CM September 2021

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

OPINION<br />

king Payment Initiation for Billers<br />

Open Banking Payment Initiation for Billers<br />

urney for You and Your Customers<br />

A Customer Journey for You and Your Customers<br />

Open Banking Payment<br />

Initiation for Billers<br />

the rigidity of Direct Debit a bad fit.<br />

owledge that Direct Debit cannot be the only easy way for people to pay their bills. People<br />

d/or low Most incomes billers – acknowledge a growing group that - Direct need Debit to manage cannot their be the finances only easy every way month, for people making to pay their bills. People<br />

with irregular and/or low incomes – a growing group - need to manage their finances every month, making<br />

the rigidity of Direct Debit a bad fit.<br />

A Customer Journey for You and Your Customers.<br />

re offer cards and wallets as online at hundreds of billers in over 20 countries for bill payment,<br />

Billers might therefore offer cards and wallets as online at hundreds of billers in over 20 countries for bill payment,<br />

their portal. Those however are very dunning, collection and more. That experience also leads<br />

payment methods in their portal. Those<br />

AUTHOR<br />

however<br />

– Jeroen<br />

are<br />

Dekker,<br />

very<br />

Solution<br />

dunning,<br />

Architect EBPP<br />

collection<br />

& RTP,<br />

and<br />

Serrala<br />

more. That experience also leads<br />

mplex reconciliation and let customers me to the organisational dimension.<br />

expensive, require complex reconciliation and let customers me to the organisational dimension.<br />

. Gateways,<br />

reverse<br />

processors,<br />

MOST transactions.<br />

acquirers,<br />

Gateways,<br />

and<br />

billers acknowledge<br />

all got along rich that inserting Direct themselves along<br />

processors, acquirers, and<br />

l got rich consumer inserting brands themselves<br />

ute for payments: the most obvious from the route Debit consumer’s for cannot payments: be the from the consumer’s<br />

tly into the only easy way for<br />

bank biller’s account bank directly account. into the biller’s bank account.<br />

people to pay their<br />

bills. People with<br />

rect route irregular Until required recently, and/or consumers that low direct incomes route to set – a required growing consumers to set<br />

ratch in group their a transfer – own need banking from to manage scratch app. their Finding<br />

their finances own banking app. Finding<br />

nt details every and from copying month, a sheet making payment of paper the details rigidity or a from PDF of Direct a sheet of paper or a PDF<br />

far from Debit makes easy: a a bad this chore fit. exercise to procrastinate<br />

far from easy: a chore to procrastinate<br />

Billers might therefore offer cards<br />

eover, people and then can forget. make Moreover, mistakes, people causountinging<br />

can make mistakes, caus-<br />

and wallets as online payment methods<br />

in negative exceptions<br />

their portal. customer in accounting,<br />

Those however contacts, negative<br />

are or customer contacts, or<br />

very<br />

ension expensive, even of service. unjustified require suspension complex reconciliation of service.<br />

and let customers reverse transactions.<br />

Gateways, Crossing the processors, Chasm: Payment acquirers, Initiation and<br />

: Payment Initiation<br />

consumer A better way brands has reached all got rich the UK inserting through Open Banking.<br />

ched the themselves UK through along Open the most Banking.<br />

The banks have published obvious APIs for route third parties to – with the<br />

lished APIs for payments: for third parties from the to consumer’s – with the<br />

consumer’s consent – push the details bank of a payment straight<br />

– push the account directly into the biller’s bank<br />

into details the consumer’s of a payment chosen straight bank app for authorisation,<br />

chosen account.<br />

eliminating bank app for<br />

Until recently, the authorisation,<br />

manual that direct retyping. route required This makes payment easy<br />

ual retyping.<br />

consumers for the This consumer. makes payment<br />

to set The up result easy<br />

a transfer is a UK from Faster Payment: cheap<br />

e result scratch (fixed is a UK fee), in Faster their real-time, own Payment: banking final, accurate, cheap app. Finding and a direct 1:1 pay-out<br />

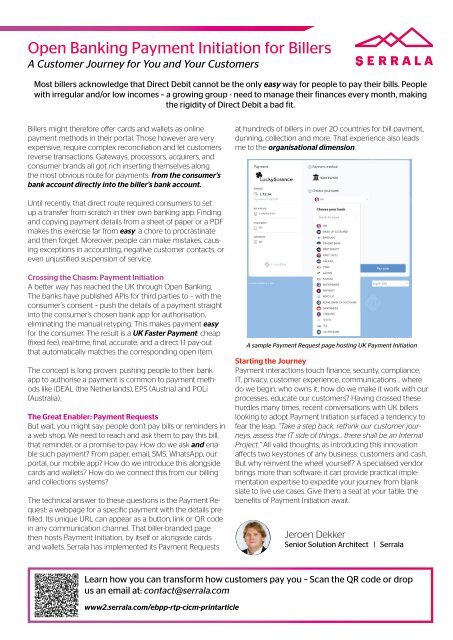

A sample Payment Request page hosting UK Payment Initiation<br />

final, accurate, and that automatically copying and a direct payment matches 1:1 pay-out details the corresponding from a A sample open Payment item. Request page hosting UK Payment Initiation<br />

atches the sheet corresponding of paper a open PDF item. makes this<br />

Starting the Journey<br />

exercise The concept far is from long proven: easy: a pushing chore people to<br />

Starting to their<br />

procrastinate and then forget. Moreover, THE GREAT bank Journey Payment interactions touch finance, security, compliance,<br />

ENABLER:<br />

STARTING THE JOURNEY<br />

proven: app<br />

people pushing to authorise<br />

can people a<br />

make to payment their mistakes, bank is common<br />

causing Payment to PAYMENT payment interactions methods<br />

is common like iDEAL in to (the payment accounting, Netherlands), meth-<br />

negative EPS (Austria) IT, privacy, But wait, and customer POLi you might experience, say: do people we begin, don’t communications… who pay owns security, it, how where compliance, do we make it IT, work with privacy, our<br />

REQUESTS touch IT, privacy, finance, customer security, Payment<br />

experience, compliance, interactions<br />

communications…<br />

touch finance,<br />

where<br />

ayment exceptions<br />

etherlands), customer (Australia). EPS contacts, (Austria) or and even POLi unjustified do bills we begin, or reminders who owns in a web processes, it, how shop. do We educate we need make our customer it work customers? with experience, our Having communications…<br />

crossed these<br />

suspension of service.<br />

processes,<br />

to reach and<br />

educate<br />

ask them<br />

our<br />

to<br />

customers? hurdles pay this many bill,<br />

Having<br />

that times, where recent crossed do conversations these we begin, who with owns UK billers it, how<br />

The Great Enabler: Payment Requests reminder, or a promise-to-pay. How hurdles<br />

do we make work with our processes,<br />

CROSSING THE CHASM:<br />

we ask many and enable times, recent<br />

looking<br />

such payment? conversations<br />

to adopt Payment<br />

From with UK<br />

Initiation<br />

billers<br />

surfaced a tendency to<br />

But wait, you might say: people don’t pay bills or reminders in fear the leap. “Take a educate step back, our rethink customers? our customer Having crossed journeys,<br />

assess the IT side these of things… hurdles there many shall be times, an Internal recent<br />

Payment PAYMENT Requests INITIATION<br />

looking paper, to email, adopt SMS, Payment WhatsApp, Initiation our portal, surfaced a tendency to<br />

a web shop. We need to reach and ask them to pay this bill,<br />

say: people A better don’t way pay has bills reached or reminders the UK through in fear our the mobile leap. “Take app? a How step do back, we introduce rethink our conversations customer journeys,<br />

this<br />

that reminder, or a promise-to-pay. How do with UK billers looking<br />

d to reach Open and Banking. ask them The to banks pay have this published bill,<br />

we<br />

assess alongside<br />

ask and enable<br />

such for payment? third parties From to paper, – with email, the SMS, do WhatsApp, we connect our this from affects our billing two keystones and of any business: customers and cash.<br />

the IT cards side and<br />

Project.”<br />

of things… wallets?<br />

All valid<br />

there How<br />

thoughts, as introducing this innovation<br />

shall be adopt an Internal Payment Initiation surfaced a<br />

APIs romise-to-pay. How do we ask and enarom<br />

paper, back, rethink our customer journeys,<br />

Project.” All valid thoughts, as introducing this tendency innovation to fear the leap. “Take a step<br />

consumer’s portal, our mobile consent app? – push How the do details we introduce of collections this alongside systems? But why reinvent the wheel yourself? A specialised vendor<br />

a cards payment<br />

email, and wallets? SMS,<br />

straight<br />

WhatsApp, How into do the we consumer’s<br />

our connect affects this from The two technical our keystones billing answer of brings to any these business: more questions than customers software: it and can cash. provide practical implementation<br />

a webpage yourself? expertise for A a specialised vendor<br />

p? How assess the IT side of things…there shall<br />

chosen and do collections we introduce bank app systems? this for alongside authorisation, But is why the reinvent Payment the Request: wheel<br />

be<br />

to<br />

an<br />

expedite<br />

Internal<br />

your<br />

Project.”<br />

journey<br />

All valid<br />

from<br />

thoughts,<br />

blank<br />

ow do we eliminating connect the this manual from our retyping. billing This brings specific more payment than software: with the slate details it to can pre-filled. live provide use cases. practical implementation<br />

is the Payment expertise Re-<br />

to expedite benefits of your Payment journey<br />

makes payment easy for consumer. Its unique URL can appear as a button,<br />

introducing Give them a this seat innovation at your table: affects the two<br />

ms? The technical answer to these questions<br />

The result is a UK Faster Payment: link or QR code in any communication<br />

keystones Initiation from blank of await. any business: customers and<br />

quest: a webpage for a specific payment slate with to the live details use cases. prefilled.<br />

questions a direct Its unique 1:1 is pay-out URL the Payment can that appear automatically Re-<br />

as a button, benefits hosts link of Payment or Payment QR code Initiation, Initiation by await. itself or But why reinvent the wheel yourself?<br />

Give them a seat at your<br />

cheap (fixed fee), real-time, final, accurate, channel. That biller-branded page then cash. table: the<br />

r to these and<br />

r a specific matches in any payment communication the corresponding with the details channel. open precan<br />

appear then The hosts as concept a button, Payment is long link Initiation, or proven: QR code by pushing itself or alongside implemented cards its Payment Requests at Jeroen than Dekker software: it can provide practical<br />

item. That biller-branded alongside page cards and wallets. Serrala has A specialised vendor brings more<br />

people to their bank app to authorise a hundreds of billers in over 20 countries implementation expertise to expedite<br />

on channel. and That wallets. biller-branded Serrala has implemented page its Payment Requests<br />

Senior Solution Architect | Serrala<br />

payment is common to payment methods for bill payment, dunning, collection and your journey from blank slate to live use<br />

Initiation, by itself or alongside cards<br />

Jeroen Dekker<br />

like iDEAL (the Netherlands), EPS (Austria) more. That experience also leads me to cases. Give them a seat at your table: the<br />

as implemented and POLi (Australia). its Payment Requests<br />

Senior Solution Architect | Serrala<br />

the organisational dimension.<br />

benefits of Payment Initiation await.<br />

Learn how you can transform how customers pay you – Scan the QR code or drop<br />

us “Take an email a step at: contact@serrala.com<br />

back, rethink our customer journeys, assess the<br />

arn how you can transform<br />

www2.serrala.com/ebpp-rtp-cicm-printarticle<br />

IT side how customers of things…there pay you shall – Scan be an the Internal QR code Project.” or drop<br />

an email at: contact@serrala.com<br />

w2.serrala.com/ebpp-rtp-cicm-printarticle<br />

Advancing the credit profession / www.cicm.com / <strong>September</strong> <strong>2021</strong> / PAGE 29