Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Country <strong>Debt</strong> <strong>Guide</strong><br />

36<br />

Egypt<br />

Chinese <strong>Debt</strong> Exposure<br />

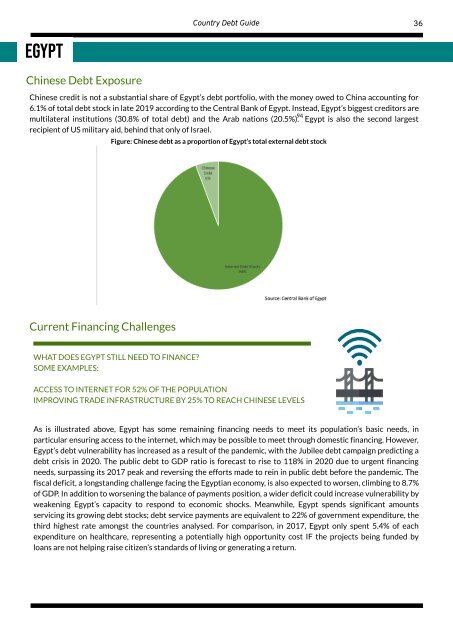

Chinese credit is not a substantial share of Egypt’s debt portfolio, with the money owed to China accounting for<br />

6.1% of total debt stock in late 2019 according to the Central Bank of Egypt. Instead, Egypt’s biggest creditors are<br />

94<br />

multilateral institutions (30.8% of total debt) and the Arab nations (20.5%). Egypt is also the second largest<br />

recipient of US military aid, behind that only of Israel.<br />

Figure: Chinese debt as a proportion of Egypt’s total external debt stock<br />

Current Financing Challenges<br />

WHAT DOES EGYPT STILL NEED TO FINANCE?<br />

SOME EXAMPLES:<br />

ACCESS TO INTERNET FOR 52% OF THE POPULATION<br />

IMPROVING TRADE INFRASTRUCTURE BY 25% TO REACH CHINESE LEVELS<br />

As is illustrated above, Egypt has some remaining financing needs to meet its population’s basic needs, in<br />

particular ensuring access to the internet, which may be possible to meet through domestic financing. However,<br />

Egypt’s debt vulnerability has increased as a result of the pandemic, with the Jubilee debt campaign predicting a<br />

debt crisis in 2020. The public debt to GDP ratio is forecast to rise to 118% in 2020 due to urgent financing<br />

needs, surpassing its 2017 peak and reversing the efforts made to rein in public debt before the pandemic. The<br />

fiscal deficit, a longstanding challenge facing the Egyptian economy, is also expected to worsen, climbing to 8.7%<br />

of GDP. In addition to worsening the balance of payments position, a wider deficit could increase vulnerability by<br />

weakening Egypt’s capacity to respond to economic shocks. Meanwhile, Egypt spends significant amounts<br />

servicing its growing debt stocks; debt service payments are equivalent to 22% of government expenditure, the<br />

third highest rate amongst the countries analysed. For comparison, in 2017, Egypt only spent 5.4% of each<br />

expenditure on healthcare, representing a potentially high opportunity cost IF the projects being funded by<br />

loans are not helping raise citizen’s standards of living or generating a return.