Cousins Properties Incorporated 2006 Annual Report - SNL Financial

Cousins Properties Incorporated 2006 Annual Report - SNL Financial

Cousins Properties Incorporated 2006 Annual Report - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SCHEDULE III<br />

(PAGE 5 of 5)<br />

COUSINS PROPERTIES INCORPORATED AND CONSOLIDATED ENTITIES<br />

REAL ESTATE AND ACCUMULATED DEPRECIATION<br />

DECEMBER 31, <strong>2006</strong><br />

($ in thousands)<br />

NOTES:<br />

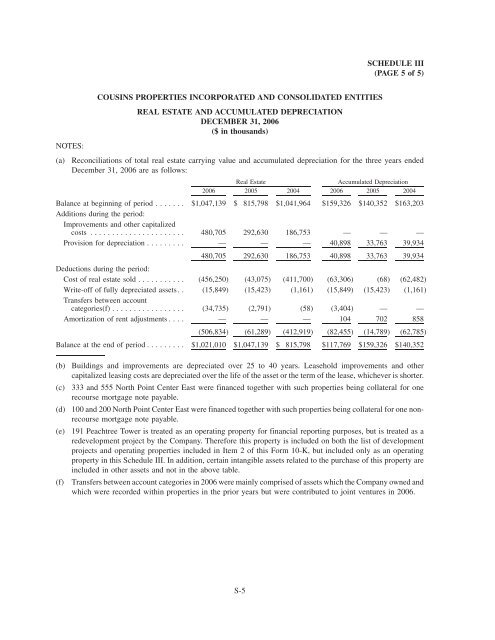

(a) Reconciliations of total real estate carrying value and accumulated depreciation for the three years ended<br />

December 31, <strong>2006</strong> are as follows:<br />

Real Estate Accumulated Depreciation<br />

<strong>2006</strong> 2005 2004 <strong>2006</strong> 2005 2004<br />

Balance at beginning of period . . . ....<br />

Additions during the period:<br />

Improvements and other capitalized<br />

$1,047,139 $ 815,798 $1,041,964 $159,326 $140,352 $163,203<br />

costs . ..................... 480,705 292,630 186,753 — — —<br />

Provision for depreciation ......... — — — 40,898 33,763 39,934<br />

Deductions during the period:<br />

480,705 292,630 186,753 40,898 33,763 39,934<br />

Cost of real estate sold . .......... (456,250) (43,075) (411,700) (63,306) (68) (62,482)<br />

Write-off of fully depreciated assets. .<br />

Transfers between account<br />

(15,849) (15,423) (1,161) (15,849) (15,423) (1,161)<br />

categories(f) . . ............... (34,735) (2,791) (58) (3,404) — —<br />

Amortization of rent adjustments .... — — — 104 702 858<br />

(506,834) (61,289) (412,919) (82,455) (14,789) (62,785)<br />

Balance at the end of period ......... $1,021,010 $1,047,139 $ 815,798 $117,769 $159,326 $140,352<br />

(b) Buildings and improvements are depreciated over 25 to 40 years. Leasehold improvements and other<br />

capitalized leasing costs are depreciated over the life of the asset or the term of the lease, whichever is shorter.<br />

(c) 333 and 555 North Point Center East were financed together with such properties being collateral for one<br />

recourse mortgage note payable.<br />

(d) 100 and 200 North Point Center East were financed together with such properties being collateral for one nonrecourse<br />

mortgage note payable.<br />

(e) 191 Peachtree Tower is treated as an operating property for financial reporting purposes, but is treated as a<br />

redevelopment project by the Company. Therefore this property is included on both the list of development<br />

projects and operating properties included in Item 2 of this Form 10-K, but included only as an operating<br />

property in this Schedule III. In addition, certain intangible assets related to the purchase of this property are<br />

included in other assets and not in the above table.<br />

(f) Transfers between account categories in <strong>2006</strong> were mainly comprised of assets which the Company owned and<br />

which were recorded within properties in the prior years but were contributed to joint ventures in <strong>2006</strong>.<br />

S-5