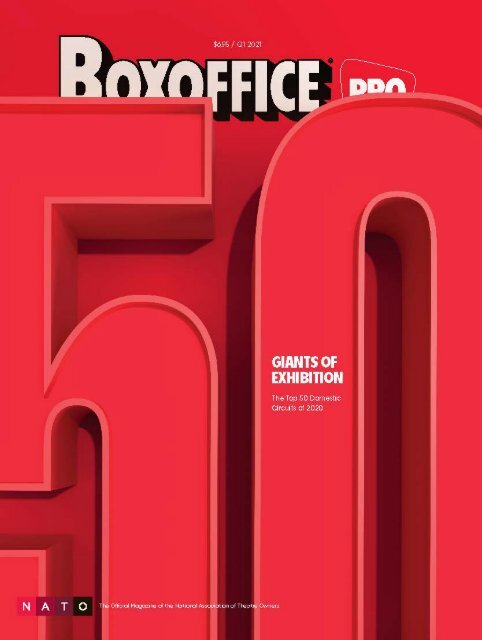

Boxoffice Pro Q1 2021

Boxoffice Pro is the official publication of the National Association of Theatre Owners.

Boxoffice Pro is the official publication of the National Association of Theatre Owners.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

We are the experts in developing and manufacturing<br />

compliant life safety venue luminaries for over 50 years.<br />

BOFO CINEMA THE LOT<br />

Fashion Island Newport Beach, CA<br />

<strong>Pro</strong>duct used: Fiberstep Titanium<br />

Tivoli has engineered life safety illuminaon soluons for<br />

theater and auditorium venues for over five decades. All<br />

while maintaining a customer-first approach, with quality<br />

products and uncompromising service delivered by our<br />

team, year aer year.<br />

View More: Step & Guide<br />

<strong>Q1</strong> <strong>2021</strong><br />

01<br />

www.tivolilighting.com • sales@tivoliusa.com<br />

01_AD-Tivoli.indd 1 12/02/<strong>2021</strong> 12:21

CHARITY SPOTLIGHT<br />

This year's Giants<br />

of Exhibition list is<br />

a reflection of the<br />

resilience and<br />

commitment to<br />

innovation of our<br />

entire industry.<br />

THE<br />

COMPANY<br />

WEBEDIA GROUP<br />

02 <strong>Q1</strong> <strong>2021</strong><br />

02-03_AD-<strong>Boxoffice</strong>.indd 2 12/02/<strong>2021</strong> 12:22

A difficult year for our entire industry was also one of<br />

unprecedented innovation and creativity as movie theaters found<br />

new ways to engage with their audiences. From mobile ordering,<br />

to take out concessions, and even at-home viewing experiences<br />

like private watch parties--exhibitors have been at the heart of<br />

defining new ways to redefine the moviegoing experience. This<br />

year's Giants of Exhibition list is a reflection of the resilience and<br />

commitment to innovation of our entire industry. We are honored<br />

to count many of these circuits as partners and clients of The<br />

<strong>Boxoffice</strong> Company.<br />

We thank you for your trust and leadership during this difficult<br />

time. Your insights and collaborations have helped us reinvent our<br />

focus to solutions that can help exhibitors get through the<br />

pandemic and bounce back faster once their cinemas reopen. Our<br />

latest projects include contactless digital ticketing and concessions;<br />

customer awareness through SEO, emailing, and social media; and<br />

co-watching streaming services.<br />

We look forward to getting out of this crisis together stronger,<br />

offering a better customer experience than ever before.<br />

Stan Ruszkowski<br />

President, The <strong>Boxoffice</strong> Company<br />

<strong>Q1</strong> <strong>2021</strong><br />

03<br />

02-03_AD-<strong>Boxoffice</strong>.indd 3 12/02/<strong>2021</strong> 12:22

CHARITY SPOTLIGHT<br />

04 <strong>Q1</strong> <strong>2021</strong><br />

04_AD-TSS.indd 4 12/02/<strong>2021</strong> 12:22

<strong>Q1</strong> <strong>2021</strong><br />

CONTENTS<br />

48<br />

The 10 Most Important<br />

Moments of 2020<br />

Our Look Back at the Top 10 Pivotal<br />

Moments of a Historic Year<br />

18<br />

Giants of Exhibition<br />

This Year's Giants of Exhibition<br />

Ranking Stands as a Testament<br />

to the Industry's Flexibility and<br />

Resolve<br />

34<br />

New Beginnings<br />

As Theatrical Exclusivity<br />

Windows Shrink, Cinema<br />

Owners Look at the Potential<br />

Impact of Streaming on Their<br />

Bottom Line<br />

64<br />

Going Big<br />

What Role Will Premium Large<br />

Format Play in Cinema’s Global<br />

Recovery?<br />

76<br />

Experience over Everything<br />

For U.K.’s We Are Parable,<br />

Screenings Are More Than<br />

Just Movies<br />

<strong>Q1</strong> <strong>2021</strong><br />

05<br />

05-06_Contents.indd 5 15/02/<strong>2021</strong> 15:08

CONTENTS<br />

INDUSTRY<br />

THEATER<br />

12<br />

16<br />

18<br />

34<br />

40<br />

48<br />

NATO<br />

Farewell to 2020: A Year of Pandemic,<br />

Pain, Patience, and Perseverance<br />

Charity Spotlight<br />

A Recap of Industry-Wide Charity<br />

Initiatives<br />

Giants of Exhibition<br />

This Year's Giants of Exhibition<br />

Ranking Stands as a Testament to the<br />

Industry's Flexibility and Resolve<br />

New Beginnings<br />

As Theatrical Exclusivity Windows<br />

Shrink, Cinema Owners Look at the<br />

Potential Impact of Streaming on<br />

Their Bottom Line<br />

A Century in Exhibition<br />

The 1990s: Globalization and<br />

Cyberspace<br />

The 10 Most Important Moments<br />

for Domestic Exhibition of 2020<br />

Our Look Back at the Top 10 Pivotal<br />

Moments of a Historic Year<br />

64<br />

70<br />

ON SCREEN<br />

76<br />

81<br />

Going Big<br />

What Role Will Premium Large<br />

Format Play in Cinema’s Global<br />

Recovery?<br />

Premium Seating <strong>Pro</strong>s<br />

Fred and Denise Jacobs Keep It All<br />

in the Family at Telescopic Seating<br />

Systems<br />

Experience Over Everything<br />

For U.K.’s We Are Parable, Screenings<br />

Are More Than Just Movies<br />

Booking Guide<br />

“With the odds stacked<br />

against them, exhibitors<br />

have been strikingly resilient,<br />

despite the mounting woes<br />

of 2020.” p. 18<br />

06 <strong>Q1</strong> <strong>2021</strong><br />

05-06_Contents.indd 6 15/02/<strong>2021</strong> 15:08

NC1201L1-A Special Pricing <strong>Pro</strong>motion!<br />

Exhibitor Price of $21,500 including a<br />

standard lens and extended warranty<br />

A bundle price of more than 50% OFF MSRP!<br />

Each bundle includes, ONE NC1201L-A,<br />

Plus, your choice of one of the following lenses:<br />

• NP-9LS12ZM1 • NP-9LS13ZM1 • NP-9LS16ZM1 • NP-9LS20ZM1<br />

Plus, a 3rd year added to the standard 2-year warranty<br />

3rd Party Financing Available through TCF Capital Funding<br />

*NC-1201L1-A bundle special is available until inventory is sold out<br />

<strong>Q1</strong> <strong>2021</strong><br />

07<br />

07_AD-Enpar.indd 7 12/02/<strong>2021</strong> 12:23

BOXOFFICE MEDIA<br />

CEO<br />

Julien Marcel<br />

SVP Content Strategy<br />

Daniel Loría<br />

Creative Direction<br />

Chris Vickers & Craig Scott<br />

at She Was Only<br />

EVP Chief Administrative Officer<br />

Susan Rich<br />

VP Advertising<br />

Susan Uhrlass<br />

BOXOFFICE PRO<br />

EDITORIAL DIRECTOR<br />

Daniel Loría<br />

DEPUTY EDITOR<br />

Rebecca Pahle<br />

EXECUTIVE EDITOR<br />

Kevin Lally<br />

MANAGING EDITOR<br />

Laura Silver<br />

CHIEF ANALYST<br />

Shawn Robbins<br />

ANALYSTS<br />

Chris Eggertsen<br />

Jesse Rifkin<br />

DATABASE<br />

Diogo Hausen<br />

CONTRIBUTORS<br />

Patrick Corcoran<br />

Larry Etter<br />

Vassiliki Malouchou<br />

Radesh Palakurthi, PhD, MBA<br />

ADVERTISING<br />

Susan Uhrlass<br />

63 Copps Hill Road<br />

Ridgefield, CT USA 06877<br />

susan@boxoffice.com<br />

SUBSCRIPTIONS<br />

<strong>Boxoffice</strong> <strong>Pro</strong><br />

P.O. Box 215<br />

Congers, NY 10920<br />

833-435-8093 (Toll-Free)<br />

845-450-5212 (Local)<br />

boxoffice@cambeywest.com<br />

CORPORATE<br />

Box Office Media LLC<br />

63 Copps Hill Road<br />

Ridgefield, CT USA 06877<br />

corporate@boxoffice.com<br />

<strong>Boxoffice</strong> <strong>Pro</strong> has served as the<br />

official publication of the National<br />

Association of Theatre Owners<br />

(NATO) since 2007. As part of this<br />

partnership, <strong>Boxoffice</strong> <strong>Pro</strong> is proud to<br />

feature exclusive columns from NATO<br />

while retaining full editorial freedom<br />

throughout its pages. As such, the<br />

views expressed in <strong>Boxoffice</strong> <strong>Pro</strong><br />

reflect neither a stance nor an<br />

endorsement from the National<br />

Association of Theatre Owners.<br />

Due to Covid-19, <strong>Boxoffice</strong> <strong>Pro</strong><br />

will be adjusting its publishing<br />

schedule. For any further<br />

questions or updates regarding<br />

your subscription, please do not<br />

hesitate to contact our customer<br />

service department at boxoffice@<br />

cambeywest.com.<br />

<strong>Boxoffice</strong> <strong>Pro</strong> (ISSN 0006-8527), Volume 157, Number 1, First Quarter <strong>2021</strong>. <strong>Boxoffice</strong> <strong>Pro</strong> is published<br />

by Box Office Media LLC, 63 Copps Hill Road, Ridgefield, CT USA 06877. corporate@boxoffice.com.<br />

www.boxoffice.com. Basic annual subscription rate is $75.00. Periodicals postage paid at Beverly<br />

Hills, CA, and at additional mailing offices. POSTMASTER: Send all UAA to CFS. NON-POSTAL<br />

AND MILITARY FACILITIES: send address corrections to <strong>Boxoffice</strong> <strong>Pro</strong>, P.O. Box 215, Congers, NY<br />

10920. © Copyright 2020. Box Office Media LLC. All rights reserved. SUBSCRIPTIONS: <strong>Boxoffice</strong> <strong>Pro</strong>,<br />

P.O. Box 215, Congers, NY 10920 / boxoffice@cambeywest.com. 833-435-8093 (Toll-Free),<br />

845-450-5212 (Local).<br />

Box Office <strong>Pro</strong> is a registered trademark of Box Office Media LLC.<br />

08 <strong>Q1</strong> <strong>2021</strong><br />

08-09_Executive-Letter.indd 8 12/02/<strong>2021</strong> 12:23

Executive Letter<br />

LIGHT AT THE<br />

END OF THE<br />

TUNNEL<br />

Like the most terrifying of horror<br />

sequels, the beginning of <strong>2021</strong> has<br />

already delivered enough jump scares and<br />

plot twists to keep us on our toes after a<br />

harrowing 2020. A slow and disorganized<br />

vaccine rollout has pushed the majority<br />

of <strong>2021</strong>’s studio slate to the second half<br />

of the year. Even positive headlines, like<br />

those announcing the introduction of<br />

new vaccines, are tempered by news of<br />

emerging Covid-19 variants that could<br />

further prolong the global health crisis.<br />

There is no denying that the industry<br />

still has a grim number of months ahead<br />

before the recovery can begin in earnest.<br />

But we can already see the light at the end<br />

of the tunnel. Despite a handful of notable<br />

exceptions, the vast majority of major<br />

studio titles have been rescheduled for the<br />

second half of the year instead of skipping<br />

theaters altogether for a streaming debut.<br />

Even the most controversial actions<br />

from distribution, Universal’s shortened<br />

window and Warner Bros.’ day-and-date<br />

release plans, the former a structural<br />

change and the latter (according to the<br />

studio) a temporary measure, have helped<br />

bring new titles to cinemas during the<br />

toughest months since reopening. The<br />

vaccination drive might be progressing<br />

slowly, but it’s moving forward—every day<br />

there are millions more around the world<br />

regaining the confidence to leave their<br />

homes after an extended lockdown. In the<br />

Asia Pacific market, where virus rates have<br />

been significantly better controlled than<br />

in the West, cinemas have already shown<br />

signs of the long-awaited recovery.<br />

The unexpected length of the<br />

pandemic has also forced modifications<br />

to our own publishing schedule at<br />

<strong>Boxoffice</strong> <strong>Pro</strong>. Our print edition was<br />

on hiatus from May through July of<br />

last year, coinciding with nationwide<br />

cinema closures. We returned in August<br />

and finished 2020 with two additional<br />

issues, in October and December, closing<br />

the year with a total of seven issues. In<br />

<strong>2021</strong>, our schedule will be modified with<br />

the printing of four quarterly issues and<br />

an additional commemorative issue in<br />

December celebrating our centennial.<br />

For all subscribers affected by these<br />

changes, we will automatically extend<br />

your subscription for the number of issues<br />

missed. If you have specific questions<br />

regarding how these changes in our<br />

schedule affect your subscription, please<br />

reach out to our circulation department at<br />

circulation@boxoffice.com.<br />

In the meantime, please enjoy this first<br />

issue of the year—and be sure to check our<br />

daily updates at <strong>Boxoffice</strong><strong>Pro</strong>.com, as well<br />

as digital initiatives like our weekly show,<br />

the <strong>Boxoffice</strong> Podcast, and our monthly<br />

<strong>Boxoffice</strong> LIVE Sessions webinar series.<br />

Daniel Loria<br />

SVP Content Strategy & Editorial Director<br />

<strong>Boxoffice</strong> <strong>Pro</strong><br />

There is no denying that<br />

the industry still has a grim<br />

number of months ahead<br />

before the recovery can<br />

begin in earnest.<br />

BOXOFFICE<br />

PRO <strong>2021</strong><br />

PUBLICATION<br />

SCHEDULE<br />

First Quarter: Giants of<br />

Exhibition<br />

February <strong>2021</strong><br />

Second Quarter: CineEurope<br />

June <strong>2021</strong><br />

Third Quarter: CinemaCon<br />

August <strong>2021</strong><br />

Fourth Quarter: ShowEast<br />

October <strong>2021</strong><br />

Commemorative Centennial<br />

Edition:<br />

December <strong>2021</strong><br />

For questions regarding your<br />

subscription, please contact<br />

circulation@boxoffice.com.<br />

<strong>Q1</strong> <strong>2021</strong><br />

09<br />

08-09_Executive-Letter.indd 9 15/02/<strong>2021</strong> 15:43

CHARITY SPOTLIGHT<br />

THE FEATURES YOU NEED.<br />

THE OPTIONS YOU WANT.<br />

THE COMPANY YOU TRUST.<br />

When it comes to concessions,<br />

it comes from Cretors.<br />

Only Cretors combines five generations of industry leadership with more than<br />

130 years of forward-thinking innovations. Backed by our industrial manufacturing<br />

R&D for global snack food giants, we bring revolutionary products to the<br />

concessions marketplace, time and again. Whether it’s an industry-changing<br />

safety feature, a long-sought-after option or a customizable machine made<br />

for the way you sell anywhere in the world, there’s no limit to our ingenuity.<br />

Made in America, loved world-round!<br />

10 <strong>Q1</strong> <strong>2021</strong><br />

Contact Shelly Olesen at 847.616.6901 or visit www.cretors.com<br />

10_AD-Cretors.indd 10 12/02/<strong>2021</strong> 12:24

NATO 12 | Charity Spotlight 16 | Giants of Exhibition 18 | A Century in Exhibition 40<br />

INDUSTRY<br />

“With the odds stacked against them, exhibitors have been<br />

strikingly resilient, despite the mounting woes of 2020.”<br />

Giants of Exhibition, p. 18<br />

<strong>Q1</strong> <strong>2021</strong><br />

11<br />

11_INDUSTRY-Opener.indd 11 12/02/<strong>2021</strong> 12:24

Industry NATO<br />

FAREWELL<br />

TO 2020<br />

A Year of Pandemic, Pain,<br />

Patience, and Perseverance<br />

BY PATRICK CORCORAN<br />

The pandemic has meant<br />

an ever-changing mixture<br />

of crisis response, managing<br />

expectations, and drawing<br />

on deep wells of experience<br />

and relationships developed<br />

over years.<br />

Bits of news had been trickling out<br />

of China about a new and contagious<br />

respiratory virus at the very end of 2019.<br />

On January 23, 2020, China announced<br />

it was closing all 70,000 cinema screens<br />

as part of its efforts to control the virus.<br />

On January 31, NATO distributed an<br />

updated and revised “Preparing for a Flu<br />

Pandemic,” originally prepared in 2009, as<br />

well as its “Crisis Management Handbook.”<br />

That same day, travel restrictions for non-<br />

U.S. citizens from China went into effect.<br />

Preparations for the 10th-annual<br />

edition of CinemaCon, scheduled for<br />

March 30–April 2, continued, with a<br />

wary eye on worsening case numbers<br />

of the novel coronavirus, now known<br />

as Covid-19. On March 11, the World<br />

Health Organization (WHO) declared the<br />

outbreak a pandemic, and NATO canceled<br />

CinemaCon that same day. NATO, unlike<br />

many organizations and event planners,<br />

had pandemic insurance, meaning that<br />

the organization would incur no losses as<br />

a result of canceling the show.<br />

Within a week, movie theaters across<br />

the country began to close, as audiences<br />

began staying away from public places<br />

and the industry anticipated statemandated<br />

closures. Most observers at the<br />

time anticipated no longer than a six-weekto<br />

three-month-long period of closures. As<br />

we all know now, they were wrong.<br />

For NATO and its members, the<br />

pandemic has meant an ever-changing<br />

mixture of crisis response, managing<br />

expectations, and drawing on deep wells<br />

of experience and relationships developed<br />

over years.<br />

NATO’s Executive Board began<br />

meeting weekly two days after the WHO’s<br />

declaration and before U.S. movie theaters<br />

began to shut down. First priorities were<br />

to understand the extent of the crisis,<br />

state and local mandates, and how to plan<br />

as an industry for what was expected to<br />

be a not-far-off reopening. The theater<br />

industry would make it known that we<br />

would behave as responsible citizens, that<br />

the health and safety of our patrons and<br />

employees were our highest concerns, and<br />

that we would be back.<br />

We called upon industry allies, and<br />

they called on us. Christopher Nolan<br />

asked what he could do. Within three days<br />

of U.S. theaters’ closing, we helped him<br />

place his piece, “Movie theaters are a vital<br />

part of American social life. They will<br />

need our help.” in The Washington Post.<br />

NATO contributed $1 million to a seed<br />

fund for the Will Rogers Motion Picture<br />

Pioneers to provide assistance for movie<br />

theater employees affected by the closure<br />

of movie theaters due to the pandemic.<br />

NATO lobbying was in full swing as<br />

discussions began in Washington over a<br />

potential aid package for businesses and<br />

individuals affected by the pandemic. NATO<br />

coordinated with its regional affiliates on<br />

outreach to local health officials on how to<br />

sensibly and safely reopen.<br />

We began weekly State of the Industry<br />

webinars on April 23 to keep members<br />

informed and to learn their concerns. We<br />

are preparing for our 35th such webinar<br />

as this article is written. There have also<br />

been stand-alone webinars on various<br />

provisions of federal aid packages, as well<br />

as operational, marketing, and other issues.<br />

There has been constant<br />

communication with the studios, large<br />

and small, on the complexities and<br />

challenges of the pandemic release<br />

calendar. While there have been<br />

disappointments in movies going straight<br />

to the home, or in hybrid home and<br />

theatrical “pandemic release windows,”<br />

the vast majority of major titles have<br />

chosen to delay their release in theaters,<br />

rather than abandon it.<br />

The first stimulus package, known as<br />

the CARES Act, provided direct aid to<br />

individuals and enhanced and extended<br />

unemployment relief. The CARES Act<br />

also provided two new loan programs:<br />

the Paycheck <strong>Pro</strong>tection <strong>Pro</strong>gram, which<br />

granted partially forgivable loans to small<br />

businesses, and the Main Street Lending<br />

<strong>Pro</strong>gram, which made loans available to<br />

companies with up to 15,000 employees<br />

and $5 billion in revenue. The CARES Act<br />

also provided tax relief to businesses of<br />

all sizes, through payroll tax deferral; the<br />

long-sought QIP fix, which corrected an<br />

error that extended capital improvement<br />

expense depreciation to 39 years and<br />

allowed businesses to amend those items<br />

in 2018 and 2019 returns; and the net<br />

operating loss carryback provision, which<br />

allowed businesses and individuals to use<br />

net operating losses against taxes incurred<br />

up to five years before, yielding hundreds<br />

of millions in tax refunds for exhibitors.<br />

As the late spring and summer<br />

stumbled forward in fits and starts of<br />

reopenings and closures, it became clear<br />

that individual company health and safety<br />

protocols were not effective at convincing<br />

12 <strong>Q1</strong> <strong>2021</strong><br />

12-14_NATO.indd 12 15/02/<strong>2021</strong> 15:10

local officials to consider allowing<br />

theaters to reopen or to lift restrictions<br />

on capacity, nor were consumers clear on<br />

just what movie theaters were doing to<br />

help keep them safe. Both problems were<br />

also making studios wary about releasing<br />

movies with large box office potential. A<br />

national movie theater health and safety<br />

protocol was necessary.<br />

NATO staff and member volunteers<br />

worked throughout the summer with<br />

epidemiologists and state boards of<br />

health to develop voluntary health<br />

and safety protocols. Unanimously<br />

adopted by NATO’s Executive Board,<br />

CinemaSafe was rolled out to members<br />

and non-members alike, with a national<br />

press conference and website and<br />

multimillion-dollar marketing effort in<br />

time for the release of Chris Nolan’s Tenet,<br />

in late August. In-theater graphics and<br />

a consumer-friendly video were made<br />

available to the historic group of 420<br />

companies, 3,150 locations, and more<br />

than 33,000 screens nationwide. Health<br />

officials in multiple countries adopted<br />

CinemaSafe as their standard for movie<br />

theater reopening protocols.<br />

CinemaSafe became a useful tool<br />

in convincing health officials across<br />

the country of the seriousness with<br />

which movie theater owners took their<br />

responsibilities and formed a framework<br />

for their reopening policies.<br />

This was not effective in all<br />

jurisdictions, as NATO and NATO of New<br />

Jersey sued the state of New Jersey in U.S.<br />

District Court to allow movie theaters to<br />

reopen at the same time the state allowed<br />

religious institutions and other similarly<br />

situated businesses and institutions to<br />

open. NATO did not prevail in that suit,<br />

but the pressure undoubtedly prompted<br />

New Jersey to reopen movie theaters<br />

weeks before they had originally planned<br />

and accelerated the opening of theaters in<br />

adjacent New York State.<br />

But the pandemic will have its way. A<br />

second wave of the virus hit the U.S. in late<br />

summer, and Europe, where the response<br />

had been far more promising and theaters<br />

had been allowed to open broadly, in<br />

the fall. Throughout this time, NATO<br />

continued to lobby on a badly stalled<br />

second pandemic stimulus program.<br />

As it became clear leading up to<br />

elections in November that negotiations<br />

on a new relief package were serious,<br />

NATO engaged its grassroots and industry<br />

The grants, much discussed<br />

in yet more NATO webinars,<br />

provide a lifeline that will<br />

help small and midsize<br />

theater companies make<br />

it until vaccines are widely<br />

available and business can<br />

return to normal.<br />

NATO MEMBERS<br />

Members<br />

Feb 2020<br />

Jan <strong>2021</strong><br />

Screens<br />

Feb 2020<br />

Jan <strong>2021</strong><br />

Locations<br />

Feb 2020<br />

Jan <strong>2021</strong><br />

676<br />

66,014<br />

7,425<br />

1,018<br />

70,222<br />

8,320<br />

allies to lobby key administration and<br />

congressional leaders to include movie<br />

theaters in their plans. NATO, through<br />

its relationship with a new association—<br />

NIVA (National Independent Venue<br />

Association)—lobbied for the Save Our<br />

Stages Act. Initially intended for live music<br />

venues, SOS had multiple Congressional<br />

sponsors and a real path to enactment.<br />

NIVA agreed that movie theaters should be<br />

included, if we could convince the sponsors<br />

to agree to add $5 billion to the initial $10<br />

billion allocated for the provision. NATO<br />

succeeded in this, and through intense<br />

lobbying, including thousands of contacts<br />

from NATO members, SOS, now known<br />

as the Shuttered Venue Operators Grant,<br />

passed Congress and was signed into law<br />

by the president.<br />

The grants, much discussed in yet<br />

more NATO webinars, provide a lifeline<br />

that will help small and midsize theater<br />

companies make it until vaccines are<br />

widely available and business can return<br />

to normal.<br />

Meanwhile, working off a template<br />

developed by NATO of Wisconsin and<br />

Upper Michigan to establish statebased<br />

grants to movie theater operators,<br />

multiple states have provided more money<br />

to movie theaters across the country.<br />

And in an extra bonus, a long-term<br />

NATO policy goal and lobbying focus, the<br />

maintenance of the ASCAP/BMI music<br />

licensing consent decree, was left in place<br />

by the outgoing head of the Department of<br />

Justice’s Antitrust Division. The decision<br />

means that U.S. movie theater companies<br />

will not have to pay hundreds of millions<br />

annually to license the music that is in<br />

movies they play, unlike our counterparts<br />

around the world.<br />

In these difficult times, NATO has<br />

also experienced something unusual for<br />

an industry in crisis. We have grown. In<br />

February 2020, NATO had 676 members<br />

(590 domestic, 3 from U.S. territories,<br />

21 from Canada, and 62 international),<br />

comprising 66,014 screens at 7,425<br />

locations worldwide; 34,171 screens at<br />

3,389 locations domestic.<br />

In January <strong>2021</strong>, NATO membership<br />

totaled 1,018 companies with 70,222<br />

screens at 8,320 locations worldwide; 904<br />

of those members were domestic, with<br />

35,854 screens at 3,828 locations.<br />

Through careful financial<br />

management and the huge success of<br />

CinemaCon over a decade, NATO had<br />

<strong>Q1</strong> <strong>2021</strong><br />

13<br />

12-14_NATO.indd 13 15/02/<strong>2021</strong> 15:10

Industry NATO<br />

accumulated a reserve fund that was<br />

quite large for an organization of its size.<br />

As a benefit to existing members and to<br />

attract new members, NATO announced,<br />

pre-pandemic, that it would suspend<br />

dues payments for fiscal year 2020–21.<br />

A pretty nice deal, but the deal has not<br />

been the driver. The vast bulk of new<br />

membership has come as a result of the<br />

pandemic and NATO’s response to it.<br />

And NATO’s response to the pandemic<br />

and all its attendant issues was not<br />

possible without that robust financial<br />

reserve, without the active engagement<br />

of a large, diverse, unified membership.<br />

Theater owners’ stories, told in hundreds<br />

of media interviews month after month,<br />

making personal their plight and their<br />

value to their communities, and told to<br />

congressional staff in districts across<br />

the country, helped make those various<br />

relief measures a possibility. Members<br />

embracing the CinemaSafe protocols and<br />

members working with the NATO regional<br />

associations got theaters reopened, lifted<br />

onerous restrictions, and got grants to<br />

keep going.<br />

NATO’s response to the<br />

pandemic and all its<br />

attendant issues was not<br />

possible without that robust<br />

financial reserve, without the<br />

active engagement of a large,<br />

diverse, unified membership.<br />

We’re not done. We will continue to<br />

lobby the Small Business Administration<br />

to make sure the Shuttered Venue<br />

Operators Grants are administered<br />

fairly; we will continue to lobby<br />

states and localities to allow theaters<br />

to reopen when it is safe to do so,<br />

without discriminatory provisions or<br />

unreasonable capacity caps; we will<br />

continue to lobby the studios to provide<br />

movie product and to return to prepandemic<br />

windowing models when the<br />

business returns to normal.<br />

We will continue to do this and more<br />

for you. But we can’t do it without you.<br />

Patrick Corcoran is the Vice President &<br />

Chief Communications Officer at NATO<br />

THE<br />

COMPANY WEBEDIA GROUP<br />

Like you, we like results:<br />

With our low risk flexible<br />

pricing, we'll give you<br />

access to our Boost<br />

ticketing solution at no<br />

upfront cost. When your<br />

online ticket sales receive<br />

a boost, everyone wins.<br />

Send an email to Scott.Hanlon@boxoffice.com to learn more<br />

14 <strong>Q1</strong> <strong>2021</strong><br />

12-14_NATO.indd 14 15/02/<strong>2021</strong> 15:10

<strong>Q1</strong> <strong>2021</strong><br />

15<br />

15_AD-GoldMedal-SpacesBetween.indd 15 12/02/<strong>2021</strong> 12:25

Industry CHARITY SPOTLIGHT<br />

CHARITY<br />

SPOTLIGHT<br />

Variety of St. Louis<br />

Studio Movie Grill<br />

Variety – the Children’s Charity<br />

Cineplex Supports Food Banks<br />

Canada<br />

This past holiday season, Cineplex was<br />

proud to support Food Banks Canada.<br />

By donating $1 from every order of food<br />

delivery and select films on the Cineplex<br />

Store for the entire month of December,<br />

Cineplex helped provide over 80,000<br />

meals to families in need. Cineplex<br />

employees also contributed by raising over<br />

$1,700 internally for the cause.<br />

Studio Movie Grill Celebrates the<br />

Season<br />

A little thing like a pandemic was not<br />

stopping two Studio Movie Grill locations<br />

from spreading Christmas cheer. Cory<br />

Brazelton, general manager at the chain’s<br />

Seminole, Florida, location, spearheaded<br />

efforts to participate in the Seminole<br />

Lake Rotary Club’s Red Sled Initiative,<br />

filling a sled with gifts for foster children.<br />

And while SMG’s Rocklin, California,<br />

location didn’t have the 50,000 guests<br />

they had in December 2019 to help their<br />

annual toy drive along, manager Elaina<br />

Newport and her team didn’t stop until<br />

over 150 children had items from their<br />

wish lists. For their toy drive, SMG’s<br />

Rocklin location worked with Foster<br />

Hope Sacramento and Child Advocates<br />

of Placer County, the latter of which also<br />

received a $1,000 donation, thanks to<br />

Newport’s tireless efforts.<br />

Variety – the Children’s Charity<br />

Thank you to everyone who helped<br />

Variety – the Children’s Charity raise<br />

more than $21,000 during its Virtual<br />

Walk, Run & Roll. Your donations helped<br />

provide vital equipment, services, and<br />

experiences to kids throughout the United<br />

States who live with special needs or are<br />

disadvantaged.<br />

Variety of St. Louis<br />

Variety of St. Louis enlisted two designers<br />

to devise and 3-D-print a handlebar<br />

adaptation specifically created for eightyear-old<br />

Maeve Boatman. Maeve has<br />

split hand and split foot syndrome, a rare<br />

physical disability occurring in about 1 in<br />

90,000 births that leaves her hands with<br />

just one gripping finger that she’s able to<br />

use to hold on to traditional handlebars.<br />

Covid-19 made Maeve’s need for a better<br />

bike apparent. With schools out and<br />

16 <strong>Q1</strong> <strong>2021</strong><br />

16-17_Charity-Spotlight.indd 16 12/02/<strong>2021</strong> 12:25

A MESSAGE FROM THE<br />

WILL ROGERS MOTION<br />

PICTURE PIONEERS<br />

FOUNDATION<br />

social distancing measures in place, her<br />

family started to take longer bike rides to<br />

get out of their home, but Maeve’s hands<br />

would quickly cramp with the strain of<br />

trying to grip the handlebars. The final<br />

product looks much like an ordinary bike,<br />

except that one of the handlebars has a<br />

3-D-printed cylinder that Maeve can wear<br />

like a glove and that clips in and out of<br />

the handlebar for a more stable grip. Now<br />

Maeve can enjoy longer rides with her<br />

parents and five siblings, ages seven to 20.<br />

Upcoming Events<br />

Variety of the Desert<br />

3rd Annual RumChata Variety Golf<br />

Scramble Presented by Trader Joe’s<br />

Indian Wells, Calif.<br />

March 29<br />

Join Variety of the Desert for a round of<br />

golf at the Indian Wells Country Club<br />

while supporting children across the<br />

Coachella Valley—it’s a real hole-inone!<br />

Variety will also make a special<br />

presentation to honor LPGA’s and the<br />

Desert’s own Susan Maxwell Brening,<br />

winner of four majors. Maxwell Brening<br />

will also be inducted into the World Golf<br />

Hall of Fame alongside Tiger Woods<br />

in 2022. Find more information at<br />

varietyofthedesert.org/our-events/.<br />

Variety of Wisconsin<br />

Spring Golf Classic<br />

Pewaukee, Wis.<br />

May 24<br />

Join Variety of Wisconsin at the Western<br />

Lakes Golf Club on Monday, May 24,<br />

for the Spring Golf Classic. Find more<br />

information at varietywi.org/events/.<br />

It takes an industry. We have made that<br />

statement numerous times since March<br />

2020, so much so that it has become a<br />

daily affirmation for many. The way the<br />

movie industry is pulling together during this<br />

unprecedented time is a vivid reminder that<br />

for the Pioneers Assistance Fund (PAF), our role<br />

in the industry is clear: help industry workers<br />

make it through this challenging time.<br />

The Pioneers Assistance Fund has been a<br />

helping hand to industry workers dealing with<br />

accident, illness, or injury for over 80 years.<br />

2020 challenged us to our maximum ability,<br />

providing financial stipends and counsel for<br />

some 10,000 people—a 1,580 percent increase<br />

from 2018, which had been our record year.<br />

From April 2020 to date, we have distributed<br />

$3.8 million, a 400 percent increase over 2018.<br />

The overwhelming majority of financial<br />

assistance disbursed by PAF went to ticket<br />

takers, concession workers, projectionists,<br />

and ushers who work, or formerly worked,<br />

at movie theaters across the country—from<br />

small, family-owned theaters to the major<br />

chains. The Phase One Emergency Grant<br />

program distributed roughly $2 million in $300<br />

stipends to furloughed theater workers early<br />

on in the pandemic to help with their basic<br />

household needs until they started receiving<br />

unemployment benefits.<br />

The Phase Two Emergency Grant distributed<br />

another $1 million based on need, with<br />

grants ranging from $300 to as much as<br />

$2,600. Ninety percent of grant recipients are<br />

assistant managers or general managers who<br />

have been on reduced pay (30%–50%) since<br />

April. Many of them have remained furloughed<br />

without pay or have been terminated.<br />

The impact the Pioneers Assistance Fund<br />

achieved during one of the most difficult times<br />

in our history would not have been possible<br />

without the support of the following donors:<br />

• Alamo Drafthouse Cinema<br />

• Amazon Studios<br />

• Cinema Service Company<br />

• Cinemark Theatres<br />

• Deluxe Digital<br />

• Dolby<br />

• Google<br />

• James and Theodore Pedas Family<br />

Foundation<br />

• James J. Cotter Foundation<br />

• Kernel Season's<br />

• Lionsgate<br />

• Malco Theatres<br />

• Mihalich Charitable Foundation<br />

• Motion Picture Club<br />

• National Association of Theatre Owners<br />

• NATO of California/Nevada<br />

• Paramount Pictures<br />

• Popcornopolis<br />

• Reel Blend<br />

• Sony Pictures<br />

• Universal Pictures<br />

The PAF is chaired by Chris Aronson,<br />

Paramount Pictures, president of distribution.<br />

“We are helping more people than we ever<br />

thought possible, and we’re not finished yet,”<br />

says Aronson. “The pandemic has challenged<br />

the Pioneers Assistance Fund, but we are<br />

committed to providing financial assistance<br />

to our dynamic workers and their families<br />

who have endured enormous hardship. We<br />

are grateful for the generous contributions<br />

and incredible support from our industry that<br />

helped us establish the emergency funds.<br />

Our reserves were set aside for a rainy day<br />

and, in this unprecedented time of need, the<br />

leadership at Will Rogers did not hesitate<br />

to utilize the funds. While it is our hope that<br />

the new federal relief program will address<br />

the looming housing crisis, the Pioneers<br />

Assistance Fund will continue to help as many<br />

industry workers as it can to keep a roof over<br />

their heads.”<br />

The thank you notes from industry workers<br />

have been overwhelming and moving. Please<br />

take a moment to read just a few of the<br />

examples of how the Pioneers Assistance Fund<br />

is making a difference now more than ever.<br />

“You have no idea what this grant has done<br />

for me and my family. I am living on reduced<br />

pay, and my prescriptions are so expensive.<br />

From the bottom of my heart and from<br />

everyone in my family, thank you so much for<br />

the help.”<br />

“I just wanted to say thank you very much for<br />

your help and blessing. ... This money will help<br />

pay my rent for a month. ... Hopefully once the<br />

theater reopens, I will try to get a fundraiser<br />

going to help out this wonderful organization.”<br />

“I want to thank you so much for the<br />

generous grant. It is buying groceries this<br />

week. We are so fortunate to have an<br />

organization that helps those in the movie<br />

theater business. There are very few such<br />

organizations out there.”<br />

<strong>Q1</strong> <strong>2021</strong><br />

17<br />

16-17_Charity-Spotlight.indd 17 12/02/<strong>2021</strong> 12:25

industry GIANTS OF EXHIBITION<br />

18 <strong>Q1</strong> <strong>2021</strong><br />

18-33_Giants-Of-Exhibition.indd 18 12/02/<strong>2021</strong> 12:26

GIANTS OF<br />

EXHIBITION<br />

The Top 50 Domestic Circuits<br />

of 2020<br />

After five consecutive years of<br />

more than $11 billion in revenue at<br />

the domestic box office, the exhibition<br />

market came to a violent halt in March<br />

2020. The biggest crisis in the industry’s<br />

history wasn’t brought about by familiar<br />

threats like home entertainment or<br />

piracy; instead, it was a global pandemic,<br />

of a scale not seen in at least a century,<br />

that plunged exhibition into the sort of<br />

existential crisis it had managed to avoid<br />

for generations. A promising start to<br />

the year sputtered to an alarming $2.25<br />

billion in ticket sales, an 80 percent<br />

year-over-year drop.<br />

While there remains to be a full<br />

accounting of the long-term damage<br />

caused by the pandemic’s economic<br />

disruption, changes to the traditional<br />

theatrical exclusivity model have already<br />

been felt at circuits across the nation.<br />

Yet despite the myriad challenges that<br />

exhibition faced in 2020, the industry<br />

rallied to persevere. Concession stands<br />

opened at theaters that were otherwise<br />

closed nationwide, pop-up drive-ins<br />

helped keep moviegoing alive during<br />

the summer months, and gift card drives<br />

provided a small respite for cinemas<br />

waiting to reopen.<br />

The reopening effort was fractured<br />

and presented its own challenges. After<br />

closing in March, major markets like<br />

New York City and Los Angeles never<br />

came back online, while other locations<br />

went through a series of openings and<br />

lockdowns with little to no warning for<br />

the business community. Those cinemas<br />

that could open were limited by a scarcity<br />

of new releases from major studios.<br />

With the odds stacked against them,<br />

exhibitors have been strikingly resilient,<br />

despite the mounting woes of 2020. This<br />

year’s Giants of Exhibition ranking stands<br />

as a testament to the industry’s flexibility<br />

and resolve.<br />

Presented By<br />

<strong>Q1</strong> <strong>2021</strong><br />

19<br />

18-33_Giants-Of-Exhibition.indd 19 12/02/<strong>2021</strong> 12:26

industry GIANTS OF EXHIBITION<br />

SPONSOR<br />

PROFILE<br />

1<br />

AMC THEATERS<br />

Location: Leawood, KS<br />

Founded: 1920<br />

Screens: 7,800 ↘ -3%<br />

Locations: 600 ↘ -5%<br />

What was supposed to be a festive year<br />

for AMC Theatres quickly devolved into<br />

a nightmare scenario. The circuit entered<br />

2020 ready to celebrate its centennial<br />

anniversary but was forced to focus<br />

its energies on making it through the<br />

biggest economic crisis in its history.<br />

The circuit was among the first major<br />

circuits in the United States to cease<br />

operations, announcing on March 16 that<br />

it would voluntarily close all its domestic<br />

locations for six to 12 weeks. It would<br />

take considerably longer than expected<br />

for AMC to get back to business, waiting<br />

until August 20—five months after<br />

closing its doors—to resume operations<br />

at 100 of its 600 locations.<br />

The closures didn’t mean AMC was<br />

quiet during the spring and early summer.<br />

In April, the circuit was the first to speak<br />

out against Universal’s decision to adopt<br />

a dramatically shortened theatrical<br />

exclusivity window, vowing not to<br />

book any of the studio’s titles under the<br />

policy. By July, it reversed its stance<br />

and welcomed back Universal titles by<br />

agreeing to a deal that would give the<br />

circuit a portion of the films’ digital<br />

streaming revenues. In June, the circuit’s<br />

decision to suggest, though not require,<br />

the wearing of face masks for patrons<br />

returning to their theaters helped spark<br />

a national debate about mask-wearing<br />

policies at businesses reopening during<br />

the pandemic. The circuit reversed<br />

course a week after announcing its<br />

original policy, citing public demand, and<br />

required face masks at all their locations<br />

once they reopened. In both instances,<br />

AMC effectively used its position as the<br />

country’s and world’s leading cinema<br />

chain to influence the reopening effort.<br />

It was also one of the first circuits in the<br />

nation to announce a comprehensive<br />

series of health and safety protocols<br />

ahead of reopening, AMC Safe & Clean,<br />

developed in collaboration with current<br />

and former faculty members of Harvard<br />

University’s School of Public Health and<br />

in partnership with The Clorox Company.<br />

AMC weathered significant stress in<br />

instituting policies and changes that<br />

will reverberate throughout the industry<br />

for years—decisions that weren’t easily<br />

made but were necessary to ensure its<br />

survival. The circuit enters <strong>2021</strong> as the<br />

only cinema chain in North America with<br />

over 7,000 screens.<br />

Kevin Shepela<br />

EVP, Chief Commercial Officer<br />

Fandango<br />

It’s been an incredibly challenging<br />

time for everyone involved in<br />

theatrical moviegoing. Today, we<br />

honor the Giants of Exhibition,<br />

who, we know, with their leadership<br />

and unwavering dedication to the<br />

industry, will help us go back to<br />

the movies bigger and better than<br />

before. At Fandango, we remain<br />

steadfast as your partner in helping<br />

film fans return to your theaters at<br />

the right time, with exuberance,<br />

confidence, and peace of mind.<br />

We are proud of the work we’ve<br />

done together over the past year<br />

to offer moviegoers new health and<br />

safety content and product features<br />

on Fandango, including social<br />

distance seat maps, occupancy<br />

guides, search filtering for reopened<br />

theaters and access to more than<br />

100 health and safety protocols,<br />

provided by theaters. With<br />

Fandango’s mobile ticketing, we’re<br />

also able to help reduce the number<br />

of contact points for moviegoers<br />

and cinema employees at the box<br />

office and throughout the theater.<br />

When new movies, event screenings,<br />

and showtimes are scheduled at<br />

your theaters, we will make sure<br />

millions of moviegoers nationwide<br />

are the first to know, so they can<br />

grab tickets for their favorite seats in<br />

your auditoriums.<br />

Our industry is resilient. There’s<br />

nothing like the thrill of watching<br />

a film on the big screen with an<br />

appreciative audience in a safe<br />

environment. We are optimistic<br />

about the future as we work together<br />

to ensure that the moviegoing<br />

experience will always be the first<br />

choice in entertainment, with fans<br />

more excited than ever to return to<br />

your wonderful theaters. We can’t<br />

wait to get back to the movies!<br />

20 <strong>Q1</strong> <strong>2021</strong><br />

18-33_Giants-Of-Exhibition.indd 20 12/02/<strong>2021</strong> 12:26

<strong>Q1</strong> <strong>2021</strong><br />

21<br />

18-33_Giants-Of-Exhibition.indd 21 12/02/<strong>2021</strong> 12:26

industry GIANTS OF EXHIBITION<br />

your future<br />

our commitment<br />

introducing SP2K Series 4<br />

projectors for smaller screens<br />

We make laser accessible for every screen.<br />

With four new SP2K models ranging from 6,000 to<br />

15,000 lumens, the next-generation Barco Series 4<br />

family is available for all screens, big and small. All<br />

Series 4 are now within reach for more theaters than<br />

ever before. Your future is our commitment.<br />

Discover more at www.cinionic.com/Series4<br />

22 <strong>Q1</strong> <strong>2021</strong><br />

18-33_Giants-Of-Exhibition.indd 22 12/02/<strong>2021</strong> 12:26

industry GIANTS OF EXHIBITION<br />

SPONSOR<br />

PROFILE<br />

Wim Buyens<br />

Chief Executive Officer<br />

Cinionic<br />

The past year has challenged our<br />

industry like never before, forcing us<br />

to confront old questions at a time<br />

when tomorrow, and even today,<br />

can seem uncertain. But it has also<br />

reminded us that we are strongest<br />

when we come together, connecting<br />

over digital platforms to share<br />

stories, encouragement, and ideas<br />

about what business might look like<br />

when life returns to the new normal.<br />

Cinionic is proud to work closely<br />

with you, our partners in exhibition,<br />

to shape the next generation of<br />

moviegoing with future-ready<br />

solutions and services. We salute<br />

our friends across exhibition. As a<br />

community, we are seeking new,<br />

innovative solutions to support our<br />

recovery while keeping the legacy<br />

of exceptional cinema alive. It takes<br />

giants to forge a shared path to a<br />

brighter future<br />

2<br />

REGAL CINEMAS<br />

Location: Knoxville, TN<br />

Founded: 1989<br />

Screens: 6,989 ↘ -3%<br />

Locations: 527 ↘ -3%<br />

The final days of 2019 gave the exhibition<br />

industry a sneak peek at what was<br />

likely to be the sector’s biggest story<br />

of 2020: the acquisition of Cineplex by<br />

Regal’s corporate parent, Cineworld. The<br />

resulting deal was to be the culmination<br />

of a major international expansion by<br />

the U.K.-based Cineworld, only two years<br />

removed from its acquisition of Regal,<br />

and would supplant AMC as the largest<br />

circuit in North America and the world. By<br />

combining Regal and Cineplex under the<br />

same ownership, Cineworld would have<br />

essentially created a mega-circuit in North<br />

America, with nearly 10,000 screens. The<br />

pandemic derailed those plans, however,<br />

leaving Regal and Cineplex as separate<br />

entities in this year’s ranking. The<br />

companies are instead sorting out the<br />

broken pieces of the failed merger in court.<br />

Cineworld’s corporate office in the<br />

U.K. led Regal’s strategy throughout the<br />

economic turbulence of 2020. The circuit<br />

was one of several to voice its concerns<br />

regarding Universal’s unilateral decision<br />

to dramatically shorten the theatrical<br />

exclusivity window for its titles; unlike<br />

its competitors, however, it has yet to<br />

announce a subsequent deal with the<br />

studio—reflecting its corporate parent’s<br />

staunch positioning on windows. The<br />

circuit has remained similarly noncommittal<br />

in reacting to Warner Bros.’<br />

controversial day-and-date release<br />

strategy for <strong>2021</strong>.<br />

Regal suspended operations in mid-<br />

March along with other top U.S. circuits,<br />

reopening select locations on August 21 in<br />

anticipation of what was expected to be a<br />

consistent studio slate. Tenet’s performance<br />

at the box office did little to bolster studio<br />

confidence in the newly reopened market,<br />

however, prompting a slew of additional<br />

schedule changes from top distributors and<br />

leaving exhibitors with few programming<br />

options. The last straw for Cineworld came<br />

in the fall with the sudden rescheduling<br />

of the James Bond title No Time to Die,<br />

prompting the circuit to suspend operations<br />

in the U.K. and U.S. until further notice—or<br />

at least until it could depend on a consistent<br />

slate of films. The majority of Regal screens<br />

in the United States remained closed<br />

through the end of the year.<br />

Once it reopens, the circuit will be<br />

taking a case-by-case approach to which<br />

titles—and under what terms—it programs<br />

in the nearly 7,000 screens it operates in<br />

North America.<br />

<strong>Q1</strong> <strong>2021</strong><br />

23<br />

18-33_Giants-Of-Exhibition.indd 23 12/02/<strong>2021</strong> 12:26

industry GIANTS OF EXHIBITION<br />

SPONSOR<br />

PROFILE<br />

Stan Ruszkowski<br />

President<br />

The <strong>Boxoffice</strong> Company<br />

3<br />

CINEMARK<br />

Location: Plano, TX<br />

Founded: 1984<br />

Screens: 4.517 ↘ -2%<br />

Locations: 331 ↘ -4%<br />

Cinemark entered 2020 from a period<br />

of growth, with 2019 marking its fifth<br />

consecutive year of record revenues.<br />

Covid-19, obviously, sent the chain in a<br />

different direction. On March 18, Cinemark<br />

closed all its U.S. locations in response<br />

to the pandemic. June 19 saw the chain<br />

embark on the first part of its phased<br />

reopening, which began with five theaters<br />

in the Dallas-Fort Worth area. Initial plans<br />

to have all of Cinemark’s U.S. theaters open<br />

by July 10 were pushed back as infection<br />

rates continued to rise and the theatrical<br />

debut of major tentpoles continued to<br />

be delayed. The main part of Cinemark’s<br />

summer reopening effort took place<br />

throughout August, leading up to the<br />

September 3 release of Warner Bros.’ Tenet.<br />

With 2020 offering up an extremely<br />

limited slate of studio tentpoles, starting<br />

in July Cinemark turned to private<br />

cinema rentals, driving customer<br />

awareness and interest with giveaways<br />

tied to Halloween, Thanksgiving, and<br />

Christmas. By December 9, more than 1.3<br />

million moviegoers had participated in<br />

one of Cinemark’s 100,000 Private Watch<br />

Parties. Private cinema rentals accounted<br />

for 17 percent of Cinemark’s Q3 2020<br />

U.S. admissions revenues. In Cinemark’s<br />

Q3 2020 investor call, CEO Mark Zoradi<br />

underscored the importance of private<br />

rentals as a way for customers who had<br />

not been to the movies since the start of<br />

the pandemic to experience Cinemark’s<br />

enhanced safety and cleanliness<br />

procedures firsthand.<br />

November saw Cinemark join AMC in<br />

signing its own agreement with Universal<br />

to distribute the studio’s films under a<br />

shortened theatrical exclusivity window.<br />

Under Cinemark’s “Dynamic Window”<br />

arrangement, Universal and Focus titles<br />

will have five weekends (31 days) of<br />

theatrical exclusivity if they open to $50M,<br />

or three weekends (17 days) if they do not;<br />

certain films will receive a five-weekend<br />

window regardless.<br />

Cinemark’s deal with Universal<br />

extends over multiple years, echoing<br />

Cinemark CEO Mark Zoradi’s belief<br />

that the shifting nature of theatrical<br />

exclusivity will continue past the<br />

cessation of the Covid-19 pandemic.<br />

A difficult year for our entire industry<br />

was also one of unprecedented<br />

innovation and creativity, as<br />

movie theaters found new ways<br />

to engage with their audiences.<br />

From mobile ordering to take-out<br />

concessions, and even at-home<br />

viewing experiences and private<br />

watch parties—exhibitors have been<br />

at the heart of finding new ways to<br />

redefine the moviegoing experience.<br />

This year’s Giants of Exhibition list<br />

is a reflection of the resilience and<br />

commitment to innovation of our<br />

entire industry. We are honored<br />

to count many of these circuits as<br />

partners and clients of The <strong>Boxoffice</strong><br />

Company.<br />

We thank you for your trust and<br />

leadership during this difficult time.<br />

Your insights and collaborations<br />

have helped us reinvent our<br />

focus on solutions that can help<br />

exhibitors get through the pandemic<br />

and bounce back faster once<br />

their cinemas reopen. Our latest<br />

projects include contactless digital<br />

ticketing and concessions; customer<br />

awareness through SEO, emailing,<br />

and social media; and co-watching<br />

streaming services.<br />

We look forward to getting out of<br />

this crisis together stronger, offering<br />

a better customer experience than<br />

ever before.<br />

24 <strong>Q1</strong> <strong>2021</strong><br />

18-33_Giants-Of-Exhibition.indd 24 15/02/<strong>2021</strong> 15:14

THE<br />

COMPANY WEBEDIA GROUP<br />

Like you, we like results:<br />

We'll quickly set you up on our<br />

world class mobile app with<br />

flexible pricing. When our product<br />

boosts ticket sales and moviegoer<br />

retention, we both win.<br />

Send an email to Michelle.Coull@boxoffice.com to learn more<br />

<strong>Q1</strong> <strong>2021</strong><br />

25<br />

18-33_Giants-Of-Exhibition.indd 25 12/02/<strong>2021</strong> 12:26

industry GIANTS OF EXHIBITION<br />

jun<br />

ce21-24<br />

ce<strong>2021</strong><br />

convention & tradeshow<br />

CCIB/BARCELONA<br />

CELEBRATING<br />

30<br />

YEARS OF<br />

CINEEUROPE<br />

CENTRE CONVENCIONS INTERNACIONAL BARCELONA (CCIB)<br />

CINEEUROPE.NET<br />

OFFICIAL CORPORATE SPONSOR<br />

26 <strong>Q1</strong> <strong>2021</strong><br />

CE21_PRINTAD_BOXOFFICE.indd 18-33_Giants-Of-Exhibition.indd 26 1<br />

12/02/<strong>2021</strong> 2/3/21 5:58 12:26<br />

PM

industry GIANTS OF EXHIBITION<br />

SPONSOR<br />

PROFILE<br />

Film Expo Group<br />

On behalf of the entire Film<br />

Expo Group family, we’d like to<br />

congratulate this year’s Giants of<br />

Exhibition. Like everyone else in<br />

this industry, Film Expo Group has<br />

weathered the challenges of the<br />

Covid-19 pandemic by innovating<br />

while maintaining our commitment<br />

as champions of the moviegoing<br />

experience. Despite not hosting<br />

any of our traditional conventions<br />

in person in 2020, we found it<br />

important to keep in touch with<br />

the exhibition and distribution<br />

communities by launching digital<br />

editions of CineEurope, ShowEast,<br />

and CineAsia. Their success would<br />

not have been possible without your<br />

continued support.<br />

In <strong>2021</strong> we are looking forward to<br />

seeing everyone once again in<br />

person. We hope that you will be<br />

able to join us in Barcelona, June<br />

21–24, for CineEurope. We will be<br />

back stateside, October 18–21 in<br />

Miami, for ShowEast. And last but<br />

not least, we are excited to finish the<br />

year in Bangkok, December 6–9, for<br />

CineAsia. We remain confident that<br />

together we will all be able to come<br />

back better and stronger.<br />

4<br />

CINEPLEX<br />

Location: Toronto, ON (Canada)<br />

Founded: 2003<br />

Screens: 1,657 ↘ -2%<br />

Locations: 161 ↘ -2%<br />

Canada’s leading exhibition circuit found<br />

itself in the midst of several transitions<br />

in what proved to be an eventful 2020. Its<br />

acquisition by U.K.-based Cineworld, first<br />

announced in December 2019, was expected<br />

to be finalized in the second quarter of the<br />

year. Instead, the circuit resorted to legal<br />

action once Cineworld abandoned its plans<br />

to acquire the chain in June.<br />

With the matter headed to court,<br />

Cineplex turned its focus to the reopening<br />

effort—effectively becoming the first major<br />

circuit in North America to reopen its doors.<br />

Cineplex welcomed moviegoers back to<br />

their screens in late June, followed by a<br />

progressive nationwide reopening over<br />

the rest of the summer. As with cinemas<br />

elsewhere, the chain had to contend with<br />

new rounds of localized closures amid a<br />

surge of cases throughout the year.<br />

Cineplex joined AMC and Cinemark<br />

in accepting Universal’s proposal to<br />

shorten the theatrical exclusivity window,<br />

signing on to the agreement in late<br />

November. The dynamic window gives the<br />

Canadian chain at least three weekends<br />

of exclusivity for any Universal or Focus<br />

Features title before it becomes available<br />

on home entertainment platforms.<br />

Strategically, the decision could help<br />

Cineplex further expand its own videoon-demand<br />

channel, the Cineplex Store.<br />

The circuit reported positive growth for<br />

its home entertainment division in 2020,<br />

reaching 1.8 million registered users by<br />

the end of Q3—a 41 percent increase over<br />

the previous year.<br />

By not relying solely on the studio<br />

release slate through its diversified<br />

entertainment offerings, Cineplex stands<br />

apart from other major North American<br />

circuits in the recovery effort, as vaccines<br />

begin to make their way across Canada.<br />

More than a cinema circuit, Cineplex<br />

has come to be known as an out-of-home<br />

entertainment destination for Canadians,<br />

which has helped launch Scene, one of<br />

the most successful loyalty programs in<br />

the country. Redemptions from its loyalty<br />

program already include discounts on<br />

digital rentals and concessions items, free<br />

standard and premium-format movie<br />

tickets, and vouchers eligible at the<br />

circuit’s entertainment centers, the Rec<br />

Room and Playdium.<br />

<strong>Q1</strong> <strong>2021</strong><br />

27<br />

5:58 PM<br />

18-33_Giants-Of-Exhibition.indd 27 12/02/<strong>2021</strong> 12:26

industry GIANTS OF EXHIBITION<br />

5<br />

MARCUS<br />

THEATRES<br />

Location: Milwaukee, WI<br />

Founded: 1935<br />

Screens: 1,097 ↘ -1%<br />

Locations: 89 ↘ -2%<br />

Like many of its exhibition<br />

colleagues in North America,<br />

Marcus Theatres shut down<br />

in March and embarked on a<br />

phased reopening throughout<br />

the summer months, in the<br />

interim investing in drive-ins<br />

as a way to keep the (projector)<br />

lights on even as indoor<br />

theaters had to remain closed.<br />

The Marcus Corporation,<br />

parent company of Marcus<br />

Theatres, was affected in<br />

unique ways by the Covid-19<br />

pandemic compared with<br />

other North American<br />

exhibitors. For one thing,<br />

The Marcus Corporation is<br />

involved in both theaters and<br />

hospitality, two industries<br />

particularly hard hit by the<br />

pandemic and its shutdowns.<br />

On the more positive side, the<br />

company's real estate holdings<br />

include most of its cinema<br />

locations, a distinct silver<br />

lining in a year when chains<br />

nationwide were engaged<br />

in difficult conversations<br />

with landlords. “We believe<br />

this remains a significant<br />

advantage for us relative<br />

to our peers, as it keeps our<br />

monthly fixed lease payments<br />

low and provides significant<br />

underlying credit support for<br />

our balance sheet,” said Greg<br />

Marcus, president and CEO of<br />

The Marcus Corporation, in<br />

the company's Q3 earnings call.<br />

Though Q3 2020 attendance<br />

was (understandably) down<br />

considerably from the same<br />

period in 2019, the average<br />

concession spend per person<br />

increased by 28 percent. In<br />

a call with investors, CFO<br />

Douglas Neis attributed<br />

this growth to shortened<br />

lines and an emphasis on<br />

advance online and mobile<br />

ordering. "While the first<br />

reason will eventually go<br />

away as attendance increases,<br />

the second reason has the<br />

potential to be long-lasting,<br />

which is very encouraging.”<br />

6<br />

HARKINS<br />

THEATRES<br />

Location: Scottsdale, AZ<br />

Founded: 1933<br />

Screens: 501 ↘ -3%<br />

Locations: 33 ↘ -3%<br />

“There is no question that this<br />

has been the most difficult<br />

time in my 50-plus years in<br />

the business,” said Harkins<br />

Theatres owner Dan Harkins,<br />

in a statement announcing<br />

the circuit’s initial wave of<br />

reopenings in August. The<br />

Scottsdale, Arizona–based<br />

circuit weathered a difficult<br />

year by instituting initiatives<br />

like gift cards, takeout<br />

popcorn, and a strategically<br />

priced private rental program<br />

to mitigate the economic<br />

downturn. Like other circuits,<br />

it even opened its doors to<br />

digital delivery apps like<br />

DoorDash and GrubHub to<br />

deliver movie theater popcorn<br />

to audiences at home to bolster<br />

concessions sales.<br />

In its open theaters, the<br />

circuit extended discounts<br />

on select concessions and<br />

implemented $5 admission<br />

nights tied to classic film<br />

series. Themed programming<br />

strands like Tuesday Classic<br />

Movie Night, Girlfriends Movie<br />

Night, Hispanic Heritage<br />

Film Fest, and October<br />

Fright Nights helped recreate<br />

part of the communal<br />

moviegoing experience<br />

throughout the year, while<br />

still adhering to reducedcapacity<br />

guidelines. That<br />

targeted outreach through<br />

programming included the<br />

circuit’s Open Caption Films<br />

series, a pair of evenings each<br />

month dedicated to playing<br />

accessible-format new releases<br />

for hard-of-hearing audiences.<br />

Harkins enters <strong>2021</strong> as one of<br />

only five U.S. circuits with over<br />

500 screens, a notable screen<br />

count considering its presence<br />

throughout four Western states<br />

as opposed to its competitors’<br />

national footprint.<br />

28 <strong>Q1</strong> <strong>2021</strong><br />

18-33_Giants-Of-Exhibition.indd 28 12/02/<strong>2021</strong> 12:26

7<br />

B&B THEATRES<br />

Location: Kansas City, MO<br />

Founded: 1924<br />

Screens: 429 ↗ 3%<br />

Locations: 49 ↗ 2%<br />

Family-owned B&B Theatres<br />

was among the first major<br />

circuits to close all its<br />

locations in mid-March,<br />

just as the full scope of the<br />

pandemic began to come into<br />

view. Days after announcing<br />

the closures, film director<br />

Christopher Nolan cited the<br />

chain by name in a call for<br />

support of the beleaguered<br />

industry, published in The<br />

Washington Post.<br />

While the majority of their<br />

locations remained closed<br />

throughout the summer, B&B<br />

was able to get back in touch<br />

with moviegoers at their three<br />

drive-in screens—a crucial<br />

lifeline for the circuit during<br />

the pandemic. While drive-in<br />

revenue didn’t fully replace<br />

income lost at its closed<br />

theaters, it helped contribute<br />

to other efforts like takeout<br />

concessions and gift card sales<br />

during the most difficult period<br />

of the pandemic.<br />

Once its theaters reopened,<br />

B&B expanded inclusive initiatives<br />

like its nationwide Sensory<br />

Backpack program. The<br />

program, developed with the<br />

guidance of Variety – the Children’s<br />

Charity of Kansas City,<br />

makes backpacks containing<br />

sensory aids like weighted lappads,<br />

noise-cancelling headsets,<br />

dark glasses, and fidget<br />

cubes, available to borrow at<br />

the box office at no cost.<br />

Even with all the disruption<br />

caused by the pandemic,<br />

B&B was nevertheless able<br />

to expand part of its circuit<br />

in 2020. The circuit unveiled<br />

its newest location, a totally<br />

renovated 14-screen multiplex<br />

in Jackson, Mississippi, in<br />

September, just days before the<br />

U.S. release of Tenet.<br />

8<br />

MALCO THEATRES<br />

Location: Memphis, TN<br />

Founded: 1915<br />

Screens: 363<br />

Locations: 35<br />

Like other chains in North<br />

America and overseas, Malco<br />

Theatres responded to the<br />

challenges of the coronavirus<br />

pandemic—specifically a<br />

lack of content from major<br />

Hollywood studios—by offering<br />

private screenings for small<br />

groups of up to 20 people,<br />

branded under the name Malco<br />

Select. The circuit introduced<br />

Malco Select in early October,<br />

following a phased reopening<br />

throughout the summer. Said<br />

Malco president and COO David<br />

Tashie at the time: “While we<br />

have always offered packages<br />

for mid-sized and large groups,<br />

this new program is geared<br />

toward guests who want to be<br />

able to select a movie and have<br />

their own private screening for<br />

themselves, family, and friends.”<br />

During the early spring<br />

months of the pandemic,<br />

Malco stayed connected with<br />

its customers with trivia<br />

nights, bulk popcorn sales,<br />

and revamped social media<br />

initiatives; it also welcomed<br />

moviegoers to its Summer<br />

Drive-In Theater starting in<br />

mid-May. The four-screen<br />

drive-in theater, located in<br />

Malco’s home city of Memphis,<br />

remained in operation<br />

through the autumn and<br />

winter and into early <strong>2021</strong>.<br />

Moving into the latter part of<br />

2020, November saw Malco add<br />

a video game component to its<br />

Malco Select program, inviting<br />

those interested in a private<br />

auditorium rental to bring their<br />

own console and games.<br />

Reflecting the challenges<br />

theaters in general have faced<br />

throughout 2020, the final<br />

month of the year saw Malco<br />

close its indoor Memphisarea<br />

theaters in accordance<br />

with local health guidelines;<br />

Malco locations that remain<br />

open ended the year with<br />

a combination of recent<br />

releases, older classics, and<br />

specialized programming.<br />

<strong>Q1</strong> <strong>2021</strong><br />

29<br />

18-33_Giants-Of-Exhibition.indd 29 12/02/<strong>2021</strong> 12:26

industry GIANTS OF EXHIBITION<br />

9<br />

CMX CINEMAS<br />

Location: Miami, FL<br />

Founded: 2016<br />

Screens: 341 ↘ -17%<br />

Locations: 31 ↘ -23%<br />

CMX Cinemas, the U.S. arm<br />

of Mexico’s Cinemex, quickly<br />

established itself as one of the<br />

top movie theater chains in<br />

the North American market<br />

after opening its first location<br />

in 2017. A combination of new<br />

sites and major acquisitions<br />

thrust the company into a<br />

market leadership position,<br />

one it expected to capitalize on<br />

in 2020. A planned takeover of<br />

Texas-based dine-in chain Star<br />

Cinema Grill was announced<br />

in mid-March, unfortunately<br />

timed just as the Covid-19<br />

pandemic started to storm its<br />

way through the country. The<br />

deal was abandoned within<br />

a matter of weeks as CMX<br />

became the first major circuit<br />

in North America to file for<br />

Chapter 11 bankruptcy due to<br />

the pandemic. Rather than<br />

grow in size with its latest<br />

acquisition, the pandemic<br />

threw both circuits into court<br />

to resolve the failed merger.<br />

As CMX emerged from<br />

bankruptcy in September,<br />

the circuit quickly moved to<br />

restructure its existing sites<br />

and business operations in<br />

order to make it through the<br />

pandemic. It has also been one<br />

of the most vocal entities in<br />

calling for a renewed business<br />

model amid studios’ rush<br />

to shorten or eliminate the<br />

theatrical exclusivity window.<br />

In an open letter published in<br />