NCFA Fintech Confidential December 2020 (Issue 3)

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited to present Vol. 1 Issue 3, FINTECH CONFIDENTIAL, a digital pop-up of the 6th annual 2020 Fintech & Financing Conference and Expo (FFCON20) held virtually across themed 8 weeks from July 9 to August 27 and co-hosted by NCFA and Toronto Finance International. The main theme of FFCON20 was “RISE”, reflecting the joint efforts of the two associations, NCFA and TFI, to build and increase the success and sustainability of Canada’s fintech and financial sector. There were many moving parts this year and a brand-new digital format with the event bringing together 100+ thought leaders, 50+ partners, and more than 500 attendees, 2 challenges and the inaugural Fintech Draft pitching and demo competitions. Congratulations to the winners: SolidBlock and MazumaGo (formerly DivDot)! Thanks to all the partners, speakers, attendees, volunteers and the entire organizing team for making FFCON20 an impactful and amazing online experience for Canada’s fintech and funding community. We hope you enjoy this issue of Fintech Confidential magazine – it certainly makes for great holiday reading! While everyone relentlessly strives to achieve success in 2021, we encourage you to bring in the new year with good health and to be mindful that we are all in this together, and to help others in your community more than ever before. Peace, happiness, and best wishes for an incredible year and journey ahead.

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited

to present Vol. 1 Issue 3, FINTECH CONFIDENTIAL, a digital pop-up of the 6th annual 2020 Fintech & Financing Conference and Expo (FFCON20) held virtually across themed 8 weeks from July 9 to August 27 and co-hosted by NCFA and Toronto Finance International.

The main theme of FFCON20 was “RISE”, reflecting the joint efforts of the two associations, NCFA and TFI, to build and increase the success and sustainability of Canada’s fintech and financial sector. There were many moving parts this year and a brand-new digital format with the event bringing together 100+ thought leaders, 50+ partners, and more than 500 attendees, 2 challenges and the inaugural Fintech Draft pitching and demo competitions. Congratulations to the winners: SolidBlock and MazumaGo (formerly DivDot)! Thanks to all the partners, speakers, attendees, volunteers and the entire organizing team for making FFCON20 an impactful and amazing online experience for Canada’s fintech and funding community.

We hope you enjoy this issue of Fintech Confidential magazine – it certainly makes for great holiday reading! While everyone relentlessly strives to achieve success in 2021, we encourage you to bring in the new year with good health and to be mindful that we are all in this together, and to help others in your community more than ever before. Peace, happiness, and best wishes for an incredible year and journey ahead.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

of the population that traditionally has been<br />

shut out of markets.<br />

Prediction for Future<br />

Given Big Tech and <strong>Fintech</strong>’s competitive<br />

advantages with machine learning and AI, I<br />

believe that they will play an inevitable role<br />

in the future of financial services. This type of<br />

competitive edge that Big Tech companies<br />

have make them ideally positioned to serve<br />

the role of a Techfin, a term coined by Jack<br />

Ma describing tech companies that provide<br />

financial services with a more customer &<br />

technology centric approach.<br />

The COVID-19 pandemic has only exacerbated<br />

the paradigm shift in the financial technology<br />

space. Growing numbers of people consider<br />

the adoption of contactless payment as a<br />

basic need to prevent the spread of the virus,<br />

and I predict the rise of many forms of <strong>Fintech</strong><br />

innovations like mobile wallets replacing<br />

physical wallets.<br />

Given the size, resources and efficiencies of Big<br />

Tech and the increasing potential of <strong>Fintech</strong>,<br />

incumbent institutions are likely feeling the<br />

heat to re-align their products and services<br />

to benefit tech-savvy consumers across<br />

the board, not just us Gen Zs. Incumbents<br />

like Chase have already taken steps in this<br />

direction by investing heavily in their digital<br />

space to offer a more unified experience for<br />

the customer. As a passionate technology<br />

user, I am eager to see what the future has<br />

in store.<br />

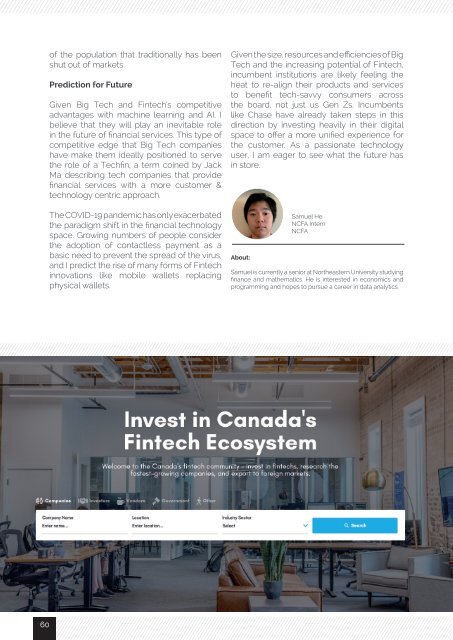

About:<br />

Samuel He<br />

<strong>NCFA</strong> Intern<br />

<strong>NCFA</strong><br />

Samuel is currently a senior at Northeastern University studying<br />

finance and mathematics. He is interested in economics and<br />

programming and hopes to pursue a career in data analytics.<br />

60