Green Economy Journal Issue 58

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ENERGY<br />

ENERGY<br />

Boosting the growth of the South African<br />

PPA market could alleviate pressure on<br />

Eskom to supply demand.<br />

• Reactive energy charges (c/kVArh) supplied more than 30% (0.96<br />

power factor or less) of the kWh recorded during peak and standard<br />

periods. The excess reactive energy is determined per 30-minute<br />

integrating period and is accumulated for the month applicable<br />

during the high-demand season.<br />

COMMERCIAL<br />

AND INDUSTRIAL<br />

Small-Scale Embedded Generation<br />

To achieve reliable and cost-efficient energy supply, commercial and industrial consumers are<br />

looking for alternative sources of energy for their operations. However, careful consideration of<br />

all the tariff components is necessary to determine the economic business case of small-scale<br />

embedded generation.<br />

Eskom<br />

Eskom C&I customers with a notified maximum demand (NMD)<br />

greater than 1MVA are typically on a time-of-use (TOU) tariff structure,<br />

namely the Megaflex tariff, while municipal licensees apply their own<br />

tariffs. All other customer segments who install small-scale embedded<br />

generation (SSEG) are required to move to a TOU structure.<br />

C&I customers who have installed grid-tied generation are moved<br />

to the Megaflex-Gen tariff (>22 kVA connections). On the Megaflex-<br />

Gen tariff, any excess energy fed into the grid that is not wheeled to<br />

another Eskom customer is credited at the Gen-offset tariff. If energy<br />

is wheeled to another Eskom customer (the off-taker), then the offtaker<br />

is credited at the Gen-wheeling tariff. The Megaflex tariff varies<br />

according to transmission zone, network connection size, maximum<br />

instantaneous demand and time of use (hour and season).<br />

Megaflex tariff components<br />

• Fixed charges (R/month) to recover overhead costs and prices<br />

that vary with customer-base size. These charges are based on<br />

the sum of the monthly utilised capacity at each point of delivery<br />

(POD) and administration charges.<br />

• Transmission, network and distribution demand charges<br />

(R/kW/month) to recover long-run marginal investments required<br />

to meet peak demand. These charges are based on the supply<br />

voltage, transmission zone and annual utilised capacity measured<br />

at the POD at all time periods. Excess network capacity charges<br />

are payable.<br />

• Energy charges (R/kWh) recover variable costs to meet the<br />

customer load. These are TOU differentiated active energy charges<br />

including losses based on supply voltage and the transmission<br />

zone of the customer. There are three TOU periods namely peak,<br />

standard and off-peak.<br />

• Ancillary service charges (c/kWh) based on the voltage of the<br />

supply applicable during all time periods.<br />

WEEKDAY TARIFF STRUCTURE<br />

Eskom and CSIR<br />

The Megaflex tariff incorporates three transparent cross-subsidies:<br />

i. The affordability subsidy funded by Eskom’s direct industrial and<br />

business customers and is calculated using the end-user’s total<br />

active energy demand.<br />

ii. The electrification and rural subsidy funded by Eskom’s direct<br />

industrial and business customers as well as municipalities and is<br />

calculated using the end-user’s total active energy demand.<br />

iii. The urban low voltage subsidy funded by all Eskom’s customers<br />

on urban tariffs that take supply at 66kV or higher. This cost is based<br />

on the voltage of the supply and charged on the annual utilised<br />

capacity measured at the POD applicable during all time periods.<br />

The actual revenue split between variable and fixed costs was<br />

determined in a cost-of-supply study (see figure 3) and demonstrates<br />

Eskom’s financial risk to declining energy volume sales. The average<br />

Figure 3. Eskom cost of supply and revenue share.<br />

ENERGY CHARGE (R/kWh)<br />

REPORT BY CSIR AND RES4AFRICA*<br />

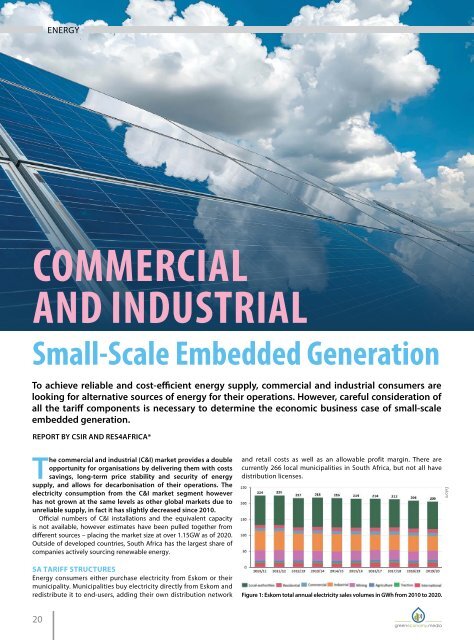

The commercial and industrial (C&I) market provides a double<br />

opportunity for organisations by delivering them with costs<br />

savings, long-term price stability and security of energy<br />

supply, and allows for decarbonisation of their operations. The<br />

electricity consumption from the C&I market segment however<br />

has not grown at the same levels as other global markets due to<br />

unreliable supply, in fact it has slightly decreased since 2010.<br />

Official numbers of C&I installations and the equivalent capacity<br />

is not available, however estimates have been pulled together from<br />

different sources – placing the market size at over 1.15GW as of 2020.<br />

Outside of developed countries, South Africa has the largest share of<br />

companies actively sourcing renewable energy.<br />

SA TARIFF STRUCTURES<br />

Energy consumers either purchase electricity from Eskom or their<br />

municipality. Municipalities buy electricity directly from Eskom and<br />

redistribute it to end-users, adding their own distribution network<br />

and retail costs as well as an allowable profit margin. There are<br />

currently 266 local municipalities in South Africa, but not all have<br />

distribution licenses.<br />

Figure 1: Eskom total annual electricity sales volumes in GWh from 2010 to 2020.<br />

Eskom<br />

Figure 2. The Megaflex tariff. Notes: Megaflex Non-Local Authority tariff; transmission zone 66kV and 132kV. High season = Jun-Aug; low season =<br />

Sep-May. Notes: Megaflex Non-Local Authority tariff; transmission zone 66kV and 132kV. High season = Jun-Aug; low season = Sep-May.<br />

20<br />

21