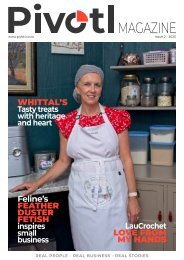

Pivotl - Issue 4-2023

In this issue we introduce you to the faces behind small businesses in South Africa. You'll read about their dreams, hopes and fears and what they have to say about their journey to being successful.

In this issue we introduce you to the faces behind small businesses in South Africa. You'll read about their dreams, hopes and fears and what they have to say about their journey to being successful.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BUSINESS BEAT<br />

imposing a Two-Pot System<br />

would triple retirement savings in<br />

South Africans. It is meant to<br />

position you, although<br />

involuntarily, to retire comfortably<br />

and reach your retirement goal.<br />

Strategies for adjusting your<br />

Retirement Plan to suit your<br />

needs in tough economic times<br />

Be advised to not be tempted to<br />

leave the sole responsibility of<br />

your retirement planning in the<br />

hands of the government or your<br />

financial advisor. It is your<br />

responsibility to ensure that your<br />

planning meets your desired<br />

income goals when you retire.<br />

Despite the Two-Pot System,<br />

there are voluntary measures<br />

that you can implement to your<br />

retirement plan in the event of<br />

unexpected expenses or changes<br />

in your financial circumstances.<br />

COVID-19 has demonstrated<br />

the need for personal financial<br />

relief for many, followed by the<br />

recent hikes in interest rates,<br />

which have led to people<br />

compromising their retirement<br />

investment plan.<br />

You can voluntarily opt to<br />

reduce your monthly<br />

contributions rather than totally<br />

stopping your retirement<br />

investments. However, while<br />

reducing your retirement<br />

investment provides a short-term<br />

relief, it is not a good solution for<br />

the long term. Merely reducing<br />

your contributions for one year will<br />

result in a reduction in your yearly<br />

income during your retirement.<br />

Ideally, increasing your streams<br />

of income weighs as a better<br />

solution for immediate and longterm<br />

financial relief. Having a<br />

side-hustle by monetising goods<br />

or a particular skillset will not only<br />

see you through tough economic<br />

times but will ensure that your<br />

retirement plan is not<br />

compromised, in fact, it might<br />

increase your monthly income<br />

during retirement.<br />

If a side-hustle is not yet an<br />

option for you, an easier way<br />

would be to discuss with your<br />

financial advisor ways to invest in<br />

an investment strategy that<br />

allows you to get the best<br />

optimum growth for your<br />

retirement investment.<br />

Diversifying your Retirement<br />

Plan and protecting it against<br />

market volatility<br />

Revisiting your retirement plan<br />

annually will give you the<br />

opportunity to evaluate if your<br />

asset allocation is still on track<br />

during seasons that markets are<br />

volatile.<br />

As the saying goes: “Don’t put all<br />

your eggs in one basket.”<br />

Market volatility is a natural<br />

characteristic of the market, so<br />

this should not scare you, but<br />

should rather motivate you to<br />

diversify your retirement<br />

investment by investing in<br />

multiple asset classes. This is also<br />

a good opportunity to learn<br />

about your risk tolerance. What<br />

sort of investor are you in high<br />

tides, are you conservative,<br />

aggressive, or in between? If<br />

you’re having trouble sleeping at<br />

night thinking about your<br />

investment, then maybe consider<br />

investing a larger portion of your<br />

money in a less riskier asset class.<br />

During high tides, you also get<br />

to determine your investment<br />

goal, are you looking for growth<br />

or for income opportunities? It is<br />

advisable to focus on growth in<br />

your earlier years and then<br />

income in your latter years.<br />

Ultimately, committing to the<br />

habit of reviewing your<br />

retirement plan annually will<br />

result to acting quicker against<br />

threats to your retirement<br />

investment, and acting promptly<br />

to market opportunities that will<br />

allow you to meet your<br />

retirement goals sooner. n<br />

Thato Malebo is a dedicated Financial Advisor on a mission to transform clients’<br />

financial dreams into reality. With a focus on Wealth Protection, Creation,<br />

Preservation, and Estate Planning, Thato employs her expertise to simplify<br />

complex financial decisions. Building lasting and mutually beneficial<br />

relationships with clients is her specialty, backed by a top-notch team of experts<br />

in various financial fields. Thato follows a straightforward 5-step approach: set<br />

goals, prioritize them, figure out what you need, create a personalized plan, and<br />

keep it on track as life unfolds. To start your journey toward financial balance,<br />

contact her at thatomalebo2@gmail.com or +27 79 049 0476.<br />

<strong>Issue</strong> 4 - <strong>2023</strong> 21