You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

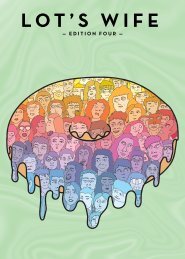

Lot’s <strong>Wife</strong> • <strong>Edition</strong> Four<br />

Lot’s <strong>Wife</strong> • <strong>Edition</strong> Four<br />

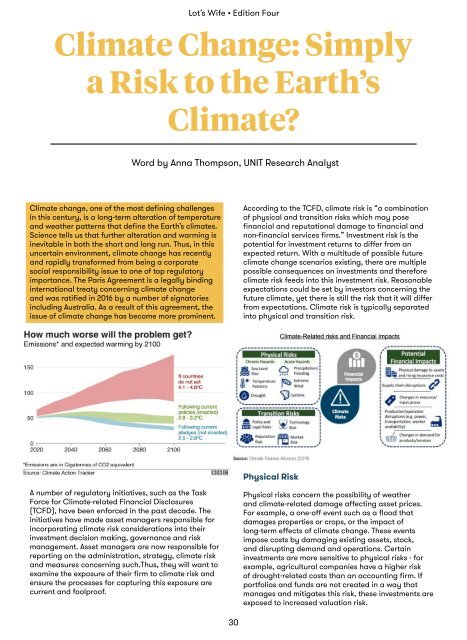

Climate Change: Simply<br />

a Risk to the Earth’s<br />

Climate?<br />

Word by Anna Thompson, UNIT Research Analyst<br />

Climate change, one of the most defining challenges<br />

in this century, is a long-term alteration of temperature<br />

and weather patterns that define the Earth’s climates.<br />

Science tells us that further alteration and warming is<br />

inevitable in both the short and long run. Thus, in this<br />

uncertain environment, climate change has recently<br />

and rapidly transformed from being a corporate<br />

social responsibility issue to one of top regulatory<br />

importance. The Paris Agreement is a legally binding<br />

international treaty concerning climate change<br />

and was ratified in 2016 by a number of signatories<br />

including Australia. As a result of this agreement, the<br />

issue of climate change has become more prominent.<br />

A number of regulatory initiatives, such as the Task<br />

Force for Climate-related Financial Disclosures<br />

(TCFD), have been enforced in the past decade. The<br />

initiatives have made asset managers responsible for<br />

incorporating climate risk considerations into their<br />

investment decision making, governance and risk<br />

management. Asset managers are now responsible for<br />

reporting on the administration, strategy, climate risk<br />

and measures concerning such.Thus, they will want to<br />

examine the exposure of their firm to climate risk and<br />

ensure the processes for capturing this exposure are<br />

current and foolproof.<br />

According to the TCFD, climate risk is “a combination<br />

of physical and transition risks which may pose<br />

financial and reputational damage to financial and<br />

non-financial services firms.” Investment risk is the<br />

potential for investment returns to differ from an<br />

expected return. With a multitude of possible future<br />

climate change scenarios existing, there are multiple<br />

possible consequences on investments and therefore<br />

climate risk feeds into this investment risk. Reasonable<br />

expectations could be set by investors concerning the<br />

future climate, yet there is still the risk that it will differ<br />

from expectations. Climate risk is typically separated<br />

into physical and transition risk.<br />

Physical Risk<br />

Physical risks concern the possibility of weather<br />

and climate-related damage affecting asset prices.<br />

For example, a one-off event such as a flood that<br />

damages properties or crops, or the impact of<br />

long-term effects of climate change. These events<br />

impose costs by damaging existing assets, stock,<br />

and disrupting demand and operations. Certain<br />

investments are more sensitive to physical risks - for<br />

example, agricultural companies have a higher risk<br />

of drought-related costs than an accounting firm. If<br />

portfolios and funds are not created in a way that<br />

manages and mitigates this risk, these investments are<br />

exposed to increased valuation risk.<br />

Stranded Assets<br />

Stranded assets are those which are unexpectedly<br />

devalued as a result of climate related events. When<br />

physical risks, such as the risk of climate events<br />

destroying particular physical inventories or certain<br />

sectors becoming obsolete as a result of a regulatory<br />

or societal retreat from activities which contribute to<br />

climate change, materialise, they can result in assets<br />

becoming stranded.<br />

Stranded assets pose risks to investments and are<br />

often used as the general unit of measurement when<br />

debating the possible financial impacts of climate risk.<br />

The London School of Economics estimated the value<br />

of global financial assets that are at risk from climate<br />

change as being US$2.5 trillion, while The Economist<br />

estimated it as being US$4.2 trillion. Stranded assets<br />

are important in managing financial risk to attempt to<br />

avoid loss after an asset has become a liability. Asset<br />

managers are expected to be wary of the possibility of<br />

investing portfolios or funds in companies or sectors<br />

prone to stranded asset risk. However, re-positioning<br />

portfolios due to possible stranded assets needs to be<br />

adequately explained by asset managers due to the<br />

possibility of incurring unnecessary costs for investors<br />

and compromising their returns.<br />

Transition Risk<br />

As discussed above, there is mounting regulatory<br />

pressure on companies to alter their operations and<br />

activities in order to mitigate negative environmental<br />

externalities. Coupled with heightened social pressure,<br />

risks arise as a resulting shift towards a greener, lowcarbon<br />

economy.<br />

This is the transition risk. As climate change worsens,<br />

market participants are likely to change their<br />

attitudes: governments may become more open to<br />

taxing emissions, and consumers may shift their<br />

demand towards more environmentally friendly<br />

products. This creates transition risk such as:<br />

• The risk of consumers switching to invest in firms<br />

with more environmentally-friendly track records;<br />

• The risk of firms with high carbon emissions<br />

facing high future regulatory costs;<br />

• Or the risk of media announcements regarding<br />

harmful environmental practices that can<br />

negatively affect a company’s market value.<br />

Conclusion<br />

Climate risk is persistent and will continue to evolve<br />

into the distant future. As a result, institutions must<br />

integrate considerations of this risk into their business<br />

strategies, and risk management and governance<br />

processes in order to not only keep up with the<br />

increasing regulations but also ensure their business<br />

can survive in the long-term. As climate change<br />

is a problem that will persist long into the future,<br />

addressing climate risk is something that needs to be<br />

integrated into everyday decision-making, rather than<br />

being a one-off process.<br />

Monash students can be aware and informed of<br />

the impacts of climate risk and the signs of a firm<br />

adequately handling this risk and having a forwardlooking<br />

attitude. This will assist in making informed<br />

financial decisions.<br />

30 31