your community more than ever before. Peace, happiness, and best wishes for an incredible year and journey ahead.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

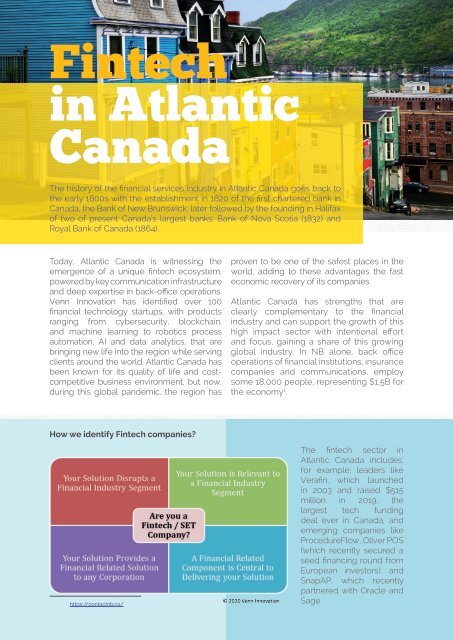

<strong>Fintech</strong><br />

in Atlantic<br />

Canada<br />

The history of the financial services industry in Atlantic Canada goes back to<br />

the early 1800s with the establishment in 1820 of the first chartered bank in<br />

Canada, the Bank of New Brunswick, later followed by the founding in Halifax<br />

of two of present Canada’s largest banks: Bank of Nova Scotia (1832) and<br />

Royal Bank of Canada (1864).<br />

Today, Atlantic Canada is witnessing the<br />

emergence of a unique fintech ecosystem,<br />

powered by key communication infrastructure<br />

and deep expertise in back-office operations.<br />

Venn Innovation has identified over 100<br />

financial technology startups, with products<br />

ranging from cybersecurity, blockchain,<br />

and machine learning to robotics process<br />

automation, AI and data analytics, that are<br />

bringing new life into the region while serving<br />

clients around the world. Atlantic Canada has<br />

been known for its quality of life and costcompetitive<br />

business environment, but now,<br />

during this global pandemic, the region has<br />

proven to be one of the safest places in the<br />

world, adding to these advantages the fast<br />

economic recovery of its companies.<br />

Atlantic Canada has strengths that are<br />

clearly complementary to the financial<br />

industry and can support the growth of this<br />

high impact sector with intentional effort<br />

and focus, gaining a share of this growing<br />

global industry. In NB alone, back office<br />

operations of financial institutions, insurance<br />

companies and communications, employ<br />

some 18,000 people, representing $1.5B for<br />

the economy 1 .<br />

How we identify <strong>Fintech</strong> companies?<br />

1<br />

https://contactnb.ca/<br />

The fintech sector in<br />

Atlantic Canada includes,<br />

for example, leaders like<br />

Verafin, which launched<br />

in 2003 and raised $515<br />

million in 2019, the<br />

largest tech funding<br />

deal ever in Canada, and<br />

emerging companies like<br />

ProcedureFlow, Oliver POS<br />

(which recently secured a<br />

seed financing round from<br />

European investors), and<br />

SnapAP, which recently<br />

partnered with Oracle and<br />

Sage.<br />

56