Aeris Annual Report 2022

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Aeris</strong> Resources Limited<br />

Notes to the consolidated financial statements<br />

30 June <strong>2022</strong><br />

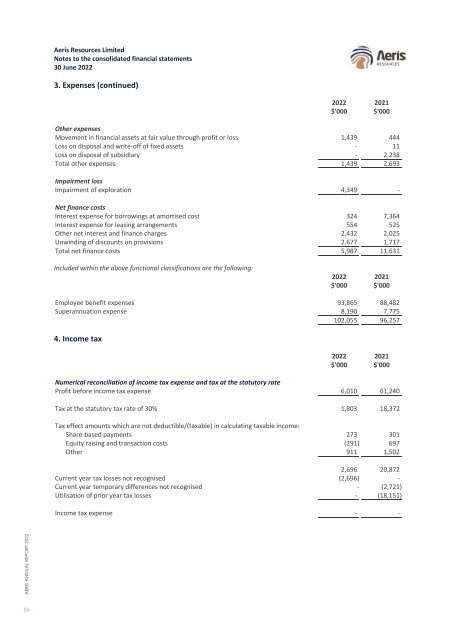

3. Expenses (continued)<br />

<strong>2022</strong> 2021<br />

$'000 $'000<br />

Other expenses<br />

Movement in financial assets at fair value through profit or loss 1,439 444<br />

Loss on disposal and write-off of fixed assets - 11<br />

Loss on disposal of subsidiary - 2,238<br />

Total other expenses 1,439 2,693<br />

Impairment loss<br />

Impairment of exploration 4,349 -<br />

Net finance costs<br />

Interest expense for borrowings at amortised cost 324 7,364<br />

Interest expense for leasing arrangements 554 525<br />

Other net interest and finance charges 2,432 2,025<br />

Unwinding of discounts on provisions 2,677 1,717<br />

Total net finance costs 5,987 11,631<br />

Included within the above functional classifications are the following:<br />

<strong>2022</strong> 2021<br />

$'000 $'000<br />

Employee benefit expenses 93,865 88,482<br />

Superannuation expense 8,190 7,775<br />

102,055 96,257<br />

4. Income tax<br />

<strong>2022</strong> 2021<br />

$'000 $'000<br />

Numerical reconciliation of income tax expense and tax at the statutory rate<br />

Profit before income tax expense 6,010 61,240<br />

Tax at the statutory tax rate of 30% 1,803 18,372<br />

Tax effect amounts which are not deductible/(taxable) in calculating taxable income:<br />

Share-based payments 273 301<br />

Equity raising and transaction costs (291) 697<br />

Other 911 1,502<br />

2,696 20,872<br />

Current year tax losses not recognised (2,696) -<br />

Current year temporary differences not recognised - (2,721)<br />

Utilisation of prior year tax losses - (18,151)<br />

Income tax expense - -<br />

AERIS ANNUAL REPORT <strong>2022</strong><br />

10<br />

86