CPD Course Catalog Fall 2021 | The School of Professional Studies

Choose a dynamic way of learning, regardless of how you choose to study. Our courses are built to provide the skills professionals need to grow in their profession, as our teaching methodology is well planned, structured, and student-centered. Whether you choose to study face-to-face, online or through online pre-recorded courses, you will get expert guidance from a panel of highly qualified and experienced tutors committed to the success of every student in all subjects. SPS CPD courses count as formal CPD as they offer a structured approach, where learning objectives/outcomes can easily be identified, and the member is essentially ‘taught’ something that enhances their knowledge and/or technical skills. Many of our seminars are approved by HRDA and suitable subsidies will, therefore be available to all HRDA qualifying participants Ways to study with us. Choose a dynamic way of learning, regardless of how you choose to study. CLASSROOM BASED COURSES LIVE ONLINE INSTRUCTOR - LED COURSES ONLINE PRE-RECORDED COURSES [ON DEMAND] HOW TO BOOK Ready to increase your potential with one of our training courses? We can’t wait to help you get started. Once you’ve selected your course, secure your place by calling us on 22713230 | 25867500 or by emailing us at SPSNicosia@cycollege.ac.cy | SPSLimassol@cycollege.ac.cy, and we will guide you on your next steps for your registration.

Choose a dynamic way of learning, regardless of how you choose to study.

Our courses are built to provide the skills professionals need to grow in their profession, as our teaching methodology is well planned, structured, and student-centered. Whether you choose to study face-to-face, online or through online pre-recorded courses, you will get expert guidance from a panel of highly qualified and experienced tutors committed to the success of every student in all subjects.

SPS CPD courses count as formal CPD as they offer a structured approach, where learning objectives/outcomes can easily be identified, and the member is essentially ‘taught’ something that enhances their knowledge and/or technical skills. Many of our seminars are approved by HRDA and suitable subsidies will, therefore be available to all HRDA qualifying participants

Ways to study with us.

Choose a dynamic way of learning, regardless of how you choose to study.

CLASSROOM BASED COURSES

LIVE ONLINE INSTRUCTOR - LED COURSES

ONLINE PRE-RECORDED COURSES [ON DEMAND]

HOW TO BOOK

Ready to increase your potential with one of our training courses? We can’t wait to help you get started.

Once you’ve selected your course, secure your place by calling us on 22713230 | 25867500 or by emailing us at SPSNicosia@cycollege.ac.cy | SPSLimassol@cycollege.ac.cy, and we will guide you on your next steps for your registration.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

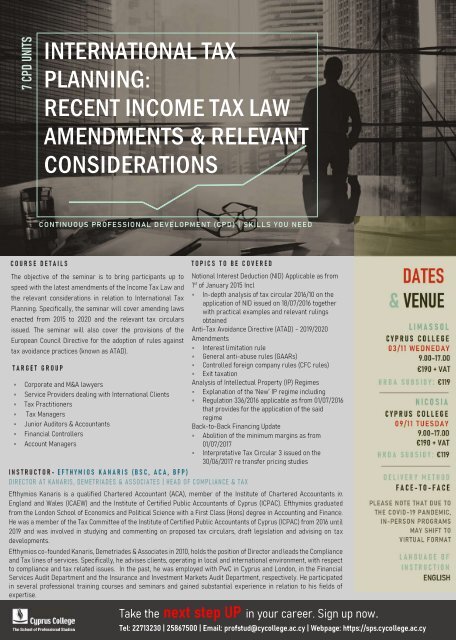

7 <strong>CPD</strong> UNITS<br />

UNITS<br />

INTERNATIONAL TAX<br />

PLANNING:<br />

RECENT INCOME TAX LAW<br />

AMENDMENTS & RELEVANT<br />

CONSIDERATIONS<br />

CONTINUOUS PROFESSIONAL DEVELOPMENT (<strong>CPD</strong>) | SKILLS YOU NEED<br />

C O U R S E D E T A I L S<br />

<strong>The</strong> objective <strong>of</strong> the seminar is to bring participants up to<br />

speed with the latest amendments <strong>of</strong> the Income Tax Law and<br />

the relevant considerations in relation to International Tax<br />

Planning. Specifically, the seminar will cover amending laws<br />

enacted from 2015 to 2020 and the relevant tax circulars<br />

issued. <strong>The</strong> seminar will also cover the provisions <strong>of</strong> the<br />

European Council Directive for the adoption <strong>of</strong> rules against<br />

tax avoidance practices (known as ATAD).<br />

T A R G E T G R O U P<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Corporate and M&A lawyers<br />

Service Providers dealing with International Clients<br />

Tax Practitioners<br />

Tax Managers<br />

Junior Auditors & Accountants<br />

Financial Controllers<br />

Account Managers<br />

T O P I C S T O B E C O V E R E D<br />

Notional Interest Deduction (NID) Applicable as from<br />

1 st <strong>of</strong> January 2015 Incl<br />

In-depth analysis <strong>of</strong> tax circular 2016/10 on the<br />

application <strong>of</strong> NID issued on 18/07/2016 together<br />

with practical examples and relevant rulings<br />

obtained<br />

Anti-Tax Avoidance Directive (ATAD) - 2019/2020<br />

Amendments<br />

Interest limitation rule<br />

General anti-abuse rules (GAARs)<br />

Controlled foreign company rules (CFC rules)<br />

Exit taxation<br />

Analysis <strong>of</strong> Intellectual Property (IP) Regimes<br />

Explanation <strong>of</strong> the ‘New’ IP regime including<br />

Regulation 336/2016 applicable as from 01/07/2016<br />

that provides for the application <strong>of</strong> the said<br />

regime<br />

Back-to-Back Financing Update<br />

Abolition <strong>of</strong> the minimum margins as from<br />

01/07/2017<br />

Interpretative Tax Circular 3 issued on the<br />

30/06/2017 re transfer pricing studies<br />

I N S T R U C T O R - E F T H Y M I O S K A N A R I S ( B S C , A C A , B F P )<br />

DIRECTOR AT KANARIS, DEMETRIADES & ASSOCIATES | HEAD OF COMPLIANCE & TAX<br />

Efthymios Kanaris is a qualified Chartered Accountant (ACA), member <strong>of</strong> the Institute <strong>of</strong> Chartered Accountants in<br />

England and Wales (ICAEW) and the Institute <strong>of</strong> Certified Public Accountants <strong>of</strong> Cyprus (ICPAC). Efthymios graduated<br />

from the London <strong>School</strong> <strong>of</strong> Economics and Political Science with a First Class (Hons) degree in Accounting and Finance.<br />

He was a member <strong>of</strong> the Tax Committee <strong>of</strong> the Institute <strong>of</strong> Certified Public Accountants <strong>of</strong> Cyprus (ICPAC) from 2016 until<br />

2019 and was involved in studying and commenting on proposed tax circulars, draft legislation and advising on tax<br />

developments.<br />

Efthymios co-founded Kanaris, Demetriades & Associates in 2010, holds the position <strong>of</strong> Director and leads the Compliance<br />

and Tax lines <strong>of</strong> services. Specifically, he advises clients, operating in local and international environment, with respect<br />

to compliance and tax related issues. In the past, he was employed with PwC in Cyprus and London, in the Financial<br />

Services Audit Department and the Insurance and Investment Markets Audit Department, respectively. He participated<br />

in several pr<strong>of</strong>essional training courses and seminars and gained substantial experience in relation to his fields <strong>of</strong><br />

expertise.<br />

Take the next step UP in your career. Sign up now.<br />

DATES<br />

& VENUE<br />

L I M A S S O L<br />

C Y P R U S C O L L E G E<br />

03/11 WED NEDAY<br />

9.00-17.00<br />

€190 + VAT<br />

H R D A S U B S I D Y : €119<br />

N I C O S I A<br />

C Y P R U S C O L L E G E<br />

09/11 TUESDAY<br />

9.00-17.00<br />

€190 + VAT<br />

H R D A S U B S I D Y : €119<br />

D E L I V E R Y M E T H O D<br />

F A C E - T O - F A C E<br />

PLEASE NOTE THAT DUE TO<br />

THE COVID-19 PANDEMIC,<br />

IN-PERSON PROGRAMS<br />

MAY SHIFT TO<br />

VIRTUAL FORMAT<br />

L A N G U A G E O F<br />

I N S T R U C T I O N<br />

ENGLISH<br />

Tel: 22713230 | 25867500 | Email: pr<strong>of</strong>stud@cycollege.ac.cy | Webpage: https://sps.cycollege.ac.cy