NCFA Fintech Confidential December 2020 (Issue 3)

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited to present Vol. 1 Issue 3, FINTECH CONFIDENTIAL, a digital pop-up of the 6th annual 2020 Fintech & Financing Conference and Expo (FFCON20) held virtually across themed 8 weeks from July 9 to August 27 and co-hosted by NCFA and Toronto Finance International. The main theme of FFCON20 was “RISE”, reflecting the joint efforts of the two associations, NCFA and TFI, to build and increase the success and sustainability of Canada’s fintech and financial sector. There were many moving parts this year and a brand-new digital format with the event bringing together 100+ thought leaders, 50+ partners, and more than 500 attendees, 2 challenges and the inaugural Fintech Draft pitching and demo competitions. Congratulations to the winners: SolidBlock and MazumaGo (formerly DivDot)! Thanks to all the partners, speakers, attendees, volunteers and the entire organizing team for making FFCON20 an impactful and amazing online experience for Canada’s fintech and funding community. We hope you enjoy this issue of Fintech Confidential magazine – it certainly makes for great holiday reading! While everyone relentlessly strives to achieve success in 2021, we encourage you to bring in the new year with good health and to be mindful that we are all in this together, and to help others in your community more than ever before. Peace, happiness, and best wishes for an incredible year and journey ahead.

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited

to present Vol. 1 Issue 3, FINTECH CONFIDENTIAL, a digital pop-up of the 6th annual 2020 Fintech & Financing Conference and Expo (FFCON20) held virtually across themed 8 weeks from July 9 to August 27 and co-hosted by NCFA and Toronto Finance International.

The main theme of FFCON20 was “RISE”, reflecting the joint efforts of the two associations, NCFA and TFI, to build and increase the success and sustainability of Canada’s fintech and financial sector. There were many moving parts this year and a brand-new digital format with the event bringing together 100+ thought leaders, 50+ partners, and more than 500 attendees, 2 challenges and the inaugural Fintech Draft pitching and demo competitions. Congratulations to the winners: SolidBlock and MazumaGo (formerly DivDot)! Thanks to all the partners, speakers, attendees, volunteers and the entire organizing team for making FFCON20 an impactful and amazing online experience for Canada’s fintech and funding community.

We hope you enjoy this issue of Fintech Confidential magazine – it certainly makes for great holiday reading! While everyone relentlessly strives to achieve success in 2021, we encourage you to bring in the new year with good health and to be mindful that we are all in this together, and to help others in your community more than ever before. Peace, happiness, and best wishes for an incredible year and journey ahead.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

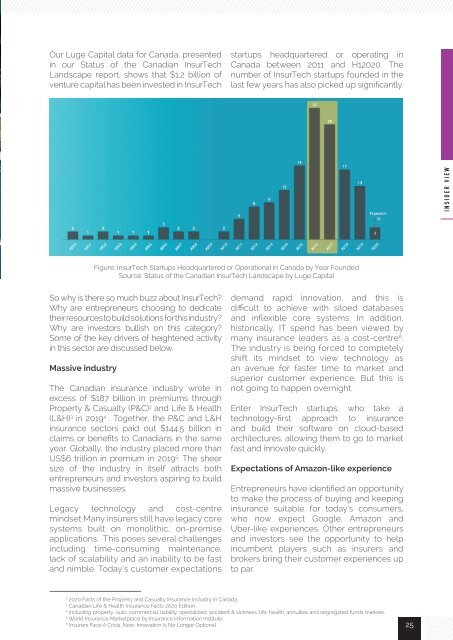

Our Luge Capital data for Canada, presented<br />

in our Status of the Canadian InsurTech<br />

Landscape report, shows that $1.2 billion of<br />

venture capital has been invested in InsurTech<br />

startups headquartered or operating in<br />

Canada between 2011 and H1<strong>2020</strong>. The<br />

number of InsurTech startups founded in the<br />

last few years has also picked up significantly.<br />

INSIDER VIEW<br />

Figure: InsurTech Startups Headquartered or Operational in Canada by Year Founded<br />

Source: Status of the Canadian InsurTech Landscape by Luge Capital<br />

So why is there so much buzz about InsurTech?<br />

Why are entrepreneurs choosing to dedicate<br />

their resources to build solutions for this industry?<br />

Why are investors bullish on this category?<br />

Some of the key drivers of heightened activity<br />

in this sector are discussed below.<br />

Massive industry<br />

The Canadian insurance industry wrote in<br />

excess of $187 billion in premiums through<br />

Property & Casualty (P&C) 2 and Life & Health<br />

(L&H) 3 in 2019 4 . Together, the P&C and L&H<br />

insurance sectors paid out $144.5 billion in<br />

claims or benefits to Canadians in the same<br />

year. Globally, the industry placed more than<br />

US$6 trillion in premium in 2019 5 . The sheer<br />

size of the industry in itself attracts both<br />

entrepreneurs and investors aspiring to build<br />

massive businesses.<br />

Legacy technology and cost-centre<br />

mindset Many insurers still have legacy core<br />

systems built on monolithic, on-premise<br />

applications. This poses several challenges<br />

including time-consuming maintenance,<br />

lack of scalability and an inability to be fast<br />

and nimble. Today’s customer expectations<br />

demand rapid innovation, and this is<br />

difficult to achieve with siloed databases<br />

and inflexible core systems. In addition,<br />

historically, IT spend has been viewed by<br />

many insurance leaders as a cost-centre 6 .<br />

The industry is being forced to completely<br />

shift its mindset to view technology as<br />

an avenue for faster time to market and<br />

superior customer experience. But this is<br />

not going to happen overnight.<br />

Enter InsurTech startups, who take a<br />

technology-first approach to insurance<br />

and build their software on cloud-based<br />

architectures, allowing them to go to market<br />

fast and innovate quickly.<br />

Expectations of Amazon-like experience<br />

Entrepreneurs have identified an opportunity<br />

to make the process of buying and keeping<br />

insurance suitable for today’s consumers,<br />

who now expect Google, Amazon and<br />

Uber-like experiences. Other entrepreneurs<br />

and investors see the opportunity to help<br />

incumbent players such as insurers and<br />

brokers bring their customer experiences up<br />

to par.<br />

2<br />

<strong>2020</strong> Facts of the Property and Casualty Insurance Industry in Canada .<br />

3<br />

Canadian Life & Health Insurance Facts <strong>2020</strong> Edition .<br />

4<br />

Including property, auto, commercial, liability, specialized, accident & sickness, life, health, annuities and segregated funds markets.<br />

5<br />

World Insurance Marketplace by Insurance Information Institute.<br />

6<br />

Insurers Face A Crisis. Now, Innovation Is No Longer Optional.<br />

25